Five funds to help you invest in a new Europe

Growth stocks are a much bigger part of European markets than many investors realise. These five funds will help you buy in.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Investors sometimes use national stockmarkets as a shorthand for their views about a country, but that doesn’t mean that a given market tells you much about the domestic economy. Take the FTSE 100. It’s the key UK equity index but it’s full of firms that don’t do a huge amount of business in Britain. It’s just a collection of companies that happen to be listed in London. The same is true for many European markets and for regional indices such as MSCI Europe.

That matters because markets get hooked on narratives, and the dominant one today is that the US means growth, while Europe is boring (if cheap). These narratives are hard to dislodge, but over time they can decline in usefulness. This might be the case in Europe, according to a recent report from analysts at Morgan Stanley. They argue that European markets are changing, with new sectors becoming more important.

Bye-bye banks

Some of the highlights really stand out. The biggest sector in Europe? Banks or energy stocks? No – healthcare and especially pharmaceuticals. Technology stocks account for about 8% of the value of the MSCI Europe index, on a par with banks, which have halved in importance since 2010. Energy has also shrunk, to under 5%.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Or if we go by countries, Germany is hugely important – but not the conventional story of engineering giants hooked on China. The largest sector in the MSCI Germany index is technology (16%), with healthcare on 12%. Meanwhile, Denmark and The Netherlands are far more important to the European markets than either Italy or Spain. In fact Denmark has been the best-performing country in Europe over the last decade, driven by healthcare.

Of course, if we look at the current situation, the picture is mixed. On the plus side, the European Union is finally providing more bloc-wide fiscal safety nets, which could make a huge difference in the long term. On the negative side, while Europe seemed to be making a better job of controlling coronavirus until a few weeks ago, that’s now clearly evolving for the worse. Expect more short-term market weakness.

Investing for growth

Still, if you want to invest in the region, there’s an excellent list of first-rate funds. These include the Baillie Gifford European Growth (LSE: BGEU), which is typical of the growth-investing style of this fund house. Top holdings include Prosus (more on which shortly), Zalando (online fashion) and IMCD (speciality chemicals and foodstuffs). BlackRock Greater Europe (LSE: BRGE) has big holdings in popular growth sectors including drugs giant Novo Nordisk, Sika (a specialist chemicals business), publisher Relx and B2B tech giant SAP. I’d also highlight the BlackRock European Dynamic Fund, which has a similar strategy and profile to the investment trust. But my own personal favourite is Montanaro European Smaller Companies Trust (LSE: MTE), which invests in a growth-orientated mix of smaller businesses (disclosure: Merryn Somerset Webb, MoneyWeek’s editor-in-chief, is a non-executive director of this trust).

There’s also my parting thought, Prosus (Amsterdam: PRX). This is a weird beast. It’s the Dutch-listed international assets division of South African media firm Naspers, which is a first-rate venture capitalist that made huge profits investing in Chinese internet giant Tencent many years ago. But it is no one-trick pony: its portfolio of investments is second to none for a business listed on the public markets. You’ve got stakes in everything from familiar names such as Autotrader, Mail.Ru and Delivery Hero through to a very diversified portfolio of newer businesses. The shares trade at a big discount to the portfolio valuation, but you get a really compelling set of businesses across different sectors, all for a very reasonable price.

Tech’s growing clout in Europe

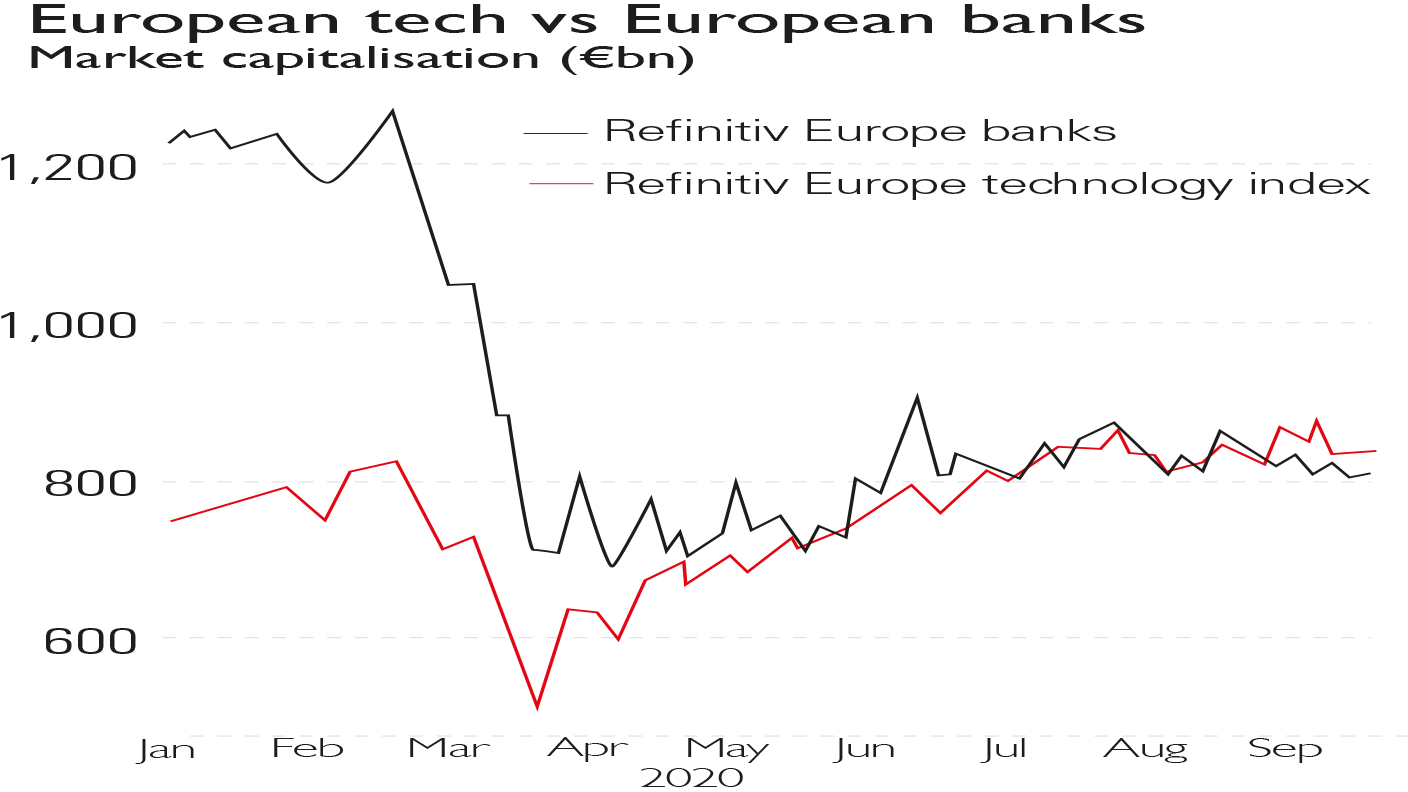

In Europe, the technology sector has surpassed the value of banks for the first time, reports the Financial Times. Ten years ago, tech accounted for just 4% of the MSCI EMU index, compared to 24% for banks, according to Morgan Stanley. Yet low interest rates have weighed on bank profitability, and the sector has tumbled by a third this year. Meanwhile, European tech stocks have advanced 11% in 2020. Hence the Refinitiv Europe technology index is now worth more (€842bn) than the banks (€822bn). A bias towards “legacy” industries such as banks has been a “significant driver” of the European market’s underperformance “over the last decade”, says Morgan Stanley. Yet with tech rising, things are changing on these bourses.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

David Stevenson has been writing the Financial Times Adventurous Investor column for nearly 15 years and is also a regular columnist for Citywire.

He writes his own widely read Adventurous Investor SubStack newsletter at davidstevenson.substack.com

David has also had a successful career as a media entrepreneur setting up the big European fintech news and event outfit www.altfi.com as well as www.etfstream.com in the asset management space.

Before that, he was a founding partner in the Rocket Science Group, a successful corporate comms business.

David has also written a number of books on investing, funds, ETFs, and stock picking and is currently a non-executive director on a number of stockmarket-listed funds including Gresham House Energy Storage and the Aurora Investment Trust.

In what remains of his spare time he is a presiding justice on the Southampton magistrates bench.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton