Twenty years on from MoneyWeek's first issue, how much have things changed?

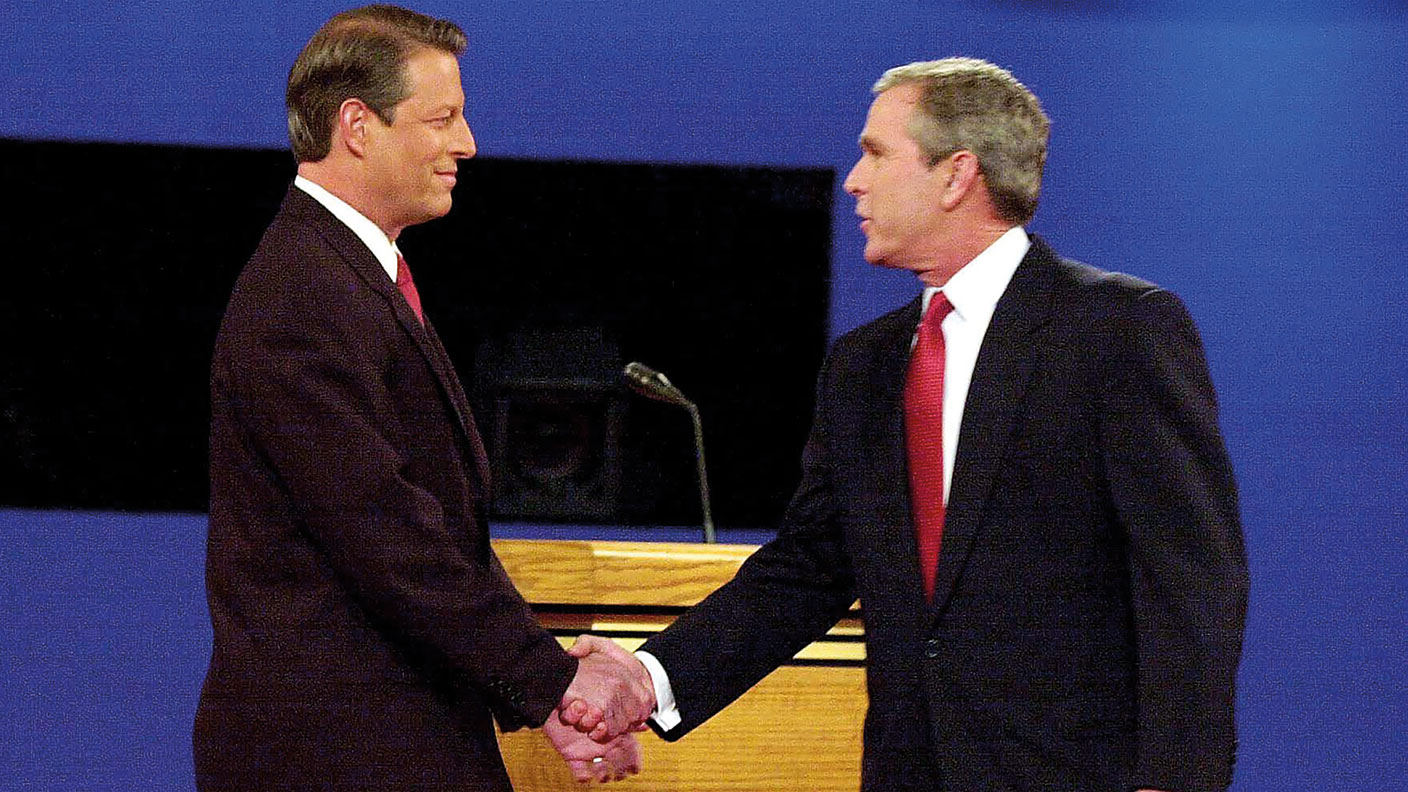

Spanning one disputed American election to another, MoneyWeek is 20 years old this week. Editor-in-chief Merryn Somerset Webb looks at what's changed, and what may be in store for the next 20 years.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

MoneyWeek was launched 20 years ago this week. It’s been quite a ride. Our first month was dominated by the disputed election in the US. Everyone expected Al Gore to beat George Bush. He didn’t – but that was only clear after a nasty row over vote counts in Florida and a month of legal battles (Gore sued). Since then we’ve covered the second part of the dotcom crash (at one point in 2000 the Nasdaq looked like it was stabilising – it wasn’t); the entry of China into the World Trade Organisation and the wave of globalisation and disinflation that followed; the ongoing collapse in bond yields; the arrival of negative interest rates; the new green revolution; the stunning rise of Silicon Valley; and everything remotely money-related along the way. This issue of the magazine (written during the week of another tight and likely-to-be-disputed US election) has a go at thinking about what we might be covering over the next 20.

Some of our writers have clear long-term thematic worries. Jonathan Compton quite rightly notes that demographics, water shortages and the obesity epidemic will provide unpleasant headwinds and that with so many tensions in Central and East Asia, it is impossible to imagine “20 years of peaceful coexistence”). The roll back of globalisation is also a major worry. The number to watch? The ratio of new tariff barriers imposed to those removed. Over the last five years it has been 3:1. If you believe that free trade makes us all richer, that should worry you. Bill is worried too. The West, and the US in particular, he says, are following a familiar (and awful) formula. “Wreck the economy with wars, controls, excess spending and pernicious incentives, and then try and shore up what is left with printing money.” It always works – to ruin those who use it.

However, read this week’s issue (subscribe here if you don't already) and it is not misery that will leap out at you from the work of MoneyWeek staff – who have covered a long list of crises in the last 20 years. It is optimism. We have plenty of investment ideas. There are family-owned firms for those looking for long-term resilience (and listen to our podcast for more). There is bitcoin and gold for those worried about inflation; commodities for those who think a new commodity supercycle is on the way (those of us who were around for the last one think just that); a few good suggestions around longevity and agrarian revolution from Jim Mellon; and a comprehensive list of investment trusts for those who want to leave the details to a professional.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But beyond the fact that whatever the environment there is always something to invest in, our optimism is based on our conviction in the long-term success of democratic capitalism and the triumphs of human ingenuity it encourages. With that in mind, we think there is an excellent chance that most of you reading this today will live to at least 100 in decent health and in a pollution-free environment, will soon be taking your first holiday in space, will have nipped to Tokyo for lunch at least once (with no quarantine!) and, most excitingly of all, from my point of view at least, will have been able to buy the kind of car that parallel parks for you. We also have your own forecasts for 2040. Here’s to the next 20 years.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

"Botched" Brexit: should Britain rejoin the EU?

"Botched" Brexit: should Britain rejoin the EU?Brexit did not go perfectly nor disastrously. It’s not worth continuing the fight over the issue, says Julian Jessop

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Tony Blair's terrible legacy sees Britain still suffering

Tony Blair's terrible legacy sees Britain still sufferingOpinion Max King highlights ten ways in which Tony Blair's government sowed the seeds of Britain’s subsequent poor performance and many of its current problems

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton

-

New Federal Reserve chair Kevin Warsh has his work cut out

New Federal Reserve chair Kevin Warsh has his work cut outOpinion Kevin Warsh must make it clear that he, not Trump, is in charge at the Fed. If he doesn't, the US dollar and Treasury bills sell-off will start all over again

-

How Canada's Mark Carney is taking on Donald Trump

How Canada's Mark Carney is taking on Donald TrumpCanada has been in Donald Trump’s crosshairs ever since he took power and, under PM Mark Carney, is seeking strategies to cope and thrive. How’s he doing?

-

Rachel Reeves is rediscovering the Laffer curve

Rachel Reeves is rediscovering the Laffer curveOpinion If you keep raising taxes, at some point, you start to bring in less revenue. Rachel Reeves has shown the way, says Matthew Lynn