Why an ageing population need not be deflationary

The idea that ageing populations inevitably condemn us to a future of falling prices is flawed, says Tom Traill. Here’s why

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Since the COP26 conference in Glasgow in November, the topic of demographics has been back in the news. There are many aspects of the global economy that ageing populations may (or may not) affect – but inflation is perhaps the most topical right now.

Discussions on demographics often hinge on the “dependency ratio”: the number of people who are either too young or too old to work, divided by the number of those in the working-age population (this is set at a range, say between 20 and 64 years old, and ignores those outside these thresholds who are working). In emerging markets, the dependency ratio may be high because there are a lot of very young people; by contrast, in developed economies, the ratio may be high because as people live longer, there are more retirees. But in virtually all countries, populations are ageing – thankfully, child mortality is falling, and life expectancy is increasing. So what impact will this have on the global economy and inflation?

The argument for falling prices

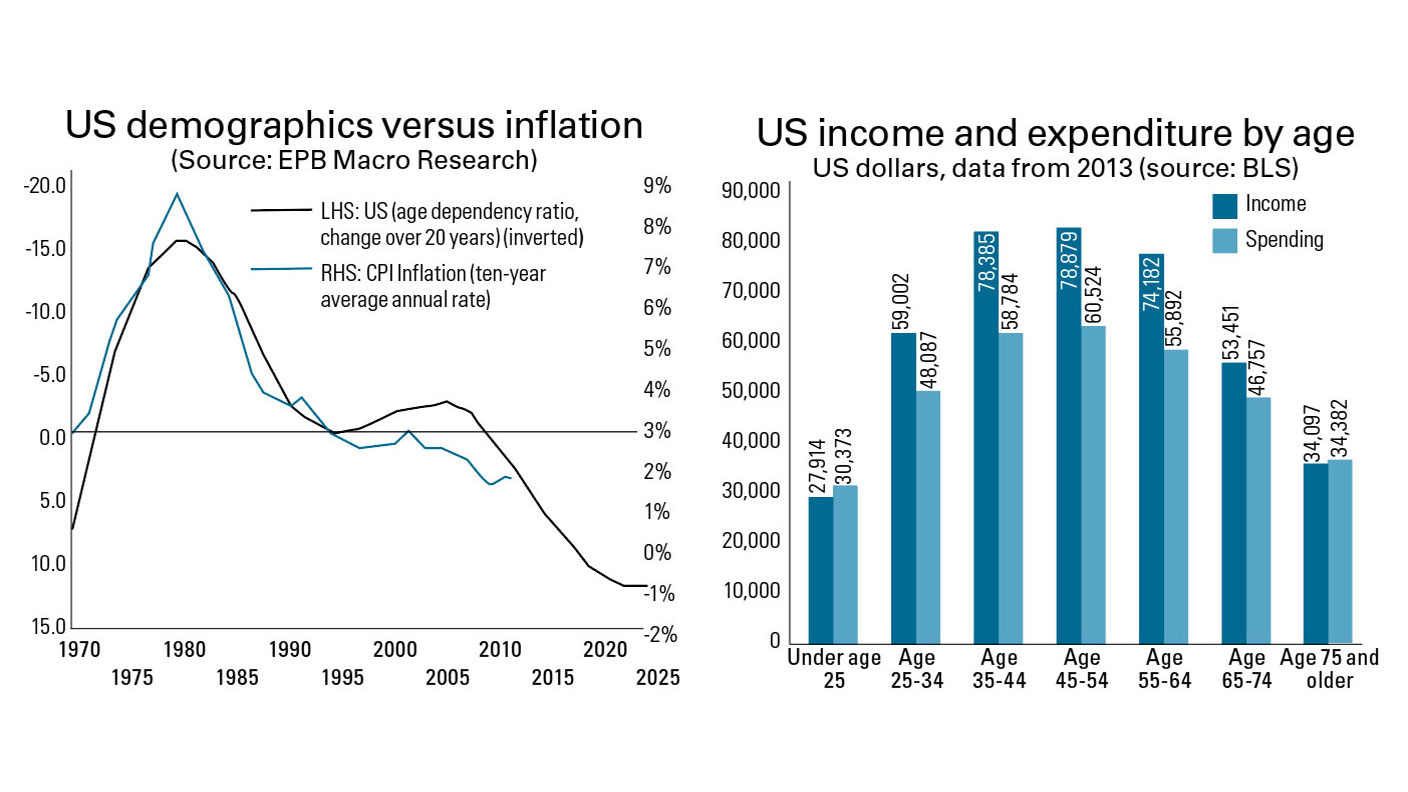

On one side of the inflation argument are those who feel that an ageing population will drag us into deflation, or at least low inflation. Albert Edwards of Societe Generale is perhaps the best-known proponent of this view, having been comparing the US to Japan for many years. Edwards recently shared a chart (see chart below, left) from EPB Macro Research to support his case. This shows that a rising dependency ratio (as measured by the change in the ratio over 20 years) seems to correlate with a falling inflation rate.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

This “low inflation” outcome appears to be backed by US spending data (second chart). The young and old spend less than those in work – and so, the argument goes, as the proportion of big-spending workers falls, demand will drop and prices fall. This is particularly applicable in developed economies, where it is the elderly who are driving the rising dependency ratio – much of the spending by those of working age is likely to benefit their children, but less so their parents. Another strand of the argument relates to asset prices: as baby-boomers retire, they will sell assets to raise funds, driving prices down. Of course, even if ageing demographics are deflationary, it doesn’t mean our destiny is predetermined. Other factors from energy-shocks to wage increases to supply disruptions can still cause rising prices. But in this scenario, they would face a constant headwind from the ageing population.

What if older people are inflationary?

However, what if this is not the case? Investors – many of whom are relying on inflation to remain low, placating their bond portfolios and avoiding central banker’s rate hikes, which might unsettle the equity apple cart – ought to be aware of both sides of the argument. Subscribers to the deflationary thesis often cite Japan as an example of what we can expect – an ageing population mired in deflation – but it may be that this is a case of correlation rather than causation. It’s equally reasonable to think that increased globalisation and technological advances were significant factors contributing to Japan’s deflation, which happened to coincide with its population ageing. The idea that a rising proportion of over 65-year-olds automatically spells slower growth is not a given.

Charles Goodhart and Manoj Pradhan wrote a book in 2020 on why demographics may prove to be inflationary, not deflationary. If a smaller proportion of the workforce has to produce the goods and services the economy needs – which is what a rising dependency ratio suggests – then supply and demand basics suggest this ought to be inflationary rather than deflationary. Accordingly, wages may need to rise sharply.

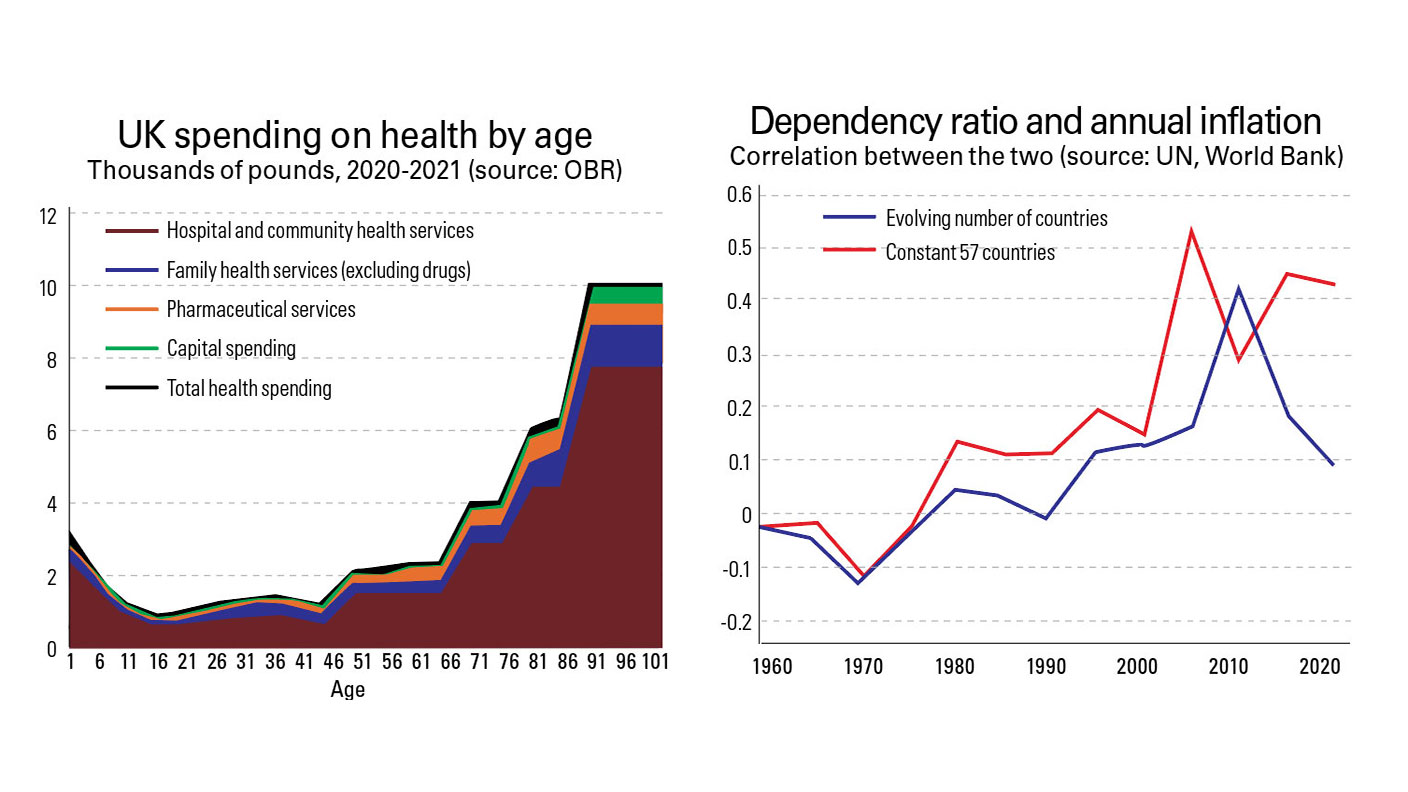

Moreover, today’s baby-boomer retirees are (on average) the wealthiest ever. Many have enjoyed growth in house prices, a 30-year bull-market in bonds, and a huge run-up in equity markets. They are now free to spend this as they wish, and hopefully have the health to do so. The idea of a 65-old-year retiring to the sofa for 25 years watching daytime television is mostly a fallacy. These retirees may spend on themselves, or disperse money to their children – but either way it gets into the economy. On top of all this, government spending on people shoots up as they age, as the third chart, breaking down healthcare costs by age in the UK, shows. It’s unclear how government will pay for these rising costs – particularly as greater demand for goods and services is traditionally inflationary.

The 60/40 portfolio may be on its last legs

The fourth chart goes global, showing the correlations between the annual inflation rate and the dependency ratio (using 20-64 as the band for working age) for a wide range of countries since 1960. The blue line uses the largest number of countries with data available at that given point, while the red line shows same 57 countries throughout. In the 1960s and 1970s the correlation was negative – suggesting that a higher dependency ratio was consistent with lower inflation – yet the correlation turns increasingly positive over time.

Detractors may argue that the higher inflation of the 1970s make that decade an anomaly, but the trend is still upwards and positive from the 1980s onwards. They may also argue that the high dependency ratio is warped by the youth of the higher-inflation emerging markets, and not the ageing developed markets. But the constant set of countries (the red line) is skewed to developed markets (which have more consistent historical data) and it still shows a stronger trend than the full selection. The fact is that no one knows how ageing demographics will affect inflation, but it is far from certain that they are deflationary. If today’s inflation proves longer lasting, then it may be helped, rather than hindered, by demographics.

That matters for investors. Inflation reduces the buying power of cash, and is particularly damaging to fixed-income assets. Research from Waverton Investment Management suggests that when three-year average core inflation (ie, excluding food and energy prices) is greater than 2.5% a year, then bonds and equities are more likely to move together.

This could have a significant impact on portfolios. In recent years bond and equity returns have generally had a negative correlation, allowing bonds to hedge against falling stocks. But if the correlation turns positive, then rather than bonds providing protection, they may fall at the same time as equities. In other words, the best days for the 60/40 portfolio – the classic equity/bond split – may be behind us.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how