Ignore George Osborne, Britain is still in deep trouble

George Osborne says ‘Britain is on the right track’. That’s nonsense, says Phil Oakley. The financial outlook is getting worse, the economy is still in trouble, and the rescue plan isn’t credible.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Above all else, George Osborne has always been a politician.

That's a shame because the country needs someone who knows a thing or two about economics. Osborne's claims today that "Britain is on the right track" don't stack up.

Nothing has changed. In fact, the country's financial outlook is getting worse. Britain's economy is still in a lot of trouble.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Lies, damn lies and economic forecasts

Human beings are lousy at predicting the future. And economists are even worse. Their fancy computer models and spreadsheets aren't very useful. Yet it doesn't stop lots of very clever people pretending that they can tell us what's going to happen.

Take the people at the Office of Budget Responsibility (OBR), those independent number crunchers who feed their views to the government.

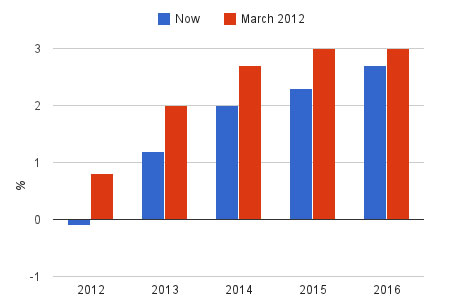

They've always believed that an economy that was built on excess debt can get back to growing at 2-3% per year fairly quickly. They still think it can - just a bit slower than they did back in March.

OBR forecasts for UK GDP

But a closer look at the OBR's forecasts leaves us thinking that they are still woefully optimistic.

Apparently our indebted households are going to spend Britain back to prosperity. Wages will be going up by nearly 5% per year by 2015-16, whilst the amount of income that people save will decline from 7.1% in 2012 to 5% in 2017.

Despite the lack of credit, business investment, which grew at just 2.9% in 2012, will be growing at 10.2% by 2015.

Our housing market will finally recover. The price of houses - already unaffordable to many - will go up by 18% by 2017. The number of residential housing transactions will go up by more than 50% and stamp duty takings will double.

And the value of shares is going to rise too. The FTSE-All Share index is going up by nearly 30% between now and 2017.

Let's hope the OBR is right. But these forecasts are hardly prudent. If Britain's economic predicament wasn't so serious, I'd be tempted to call them laughable.

Britain is in what's called a balance sheet recession. It's in a debt trap where too much borrowed money from the past has to be paid back before the economy can grow again. If you want to see what one looks like, look at Japan's economy over the last 20 years.

Debt is going through the roof

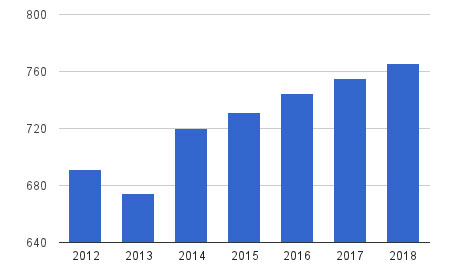

The problem with the government's deficit reduction plan is that it has never been credible. Government spending is still on an upward trend. Apart from a small reduction this year (due to capital spending reductions), it is forecast to keep on going up.

Government spending (£bn)

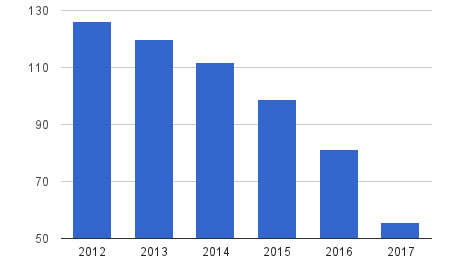

Cutting the deficit (our annual overspend) has always been based on growing our way out of trouble and getting bigger amounts of tax in the coffers on the back of it. Yet even if you believe the OBR's forecast for economic growth, £466bn will still be added to the government's overall debt pile over the next five years.

UK government budget deficit (£bn)

Excluding Royal Mail pension transfer and APF money

How long can the bond market and the pound defy reality?

Cutting corporation tax rates and encouraging business investment are welcome. Capping the increase in welfare payments is long overdue. But the fact remains that the size of the state is too big and Britain is still living beyond its means.

Osborne keeps harping on about how the low bond yields on government debt are a sign of confidence in Britain.

This is delusional. It's true that other countries are diversifying their foreign currency reserves and some of that is going into gilts, but bond yields are low mainly because of the Bank of England's printing press. The Bank now owns virtually a third of all bonds outstanding.

Someone has to buy the £466bn (or more) of extra debt that the government will take on. If the Bank of England buys it by creating money out of fresh air, it might keep interest rates lower than they should be for a while longer. But it won't be able to do anything about stopping the pound from falling in value.

Britain is drowning in debt. That's why we'd continue to stay away from bonds and invest in foreign assets to diversify your exposure to sterling.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

How to navigate the inheritance tax paperwork maze in nine clear steps

How to navigate the inheritance tax paperwork maze in nine clear stepsFamilies who cope best with inheritance tax (IHT) paperwork are those who plan ahead, say experts. We look at all documents you need to gather, regardless of whether you have an IHT bill to pay.

-

Should you get financial advice when organising care for an elderly relative?

Should you get financial advice when organising care for an elderly relative?A tiny proportion of over 45s get help planning elderly relatives’ care – but is financial advice worth the cost?