Gamble of the week: An unusual insurer

If you think stock markets are in for a period of calm, this closed-fund insurer could be worth a punt, says Phil Oakley.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Phoenix Group Holdings is a different type of insurer. Unlike Aviva or Legal & General, it doesn't sell insurance policies to new customers. Instead, it operates what is known as a closed fund business. Winning new life insurance business is usually a costly affair.

With more money buffers needed to protect customers, it's become increasingly tough for insurers to make money from them. It's cheaper and simpler to close the business to new customers and look after existing ones. This is largely how Phoenix Group, which also owns an asset management business, Ignis, makes a living.

Phoenix Group was set up a few years ago to buy closed life insurance and with-profits funds, cut the costs of running them, and focus on generating surplus cash to pay dividends to shareholders. Closed-life funds can be attractive businesses to own. Life insurance and pension annuities have reasonably predictable maturities and liabilities.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The insurer takes in regular premiums and invests them in various assets. It gets income from investment returns and management fees. As the policies mature or end, the insurance company no longer has to hold as many assets to protect customers that it no longer has. This often creates a surplus of cash that can be paid out to investors.

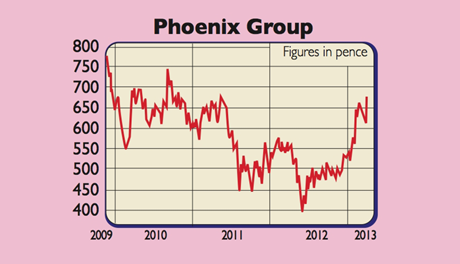

Phoenix Group (LSE: PHNX)

Phoenix has been quite good at churning out cash. It has taken closed funds, merged them with others, and cut costs. It has also outsourced its administration functions to keep operating costs low. As long as it keeps policyholders happy and the markets don't collapse, it can keep generating decent cash flows until there are no policies left.

As with most things in life, of course, there's no free lunch. Stock markets can, and do, crash. But the big risk is that Phoenix has borrowed lots of money £2.7bn at the end of 2012. This compares with a market capitalisation of £1.5bn and equates to 57% of its gross embedded value (that's a way of measuring an insurer's value). This debt means that a drop in markets and cash flows could blow a big hole in the company's value.

But if markets remain steady, then the shares look interesting at current levels. Since December, £450m of debt has been paid off and this should keep falling. This frees up more cash for dividends, which are expected to hit 51.5p per share for 2013. This gives a 7.7% yield at today's share price of 667p. In this case, high yield equates to high risk, but the shares are worth a punt.

Verdict: speculative buy at 667p

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how