'Total yield': A new way to hunt down a decent income

When looking for shares that pay a decent income, it's not enough to go on dividend yield alone. Instead, you should consider the 'total yield'. Tim Bennett explains.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

With interest rates so low, most of us would like to get a decent income from our stocks. But it's a mistake to just look at dividend yield, Chris Brightman of Research Affiliates tells Fortune. Instead, you should consider the total yield'. So what is it, and why does it matter?

The trouble with dividend yields

The dividend yield on a stock is simply the annual dividend expressed as a percentage of the share price (take the last 12 months if you want a historic' yield, or the analysts' forecasts for the next 12 months for a prospective' yield). So if the forecast dividend is 10p per share and the share price is £2, the prospective yield is (10p/£2) x 100%, or 5%.

From an income investors' point of view, the higher the better, subject to a few safety checks on a firm's ability to keep paying dividends at that level. The problem now, however, is that rising share prices have driven yields lower. In turn, investors desperately hunting for an inflation-beating income have been taking ever more risks to get it.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

A better approach, and one that won't expose you to as much risk, is to focus on total yield', says Brightman. This factors in both dividend yield and share buybacks.

What are buybacks?

A company that has spare cash and wants to boost its earnings per share (EPS) can use a share buyback. The firm offers to pay existing shareholders a fixed price for their shares. In doing so, it gets rid of the excess cash, gives a bonus cash return to those shareholders, and even improves the firm's performance (on paper at least).

Imagine a firm has 100 million shares in issue, and makes a profit of £10m. EPS is £10m/100m, or 10p. Say the firm buys back ten million shares. If earnings don't change, EPS is now £10m/90m, or 11.1p.

Understandably, firms that engage in buybacks are often criticised for this sleight of hand and for the fact that buybacks usually target selected shareholders the firm could pay out any spare cash as a dividend to all shareholders instead. Yet, says Brightman, in today's environment, these firms are worth targeting.

Looking for a total return

Brightman, notes Fortune's Shawn Tully, believes "that the overall market will reap puny rewards for the foreseeable future". In the past, investors have expected to get around 9% a year (including inflation). They'll have to lower their expectations, says Brightman.

The current dividend yield on the S&P 500 is 2%, half its historic average. He reckons EPS, meanwhile, will grow by just 1.5% a year, after inflation of around 2.5% a year. That gives an expected return of around 6%. So investors need to take any boost they can get their hands on. And one way to do it, says Brightman, is to target firms with a total yield of 8% or more.

There are four key components. The first is an above-average dividend yield (3% or higher, in the case of the S&P 500). Next, look for a firm that's expected to buy more than 2% of its outstanding shares each year. The logic here is that (assuming profits remain steady) EPS, and therefore the share price, should rise by about 2% a year too.

Brightman then looks for firms that are expected to grow their earnings by inflation plus 0.5% a year (3% in total). Those elements added together give you your 8% (3% dividend yield, 2% share buybacks, and earnings growth of 3%).

The final test is to check for decent free cash flow (the cash generated by a firm's operations, less the cost of capital expenditure required to maintain those cash flows). That increases the odds that a company will be able to maintain its dividend and buyback programmes.

What to buy

Among others, Brightman's screen throws up two stocks we like: pharmaceutical giant Pfizer (NYSE: PFE) with a 3.6% yield and 4% from buybacks; and medical equipment maker Medtronic (NYSE: MDT), which offers a 2.3% yield plus 3.7% from buybacks.

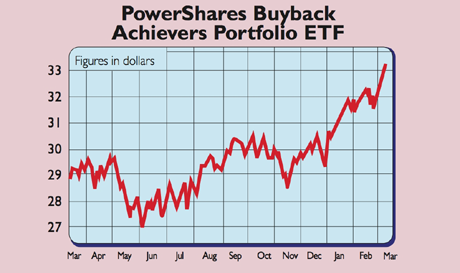

Alternatively, you could consider the PowerShares Buyback Achievers Portfolio ETF (NYSE: PKW). It's posted an annualised five-year return of 8.5% compared to 4.8% for the S&P 500. It targets firms that have repurchased at least 5% of their outstanding shares over the previous 12 months.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Tim graduated with a history degree from Cambridge University in 1989 and, after a year of travelling, joined the financial services firm Ernst and Young in 1990, qualifying as a chartered accountant in 1994.

He then moved into financial markets training, designing and running a variety of courses at graduate level and beyond for a range of organisations including the Securities and Investment Institute and UBS. He joined MoneyWeek in 2007.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how