Permanent interest bearing shares: a high-yield play on building societies

Permanent interest bearing shares (Pibs) are a form of debt issued by building societies. If you pick the right Pibs, you could lock in high returns. But beware, they can be a risky investment. So which Pibs look attractive now?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

"They've been seen as a nice little earner in the past," says Annie Shaw in the Daily Express. But permanent interest bearing shares (Pibs) are no longer the safe, boring investments they once were and more's the pity.

A form of debt issued by building societies, Pibs are similar to corporate bonds, trading on the Stock Exchange and paying a fixed rate of interest twice a year. But after the collapse of Bradford & Bingley and the recent refinancing of the West Bromwich Building Society, investors are realising Pibs are nowhere near as safe as they once thought.

Holders of West Bromwich's £75m outstanding permanent interest bearing shares, for example, will see their 6.15% annual interest payout cut to 1.5% next year. Investors in B&B's perpetual subordinated bonds (what Pibs become when building societies turn into banks) didn't get the payout due on 20 July and are unlikely to see any for the forseeable future.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

This was the first time Pibs had failed to make a payment. After this "unwelcome precedent", says Mark Glowrey, a director of Stockcube Research in Investors Chronicle, "other struggling societies might decide there's less reputational damage to be suffered by following suit".

So while the double-digit yields available on some Pibs look tempting, they are high for a reason. Dunfermline Building Society was another high-profile failure in the sector, and credit ratings agency Moody's has downgraded no fewer than nine building societies. It's little wonder investors are jumpy.

But if you pick the right permanent interest bearing shares, you could lock in high returns.

Hence this week's launch of the first Pibs fund in Britain. London-based Guardian Managers (020-7001 2650) will focus on these securities alone and aims to pay a yield of 7%-9% a year. But there are catches.

There's a minimum investment of £107,500. As Pibs are not an asset class you want to sink all your money into, that restricts the fund to investors with a large portfolio. Then there's the 5% up-front sales charge, 1.5% annual fee and 20% performance fee (over a 7% hurdle rate).

Given all this, if you're tempted to take the plunge we think you'd be better doing it yourself.

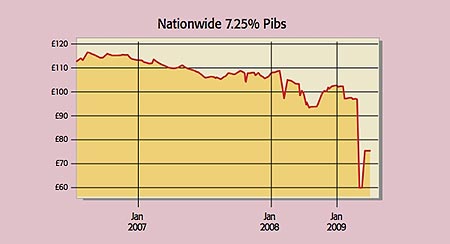

So which Pibs look attractive? Pibs are only as secure as the society issuing them. On a tier-one capital ratio (a key measure of financial strength) of 15.1% at year-end 2008, Nationwide fits the bill. You can buy the Nationwide 7.25% Pibs on a gross yield of around 8.5%-9% (depending on the spread at the time of buying) via a broker such as Collins Stewart (020-7523 8000).

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?