Is wine worth a punt?

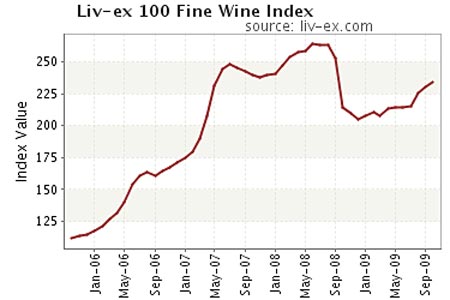

The Liv-ex 100 Fine Wine Index is up 9.5% over 12 months. So should you be piling into the fine wine market? Jody Clarke finds out.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Up 9.5% over 12 months, the Liv-ex 100 Fine Wine Index (below) has clawed back some of last year's losses, when the industry's main benchmark index fell 14.6% in 2008. So should you be piling into the fine wine market?

Probably not. First off, new Asian buyers and a "whole pile of Johnny-come-lately types" are fuelling current demand. A six-litre bottle of Chteau Ptrus 1982 recently sold for a record £60,000 at auction in Hong Kong, a city where wine imports rose by more than 40% in the first eight months of the year.

Meanwhile, in Christie's spring 2009 global sales, Asian and Chinese buyers accounted for 61% of the total sale value, compared to 7% in 2005. "With demand coming almost entirely from Asian buyers, and with that demand so heavily biased towards one particular producer, it would be wrong to start heralding the return of a bull market", say the people over at the Vintage wine fund.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Asia is beginning to resemble Japan in the late 1980s, when cash-flush companies and property developers splurged on trophy works by artists such as Van Gogh.

But there's another reason why wine just isn't such a great investment. Yes, it's true, the price of 'blue chip' wines should increase with age. After all, the volume remains limited. The number of bottles of a certain 'brand' - say, Chteau Mouton Rothschild 1998 - will only decrease after harvest. However, if you are storing it, you'll need a cellar with carefully monitored humidity and temperature levels. And when it comes to selling the stuff, you often end up turning to the broker who you originally bought it off to do so. That doesn't sound like a great idea.

Of course, you can plump for a wine fund such as the Wine Investment Fund, which is currently taking subscriptions for a new tranche at a minimum investment of £10,000. But we have never been a fan of large fees. And the hedge fund-like subscription fees of 5%, followed by a 20% performance fee charged at maturity, means you would have to be exceedingly bullish on themarket if you were to plump for it.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Jody studied at the University of Limerick and was a senior writer for MoneyWeek. Jody is experienced in interviewing, for example digging into the lives of an ex-M15 agent and quirky business owners who have made millions. Jody’s other areas of expertise include advice on funds, stocks and house prices.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how