Funds: Why you should venture into Europe

Generating a decent income from your money is getting harder. So where should you look? With sterling likely to keep sliding against the euro, European equity income funds might offer an answer, says Jody Clarke.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Generating a decent income from your money is getting harder. Corporate bond yields, for example, have fallen from a high of 8.5% in March to 5.8% today, according to the BARCAP bond index. Gilt (UK government bond) yields are at historic lows, and vulnerable to any changes in policy over quantitative easing. And UK equity income funds aren't much more attractive, given the risk of slashed dividends in the year to come.

So where can income-hungry investors look? With sterling likely to keep sliding against the euro, European equity income funds might offer an answer, and not just because they offer currency gains.

"There are a lot of sectors you don't get so much exposure to in the UK, like oil services," says Oliver Russ, manager of Ignis Argonaut European Income fund. "You can get exposure to a wider set of banks than in the UK, some of which are doing well."

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

He points to Greek and Turkish banks, which did not have massive subprime exposure and have already hit peak loan losses. They trade on six to seven times 2011 earnings, even though they have far less bad debt on their balance sheets than their British counterparts.

The trouble is that there is a perception that European companies don't pay generous dividends. This certainly used to be the case. The Dow Jones Euro Stock Index, which tracks the performance of 313 European stocks outside Britain, yielded 1.37% back in February 2000 against 2.28% for the FTSE All Share. Yet today it has a yield of 3.71% against 3.55% for the FTSE.

That seems like a reasonable argument to move some of your portfolio on to the continent. Throw in the fact that both companies and consumers are far less indebted than their British counterparts, and this option becomes compelling.

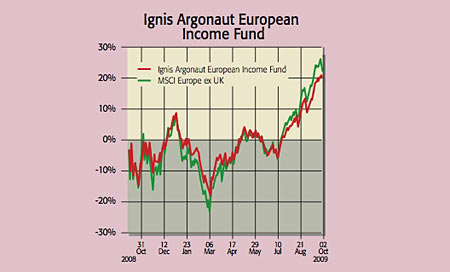

Hargreaves Lansdown (0117-900 9000) has just one European equity income fund in its Wealth 150, a list of what it considers to be the best funds across all major sectors. It is Russ's Ignis fund, up 12.4% over one year against a 5.7% drop in the MSCI Europe ex UK index. However, we also like the Jupiter European Income fund. Up 31.5% over one year, it's yielding 3.9% and has extensive exposure to healthcare stocks such as Roche and consumer goods companies, including Nestle.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Jody studied at the University of Limerick and was a senior writer for MoneyWeek. Jody is experienced in interviewing, for example digging into the lives of an ex-M15 agent and quirky business owners who have made millions. Jody’s other areas of expertise include advice on funds, stocks and house prices.

-

Japanese stocks rise on Takaichi’s snap election landslide

Japanese stocks rise on Takaichi’s snap election landslideJapan’s new prime minister Sanae Takaichi has won a landslide victory in a snap election, prompting optimism that her pro-growth agenda will benefit Japanese stocks

-

Alphabet 'is planning a 100-year bond': would you back Google for 100 years?

Alphabet 'is planning a 100-year bond': would you back Google for 100 years?Google owner Alphabet is reported to be joining the rare century bond club