Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

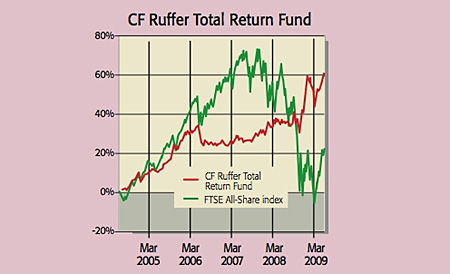

Like other cautious managed funds, the CF Ruffer Total Return Fund aims not to lose money. However, "unofficially, the aim is to make 10% a year", says the fund's co-manager Steve Russell. So far, that is no idle brag. Up 58% since 2004, the fund has returned 18% since July 2008 against a 16% drop for the FTSE All-Share.

A graduate in PPE from Oxford, Russell and his fellow manager David Ballance are self-confessed inflationists. They have a large exposure to index-linked government bonds in the UK, US and Japan. Another 7% of the fund is in gold: half in major miners such as Barrick Gold and Newcrest Mining and the other half in gold exchange-traded funds. "Governments are printing money to such a degree that there is a real risk of a loss of faith in paper money," he says.

Equities make up a major share of the portfolio. But fearing a long recession, "and quite possibly a W-shaped one", he is avoiding cyclicals. Instead, UK blue-chips and Japanese stocks make up the majority of the fund's equities.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Defensives such as BP and BT have lagged in the recent rally, so should do well in the third quarter, he believes. "But the biggest attraction is that they have a safe and steady yield of 6-7%." Cyclicals, in contrast, pay practically no dividend.

Aside from the UK, Japan is favoured for its strong balance sheets; "Japanese banks look better (than Western ones) on a risk-reward basis", he says. But the biggest draws are certain real estate investment trusts, such as Nippon Building Fund. "As Japanese banks normalise lending criteria, there is a big upside available on yields of 4-5%".

Telephone: 020-7963 8215.

table.ben-table table { border: 3px solid #2b1083;font: 0.928em/1.23em verdana, arial, sans-serif;}

th { background: #2b1083; padding: 10px 5px;color: white;font-weight: bold;text-align: center;border-left: 1px solid #a6a6c9;}th.first { border-left: 0; padding: 5px 2px;text-align: left;}

tr {background: #fff;}

tr.alt {background: #f6f5f9; }

td { padding: 5px 2px;text-align: center;border-left: 1px solid #a6a6c9;color: #000;vertical-align: center;}td.alt { background-color: #f6f5f9; }td.bold { font-weight: bold; }td.first { border-left: 0; text-align: left;}

CF Ruffer Total Return's top ten holdings

| Inflation Linked Gilt 1.25 22/11/17 | 8.7 |

| Japanese gov't inflation-linked bond 1.2 03/10/17 | 5.7 |

| Norwegian gov't bond 4.25 05/19/17 | 5.5 |

| CG Portfolio Fund Plc | 4.9 |

| US Treasury index-linked 2 3/8 01/15/25 | 4.7 |

| Japanese gov't inflation-linked bond 1.4 06/10/18 | 4.3 |

| Gold Bullion Securities | 3.9 |

| Inflation Linked Gilt | 3.9 |

| BP Plc | 3.2 |

| Annaly Capital Management | 3.0 |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.