Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

A successful long-term investor needs to put recent movements in various asset classes in perspective. Enter the annual Credit Suisse Global Investment Returns Yearbook, written by Elroy Dimson, Paul Marsh and Mike Staunton of the London Business School. It spans 113 years of data across 25 countries.

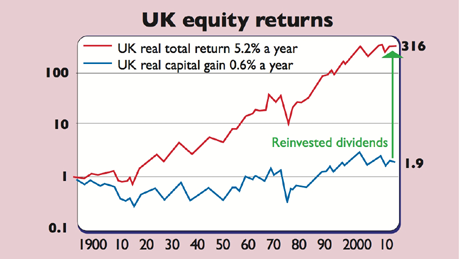

The first basic message is that stocks beat bonds or cash over the long term. Global equities have returned an annual 5% after inflation since 1900, bonds 1.8% and cash 0.9%. For Britain, the figures are 5.2%, 1.5% and 0.9% respectively. British stocks have also beaten bonds since 1950 and 1980. In global terms, however, for the period since 1980, bonds narrowly beat stocks as the post-2000 bear market hit shares.

So it's a case of stocks for the long run, but this doesn't rule out a lousy decade or two. Indeed, a truly unfortunate investor would have bought Austrian stocks just before World War I. That would have led to 97 successive years of losses. In Britain, the longest stock investors have had to wait for a positive real return since 1900 is 23 years.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Source: London Business School

What now? Note, says the report, that our expectations have been skewed by the strong recent performances of both bonds and stocks. "The high equity returns of the second half of the 20th century were not normal, nor were the high bond returns of the last 30 years." With bond yields so low (reflecting sky-high prices), prospective real returns over a 20-year holding period will be "firmly negative".

Low real interest rates aren't good news for stocks either; they are associated with poor returns over the subsequent five years. Investors demand a higher return from stocks to compensate for the extra risk compared to risk-free bonds or cash. But if bond yields and interest rates are historically low, then stock returns, once the extra return investors demand is accounted for, will be lower than usual too.

So global stocks may only return around 3.5% a year over the next 20 years, reckons the study. We are stuck in a post-crisis, low-return world, and it could be years before we shake off the post-bubble hangover and interest rates rise significantly. The unusually uncertain outlook makes it all the more important to reinvest dividends. Since 1900 British stocks have risen 316-fold with dividends reinvested but just 1.9-fold without.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how