Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

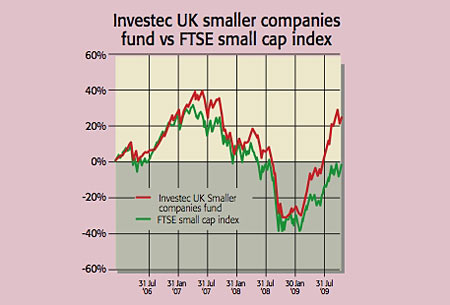

Philip Rodrigs likes to keep beating his benchmark. Since taking over the Investec UK Smaller Companies Fund in 2006, he has chalked up a 25% rise over three years against a 2.6% drop in the FTSE Small Cap index. And despite returning 82% over 12 months, Rodrigs still sees further upside for the 80 or so firms in his portfolio. "There are still a lot of companies where (recent economic) stability is not fully reflected in the price."

An Oxford Economics graduate, Rodrigs bases his investment decisions on Investec's unique "four factor process". He looks for high-quality firms with cheap valuations, where operating performance is improving and investors are beginning to take note. This led him to buy Trinity Mirror for 25p back in March when it was trading on a price-to-earnings ratio below 1. It is now priced at 163p. "It had hit hard times and the market was assuming they would go bust. But the newspaper industry is very cash generative, so we felt the banks wouldn't see it that way."

GlobeOp Financial Services, which provides back-office technological support to hedge funds, is one of the fund's top holdings. On 13-times forecast earnings, with operating margins of 25%, it's on a "modest valuation for a global leader", especially with hedge funds still doing well.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Rodrigs is still only 28, "but he has quietly been building a solid reputation", says Meera Patel of Hargreaves Lansdown in FT Adviser. "If you are stuck for new ideas in this sector, it is worth keeping an eye on this fresh talent." His fund's total expense ratio is 1.61%.

Contact: 020-7597 1800

table.ben-table table { border: 3px solid #2b1083;font: 0.928em/1.23em verdana, arial, sans-serif;}

th { background: #2b1083; padding: 10px 5px;color: white;font-weight: bold;text-align: center;border-left: 1px solid #a6a6c9;}th.first { border-left: 0; padding: 5px 2px;text-align: left;}

tr {background: #fff;}

tr.alt {background: #f6f5f9; }

td { padding: 5px 2px;text-align: center;border-left: 1px solid #a6a6c9;color: #000;vertical-align: center;}td.alt { background-color: #f6f5f9; }td.bold { font-weight: bold; }td.first { border-left: 0; text-align: left;}

Investec UK Smaller Companies Fund top ten holdings

| INTEC Telecom Systems | 3.7 |

| BATM Advanced Communications | 2.7 |

| LSL Property Services Plc | 2.7 |

| Unite Group | 2.4 |

| Elementis | 2.2 |

| Lookers | 2.0 |

| CSR | 1.9 |

| Safestore Holdings Plc | 1.9 |

| GlobeOp Financial Services SA | 1.9 |

| Hill & Smith Holdings | 1.8 |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Pension Credit: should the mixed-age couples rule be scrapped?

Pension Credit: should the mixed-age couples rule be scrapped?The mixed-age couples rule was introduced in May 2019 to reserve pension credit for older households but a charity warns it is unfair

-

Average income tax by area: The parts of the UK paying the most tax mapped

Average income tax by area: The parts of the UK paying the most tax mappedThe UK’s total income tax bill was £240.7 billion 2022/23, but the tax burden is not spread equally around the country. We look at the towns and boroughs that have the highest average income tax bill.