Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

As fund management jobs go, "I have a very hard one to be honest", says Nick Evans, manager of the Polar Capital Global Technology Fund. He has to convince investors there is still money to be made in technology, "eight to nine years after people got badly burnt".

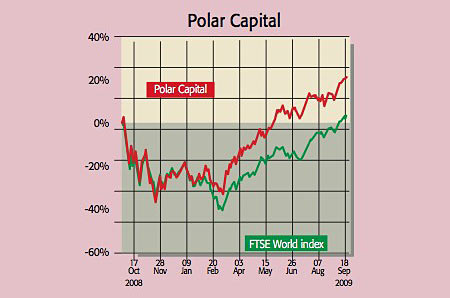

But his job might be getting easier investors seem to have finally got the message. Assets under management have gone from $20m in February to $105m, during which time the fund has returned 63.71%. Over the same period, the FTSE All-World is up 46.4%. Can the outperformance continue?

Evans believes so. He's convinced that a new technology cycle is unfolding. Cloud-computing and new internet broadband applications should drive growth in the sector, as corporations look to new technology to drive down overheads. "Productivity matters now, it didn't before."

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

This should help companies such as Aruba Networks, which installs low-cost wireless internet connections for firms. It's stealing market share from Cisco Systems and growing profits "yet it trades on a reasonable 2.5x forward enterprise-value/revenue multiple".

He also likes Apple, "the clear leader in smart phones", as it has "a significant 18-month-plus advantage relative to competitors." It has sold 30 million iPhones to date in a handset market that sells over 1.1 billion units a year. Yet along with RIMM, the makers of the BlackBerry, it boasts 45% of the industry's profits. "People got caught up in the hype" around 2000, says Evans.

But the tech sector has since gone from an earnings multiple of 60 times or more to lows of 12 times earnings this year. With low pensions liabilities and as the only sector with net cash on the balance sheet, "it is finally delivering on that hype".

Tel: 020-7227 2709.

table.ben-table table { border: 3px solid #2b1083;font: 0.928em/1.23em verdana, arial, sans-serif;}

th { background: #2b1083; padding: 10px 5px;color: white;font-weight: bold;text-align: center;border-left: 1px solid #a6a6c9;}th.first { border-left: 0; padding: 5px 2px;text-align: left;}

tr {background: #fff;}

tr.alt {background: #f6f5f9; }

td { padding: 5px 2px;text-align: center;border-left: 1px solid #a6a6c9;color: #000;vertical-align: center;}td.alt { background-color: #f6f5f9; }td.bold { font-weight: bold; }td.first { border-left: 0; text-align: left;}

Polar Capital Global Technology's top ten holdings

| Apple | 3.5 |

| 3.4 | |

| Microsoft | 3.0 |

| Qualcomm | 2.8 |

| Cisco Systems | 2.8 |

| Oracle | 1.8 |

| Samsung Electronics | 1.6 |

| Intel | 1.6 |

| Cognizant Technology Solutions | 1.6 |

| Analog Devices | 1.6 |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement today (3 March). What can we expect in the speech?