Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

As fund management jobs go, "I have a very hard one to be honest", says Nick Evans, manager of the Polar Capital Global Technology Fund. He has to convince investors there is still money to be made in technology, "eight to nine years after people got badly burnt".

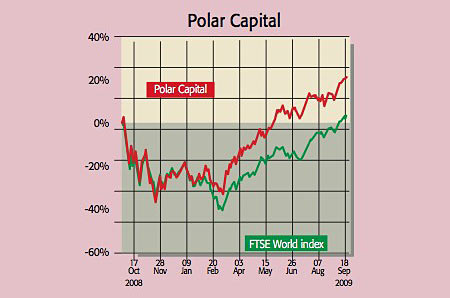

But his job might be getting easier investors seem to have finally got the message. Assets under management have gone from $20m in February to $105m, during which time the fund has returned 63.71%. Over the same period, the FTSE All-World is up 46.4%. Can the outperformance continue?

Evans believes so. He's convinced that a new technology cycle is unfolding. Cloud-computing and new internet broadband applications should drive growth in the sector, as corporations look to new technology to drive down overheads. "Productivity matters now, it didn't before."

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

This should help companies such as Aruba Networks, which installs low-cost wireless internet connections for firms. It's stealing market share from Cisco Systems and growing profits "yet it trades on a reasonable 2.5x forward enterprise-value/revenue multiple".

He also likes Apple, "the clear leader in smart phones", as it has "a significant 18-month-plus advantage relative to competitors." It has sold 30 million iPhones to date in a handset market that sells over 1.1 billion units a year. Yet along with RIMM, the makers of the BlackBerry, it boasts 45% of the industry's profits. "People got caught up in the hype" around 2000, says Evans.

But the tech sector has since gone from an earnings multiple of 60 times or more to lows of 12 times earnings this year. With low pensions liabilities and as the only sector with net cash on the balance sheet, "it is finally delivering on that hype".

Tel: 020-7227 2709.

table.ben-table table { border: 3px solid #2b1083;font: 0.928em/1.23em verdana, arial, sans-serif;}

th { background: #2b1083; padding: 10px 5px;color: white;font-weight: bold;text-align: center;border-left: 1px solid #a6a6c9;}th.first { border-left: 0; padding: 5px 2px;text-align: left;}

tr {background: #fff;}

tr.alt {background: #f6f5f9; }

td { padding: 5px 2px;text-align: center;border-left: 1px solid #a6a6c9;color: #000;vertical-align: center;}td.alt { background-color: #f6f5f9; }td.bold { font-weight: bold; }td.first { border-left: 0; text-align: left;}

Polar Capital Global Technology's top ten holdings

| Apple | 3.5 |

| 3.4 | |

| Microsoft | 3.0 |

| Qualcomm | 2.8 |

| Cisco Systems | 2.8 |

| Oracle | 1.8 |

| Samsung Electronics | 1.6 |

| Intel | 1.6 |

| Cognizant Technology Solutions | 1.6 |

| Analog Devices | 1.6 |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Last chance to invest in VCTs? Here's what you need to know

Last chance to invest in VCTs? Here's what you need to knowInvestors have pumped millions more into Venture Capital Trusts (VCTS) so far this tax year, but time is running out to take advantage of tax perks from them.

-

ISA quiz: How much do you know about the tax wrapper?

ISA quiz: How much do you know about the tax wrapper?Quiz One of the most efficient ways to keep your savings or investments free from tax is by putting them in an Individual Savings Account (ISA). How much do you know about ISAs?