Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

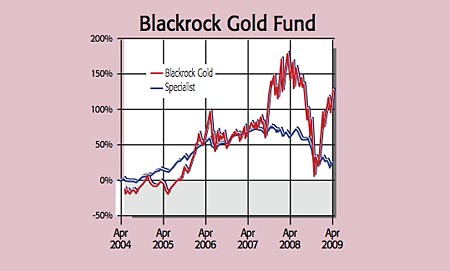

Investing in gold, mining and precious metal stocks, we've been fans of the £1.5bn BlackRock Gold & General Fund here at MoneyWeek for some time. Up 123% over five years, it's easy to see why. But should you hold on to your position in it now that its manager of ten years, Graham Birch, is leaving for a 12-month sabbatical?

We'd cautiously say yes. Birch's replacement, Evy Hambro, is hardly inexperienced he's part of BlackRock's 14-strong natural resources team, managing $20bn worldwide. And he has run BlackRock's offshore World Gold fund alongside Birch for some time.

So although "it is always a little disappointing when a good fund manager takes time out of the industry, we feel confident that BlackRock's team can continue to do a good job for investors in Mr Birch's absence", said Stuart Goodwin at Hargreaves Lansdown.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The gold price is currently hovering below $900 an ounce, but Hambro thinks it will rise sharply. Production problems mean demand for gold, which is rising among nervous investors looking for hard currency, won't be met. He tells The Daily Telegraph: "Gold production fell last year and may fall further in 2009. This is partly due to the lack of exploration success by the gold mining industry, which discovered 15 million ounces last year, compared with production of 80 million ounces."

As continued fears over the world's paper currencies and the state of the economy push the price of gold higher, gold miners, which remain cheap compared with bullion, should take off.

Contact: 0800-445522.

TABLE.ben-table TABLE {BORDER-BOTTOM: #2b1083 3px solid; BORDER-LEFT: #2b1083 3px solid; FONT: 0.92em/1.23em verdana, arial, sans-serif; BORDER-TOP: #2b1083 3px solid; BORDER-RIGHT: #2b1083 3px solid}TH {TEXT-ALIGN: center; BORDER-LEFT: #a6a6c9 1px solid; PADDING-BOTTOM: 10px; PADDING-LEFT: 5px; PADDING-RIGHT: 5px; BACKGROUND: #2b1083; COLOR: white; FONT-WEIGHT: bold; PADDING-TOP: 10px}TH.first {TEXT-ALIGN: left; BORDER-LEFT: 0px; PADDING-BOTTOM: 5px; PADDING-LEFT: 2px; PADDING-RIGHT: 2px; PADDING-TOP: 5px}TR {BACKGROUND: #fff}TR.alt {BACKGROUND: #f6f5f9}TD {TEXT-ALIGN: center; BORDER-LEFT: #a6a6c9 1px solid; PADDING-BOTTOM: 5px; PADDING-LEFT: 2px; PADDING-RIGHT: 2px; COLOR: #000; PADDING-TOP: 5px}TD.alt {BACKGROUND-COLOR: #f6f5f9}TD.bold {FONT-WEIGHT: bold}TD.first {TEXT-ALIGN: left; BORDER-LEFT: 0px}

BlackRock Gold & General Fund top ten holdings

| Newcrest Mining | 7.9 |

| Newmont Mining Corporation | 7.7 |

| Kinross Gold Corporation | 7.6 |

| Lihir Gold | 5.1 |

| Goldcorp Inc | 4.5 |

| Randgold Resources | 4.5 |

| Compania de Minas Buenaventura SA | 4.4 |

| Gold Fields | 4.4 |

| Barrick Gold Corp | 3.8 |

| Fresnillo Plc | 3.8 |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how