Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

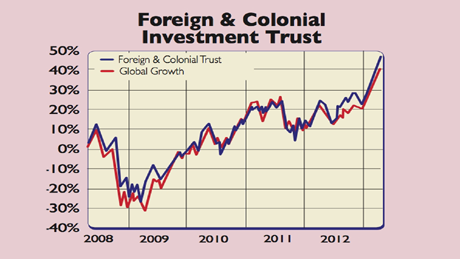

Steady sources of investment income are getting harder to find. So it's easy to see the attraction of Foreign & Colonial Investment Trust's "mouthwatering combination of income and capital growth for its 100,000-strong army of private investors", says Jeff Prestridge in The Mail on Sunday.

Founded in 1868, the oldest investment trust in existence boasts an impressive dividend track record, having raised payments every year for the past 42 years. This year, true to form, manager Jeremy Tigue will be increasing payments by 5.9% to 9p, following a 19.7% hike in 2012.

Only four investment trusts have a better track record of delivering consecutive income growth over the past 40 years, notes the Daily Mail, and F&C has nowalso switched to more regular quarterly dividend payments. The trust has also delivered returns of 19% over one year, 37% over three years and 52% over five years, according to Trustnet.com. The ongoing charge is a reasonable 0.9%.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Originally launched to give investors access to international investments, the trust has exposure to over 600 quoted and unquoted stocks in 35 countries. Recently, Tigue's strategy has been to take the fund back to its original overseas roots.

With the aim of diversifying the trust's income, in January he cut its home market exposure from 33% to 22%, switching out of UK shares and into a global portfolio of higher-yielding shares outside the British market.

By 2018, Tigue aims to trim the fund's UK exposure to 15% and increase its American holdings from 25% now to 35%. That makes this trust a good option for income-seekers looking for international exposure.

Contact: 020-7628 8000.

Foreign & Colonial Trust'stop ten holdings

| Pantheon Europe V | 2.5 |

| HarbourVest V Direct Fund | 2.2 |

| Pantheon Europe Fund III | 2.1 |

| Doverstreet VII | 1.9 |

| HarbourVest Buyout Fund | 1.4 |

| Royal Dutch Shell | 1.3 |

| HSBC Holdings | 1.3 |

| GlaxoSmithKline | 1.3 |

| BP | 1.3 |

| Utilico Emerging Markets | 1.2 |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how