Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

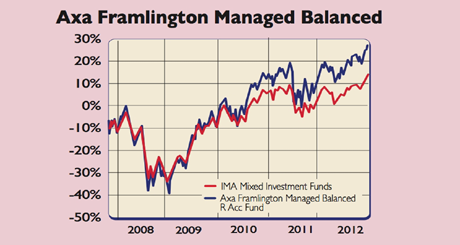

Its moniker may lack glamour, says Mark Dampier of Hargreaves Lansdown in The Independent, yet Axa Framlington Managed Balanced is "the type of fund most investors should own". This is because it includes equities, bonds and cash, making it a "ready-made portfolio".

The strategy behind the fund, launched in 1992, is to seek capital growth by investing 80% in shares and the rest in cash and bonds. It can buy securities in any worldwide economic sector that manager Richard Peirson believes shows above average profitability. So far this approach is paying off.

According to Trustnet.com, the fund delivered a return of 13.3% over one year, 26.5% over three years and 28.6% over five years. Its annual charge, meanwhile, is a reasonable 1.25%. By striking a balance between bonds, cash and equities Peirson also reduces volatility.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

A high equity weighting means that "if the good times return then he will be there to take advantage", says Frank Talbot on Citywire.co.uk, while the bond and cash position "provides insurance against the situation getting worse".

The secret of the veteran fund manager's success is favouring FTSE 250 companies. These, notes Dampier, have largely beaten the FTSE 100 in the last ten years. Around 48% of his holdings are British stocks, with about 40% international shares, selected by other specialist Axa Framlington managers.

Despite Britain's economic gloom, Peirson remains optimistic about the opportunities in the FTSE 250. For investors seeking diversification, Axa Framlington Managed Balanced offers "an aggressively positioned mixed asset fund" that's well worth a look, says Talbot.

Contact: 0845-777 5511.

Axa Managed Balanced top ten holdings

| Axa Fram. Emerging Markets | 3.0 |

| Treasury 5% gilt 2025 | 2.6 |

| Germany 0.75% BDS 13/09/13 | 2.4 |

| HSBC Holdings | 2.2 |

| Royal Dutch Shell | 2.1 |

| Treasury 2 1/2% IDX-linked gilt | 2.0 |

| GlaxoSmithKline | 1.6 |

| Vodafone | 1.4 |

| BP | 1.4 |

| Diageo | 1.4 |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how