Why I’m buying index-linked bonds

Finding a reliable source of income is tough, as yields on everything sink. But one investment – 'linkers' – could solve the problem. Phil Oakley explains what they are and how to buy them.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

To have any hope of maintaining a decent standard of living in your retirement, it's not enough just to grow your savings. They have to give you a real' return.

In other words, they have to grow at above the rate of inflation. Otherwise, if you're not careful, you'll find that the money you've been tucking away for the future won't buy you as much as you'd hoped it would.

Trouble is, it's very hard to find an inflation-beating return just now.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Governments see inflation as the easy, stealthy solution to their huge debt problems. So they are pursuing policies that make life hard for savers. As a result, income-hungry investors have embarked on a desperate 'dash for yield'.

This has driven down yields on everything from dividend stocks to junk bonds. For example, the Bolivian government is able to borrow money at less than 5% a year not my definition of a good investment.

But there's one type of government debt that does look interesting index-linked debt

The case for linkers

Some of you will be thinking that I must be mad to consider investing in index-linked government bonds.

I can understand why.

Inflation-protected (or index-linked) bonds must be one of the most expensive assets in the world just now. They are so popular that they currently offer a negative real yield - in other words they return less than inflation. (I'll explain how they work in a moment). This is true on both sides of the Atlantic, as the charts below show.

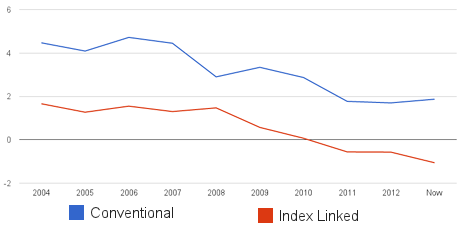

UK conventional and index-linked bond yields

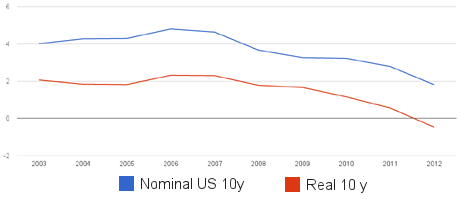

US conventional and index-linked bond yields

Yields are negative because index-linked bonds have been among the best-performing asset classes in recent years. More and more people, worried by inflation and inflationary policies, have flocked to them as a way to protect their money. This has pushed prices up and yields down.

The UK Treasury 2.5% 2024 index-linked bond has a current real yield to maturity (the return you get, after inflation, if you buy now and hold until the bond is paid back in 2024) of minus 1.06%. The US Treasury 0.625% 2021 bond has a real yield of minus 1%.

So why on earth would you buy now? To answer that, we need to look at the basic mechanics of these bonds.

How linkers work

Both the capital value and the income payments on index-linked bonds move in line with inflation. Let's go back to our UK bond, which matures in 2024, to explain how this works.

This bond was issued in 1986 with a face (or par) value of £100. It now has a face value of around £248 (due to the inflation adjustment).

In 1986 you would have received around £2.50 of income on each bond (2.5% x £100). You now get an income of around £6.20 (2.5% x £248).

If inflation averages 3% a year between now and 2024, you will end up getting £348 back for each bond. Your final year's income will be around £8.70 (2.5% on £348). Sounds good.

Trouble is, you have to pay £356 for this bond today. So if inflation is only going to be 3% a year between now and 2024, you will get back less money than you paid for it.

But and this is the big but what if inflation ends up being much higher than 3%?

Our government relies on money-printing to stay afloat. On top of this, we import more than we export, and with our North Sea oil and gas reserves running out, that's likely to continue.

That means we need to sell more pounds to buy goods priced in other currencies. This tends to weaken the pound, and drive up the cost of imports.

It seems to me that inflation could easily go above 5% (as it was as recently as 2008), or even higher. If that happens, then buying index-linked bonds at what seem like high prices today could be a good move.

Markets aren't yet pricing this level of inflation in. We can tell this by looking at the 'break-even rate'. This is the difference between the yield on normal gilts, and the 'real' yield on index-linked ones. This tells you what the rate of inflation will have to be for the index-linked bond to give the same return as a conventional one. This rate is often used by actuaries to estimate what inflation will be in the future.

In the UK, the break-even rate is currently 3.2%; in the US, it's 2.5%. If you expect inflation to be above these rates, you will be better off buying the index-linked bond rather than the conventional one.

An added attraction of buying US index-linked government bonds (Tips Treasury inflation-protected securities) is that you'll get exposure to the US dollar too. If inflation takes off to a greater extent in Britain than in the US, then buying Tips would hopefully give you both an inflation-linked income stream, plus a currency gain on top.

I'm buying both types of linkers, because I think inflation will be a lot higher than most people do.

What could go wrong?

You could try buying overseas shares or gold as an inflation hedge (I own both). I have a lot of sympathy for the view that governments understate the true rate of inflation. Only recently, the benchmark index for index-linked gilts was almost changed from RPI to a more forgiving inflation measure. There's nothing to say that another attempt won't be made. (This is a form of financial repression we've written more on the topic in general in a special report we issued this weekend if you missed it, check it out here.)

So other real' assets may give you a better inflation hedge. But they will probably also be more of an emotional rollercoaster ride than index-linked bonds.

That said, I don't want you to give the impression that index-linked bonds are a worry-free investment. There's one big risk - rising interest rates.

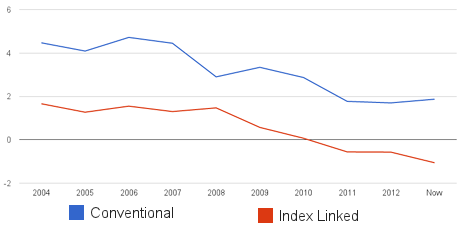

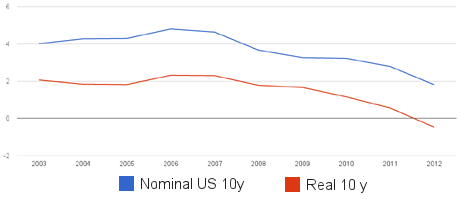

Lots of index-linked bonds have very long lives. In bond speak, they have long durations'. In practical terms, this means their prices are very sensitive to changes in interest rates. Take a look at the red lines on those charts again (we've republished them below for convenience).

UK conventional and index-linked bond yields

US conventional and index-linked bond yields

You can see that up until quite recently investors demanded real yields on index-linked bonds of closer to 2%, not negative yields. If investors get spooked by the bond markets and demand higher yields again, then you could lose money on these bonds in the short term.

That's why holding them until they mature (ie until the face value is repaid) makes sense, as the income from the coupons should cushion you against some of the risk of higher interest rates.

How to buy index-linked bonds

You won't get rich owning these bonds. But I think they should still have a place in your portfolio as a way to spread your risk, particularly if you think that inflation is going to go a lot higher, and the pound is going to fall a lot further.

View these as long-term 'buy and hold' investments. You can buy individual bonds from most stockbrokers; alternatively you could look at buying an exchange traded fund (ETF). The iShares Barclays £ Index-Linked Gilts (LSE: INXG) tracks an index of UK index-linked gilts. The total expense ratio (TER) is 0.25% a year. For US bonds, the iShares Barclays $ TIPS (LSE: ITPS) tracks the Barclays US TIPS index. It has a TER of 0.25% and sticks close to the index after fees.

For disclosure: Phil Oakley owns both INXG and ITPS

This article is taken from the free investment email Money Morning. Sign up to Money Morning here .

Our recommended articles for today

Five ways companies can cook cash flow

Most investors know that company directors can boost profits with crafty accounting. But can they do that with cash flow? Tim Bennett looks at five ways a firm could dupe you into thinking its cash flows are stronger than they really are.

George Osborne goes 'all in'

Between the lines of the latest Budget is a hidden message that's screaming out to you, says Bengt Saelensminde. Here, he reveals what it is, and what it means for your investments.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how