Join the race to claim the Falkland Islands' oil

The seas around the Falkland Islands are believed to contain as much oil and gas as the North Sea. But geology, climate and international relations have all hampered its exploitation. But now explorers are making progress. Eoin Gleeson looks at the sector, and finds the best way investors can stake their claim.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Ever since Britain regained control of the Falkland Islands in 1982, Argentina has done its best to restrict travel to the island. If you want to get there today, you either take a weekly flight from Chile, or you call up the Royal Air Force. Even after, 20 years ago, geologists confirmed that an oil field the size of the North Sea lies off the coast of Falklands, oil groups abandoned the archipelago leaving the island's 3,000 inhabitants to subsist on sheep sheering and wool production.

But there was fresh hope for Falklanders last month when one of the small explorers that stayed behind to scope out oil made a huge discovery. Testing a well drilled by Shell ten years earlier, British firm Rockhopper Exploration (LSE: RKH) discovered a massive natural gas deposit one that could be as big as 7.9 trillion cubic feet. And with oil majors looking to return to the Falklands now that oil is no longer $10 a barrel, this remote region is suddenly a hotbed for oil exploration again.

There are two areas being explored at the moment the North and South Basins. Rockhopper made its discovery in the North, where the water is shallow at 100m-600m and the drilling conditions relatively benign. The South Basin, where fellow explorers Falkland Oil & Gas and Borders & Southern (LSE: BOR) are active, is another matter. The water is up to 1,200m deep and the drilling conditions far trickier.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

So far, Rockhopper's discovery remains just that there is no nearby market for gas and transporting it by pipe or in liquid form would require huge investment. There is also the problem of diplomatic wrangling. In May, the Argentinian government submitted a claim at the UN to 1.7 million square miles of seabed that includes the Falkland Islands oil basin. The British authorities refute it, but the dispute could still hold up drilling activity until a resolution is reached, according to Eric Watkins in the Oil & Gas Journal.

Undeterred, the oil explorers have made huge progress in recent months, says Martin Li in Investors Chronicle. Four have completed their reviews of seismic data and identified drill targets. And major oil groups are already offering critical financing to the explorers in exchange for revenue from these wells. Falklands Oil & Gas, for example, has secured the backing of resource giant BHP Billiton. Initial drilling now looks possible in the North Basin as early as the first quarter of 2010, according to Oriel Securities analyst Richard Rose.

The main remaining challenge will be securing a rig. With oil groups keen to develop huge oil finds off the coast of Brazil and Africa, there is little incentive for rig suppliers, already commanding huge day rates, to release a rig to such a remote corner of the globe. And there is no guarantee that the Falkland oil explorers will tap a well with reserves that are large enough even to cover the cost of renting a rig.

Still, given the possible rewards, the race is on to start drilling as soon as possible. Those who have the backing of major resource companies have a huge advantage. With rig slots becoming available later this year some Falkland explorers are close to a major windfall. How big could it be? The British Geological Survey reckons there are perhaps 60 billion barrels of oil lying off the coast of the Falklands. We look below at the best way to stake a claim to those reserves.

The best bet in the sector

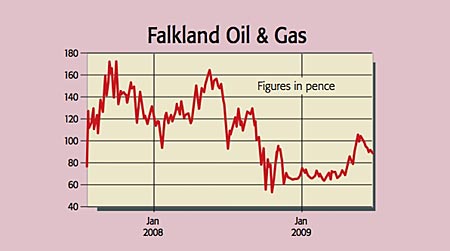

With the backing of resource giant BHP Billiton, Aim-listed Falkland Oil & Gas (Aim: FOGL) has every chance of securing a rig this year. Farming out its operation to BHP in return for a 51% stake will see BHP funding more than two-thirds of the two wells Falklands plans to drill. Things are moving. The firm said in March it will be ready to drill by the third quarter of this year and has just raised £7.6m in a share placing to fund its share of the cost of drilling equipment.

The company faces plenty of challenges. Sure, it controls a large acreage in the South Basin and there is huge potential here, says Tom Bulford in his Penny Shares newsletter. For example, a 500-million-barrel discovery could be worth around £14 per share, while even a smaller 100-million-barrel field would be viable as long as oil stays above $25 a barrel. But any revenue from oil is still about five years away a storage vessel needs to be built and more known about the fields, according to CEO Tim Bushell.

Given there is no guarantee that Falkland Oil & Gas will extract oil from the difficult terrain of the South Basin, investors should be prepared, in the worst case, to lose their cash.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Eoin came to MoneyWeek in 2006 having graduated with a MLitt in economics from Trinity College, Dublin. He taught economic history for two years at Trinity, while researching a thesis on how herd behaviour destroys financial markets.