Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The purpose of the threesixty newsletter is to explain how what's going on impacts upon investment opportunities and investment decisions. Thus, we don't usually waste time talking about politicians.

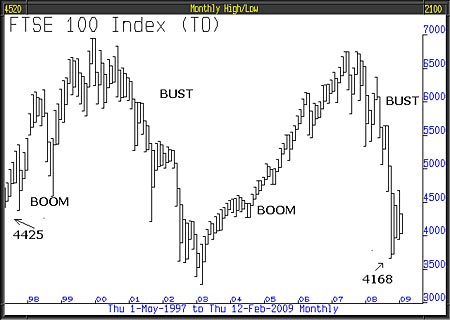

However, when New Labour came to power, shortly afterwards, Gordon Brown declared that New Labour would banish boom and bust. Since then the stock market has known nothing else but boom and bust. From May 1997 until 2000, FTSE enjoyed a boom; then from 2000 to 2003 suffered a huge bust, followed by another boom from 2003 to 2007, followed by another bust from 2007. Over the entire period of this Labour government, ignoring the gyrations, it moved down from 4425 to 4168.

Of course, poor old Gordon, who was Chancellor for most of that time, made no mistakes - it was all down to global conditions which nobody could have foreseen except perhaps by those of an enquiring nature who study the lessons of history.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

From 1982 until 2000, FTSE and the S&P 500 in the US, delivered annual total returns averaging 14% per annum, suffice to say, it is impossible for the stock market to indefinitely deliver greater returns than the growth in the economy. The lesson from history is that for every 17 years, the stock market rises on average 14% per annum, and it periodically does this; what logically has to follow is, on average, 16-years of nothing. In other words, based on the lessons of history, the stock market will most likely be no higher than it was in 2000 until at least 2016. In fact, conditions are this time so extraordinary, it might be like Japan, where 18-years after 1990 when the Nikkei Dow was at 40,000 it is still at only 7,705, you ignore the lessons of history at your peril.

The good thing is that we had the foresight to advise about these major truths when it mattered, not with hindsight nine years later. Consider this; if you were invested in the stock market in 2000 and remained so, as vast numbers have, you would have no reasonable hope of enjoying an average return of 7% per annum until 2033; in other words, 16-years of averaging nothing per annum followed by 17-years from about 2016 averaging 14% per annum. Unless it's a Japan type collapse, in which case, if the quality of your life depends upon your investments, you are ruined.

In our view, what is needed to succeed is a thoughtful process; not a mindless one that relies upon failed theories, promoted as if they were words of wisdom written in stone and which the lessons of history have repeatedly proved to be flawed.

The investment industry works on a simple principle the worst thing to happen is for fund managers to be wrong on their own, it is much better to be wrong in good company and by golly, they have managed to do that.

Another dilemma facing investors is that returns from money on deposit get more derisory by the month. We have come to the conclusion that those with reasonable wealth can achieve more acceptable returns from well run and actively managed investment portfolios aimed at absolute returns and where the manager is determined not to suffer unreasonable losses.

We have always said that the road to investment success is to be always invested but not to lose money, the returns will vary over time, but if you are constantly exposed to the investment opportunity and not losing, you must win.

Many clients find our model portfolio more attractive than deposits with banks which, after all, have ruined the world investing money on deposit for virtually nothing in return, makes no sense. This line of thought will be adopted by more people as banking conditions continue to deteriorate.

The other problem facing those who hold money on deposit is the loss of investment nerve. A depositor may think that whilst he is holding cash he is waiting for the unique opportunity to buy the market at the bottom. However, he will, more likely than not, forever find excuses not to invest.

We certainly would not recommend the sort of investment being pushed by some of the big banks, an example of which is to invest in a structured note that will give you decent yield and your money back as long as FTSE doesn't fall 50%. We actually expect FTSE to fall 50%! An 8% yield and the risk of losing half of your money is a classic example of insufficiently rewarded excessive risk. Once bought, such an investment, if it goes wrong, is a disaster. We suspect most of the people who buy it can least afford to lose half of their money!

The ultimate fitness test for fund managers, is to ask this question "What action would you take if you found your investment process isn't working." The invariable answer is they wouldn't change anything because they are in it for the long term. To which you might ask, "How long?"You can be sure that they would not answer 33 years. The only investment process with any merit is one that changes as conditions go fullCircle and one that is obsessed with avoiding damaging losses.

This article was written by Full Circle Asset Management,and published in the threesixty Newsletteron 13 February 2009.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.