Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

With the cheapest European stocks having outperformed in the relief rally, it's time to move away from a pure "value" strategy, says Ronan Carr of Morgan Stanley. Past cycles suggest that a search for a combination of value, quality and growth is best at this point.

But where can you find strong growth in the eurozone?

The region's prospects are "steady but unspectacular", says Capital Economics. The recession is over, with GDP growing by 0.4% quarter-on-quarter in three months to September, weaker than America's 0.9% gain but better than the UK's, which remains in recession. But it has has done little of the heavy lifting itself; domestic demand remains subdued, with the improvement due to stronger exports.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

History suggests that this is not unusual in Europe. Growth immediately out of a recession has always tended to be lacklustre at first. "Conditions for a domestic recovery are gradually coming into place" and momentum should pick up in the next few quarters.

However, the strength of international markets is likely to remain very important, which suggests you should look for European companies that have high exposure to faster-growth emerging markets such as Asia. These firms should be able to grow their revenues significantly faster than domestically orientated peers, says Carr.

The food, beverages and tobacco sector looks especially attractive; it's one of the most emerging-market-exposed sectors at 39% of sales. What's more, it offers high-quality cash generation and has enough pricing power to be a good hedge against an unexpected rise in inflation.

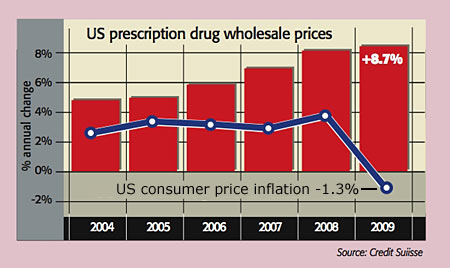

The big picture: big pharma pushes through price hikes

The deflation threat is apparently not a problem for drug-makers. American pharmaceutical firms have raised the price of brand-name prescription drugs by almost 9% over the last year, according to analysts at Credit Suisse; over the same period the consumer price index fell by 1.3%.

The companies say that rising research and development costs make the increase necessary. Critics claim the industry is pushing through big rises now in an effort to cancel out the effect of the $8bn-a-year cost-cutting measures they've agreed as part of the Obama adminstration's healthcare-reform plan.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.