Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Noel Coward once remarked that it was "extraordinary how potent cheap music is", says The Economist. "He could have said the same about cheap money." With interest rates close to zero in many countries, individuals and institutions are "stampeding" out of cash into financial markets, as Crispin Odey of Odey Asset Management puts it, driving the MSCI World Index up by almost 70% over the past six months. Deutsche Bank estimates that over the past few months excess liquidity money available to buy financial assets has been rising at its fastest rate for two decades, says Edward Hadas on Breakingviews.com.

Money created by quantitative easing (QE) is also finding its way into stocks and accelerating the rush away from cash and expensive government bonds. "Markets are entering a bubble phase", reckons Odey, which could last until the end of the year. "At some point" QE will end, but until it does "this bull market is sponsored by her Majesty's government".

Stocks certainly appear to be in a "sweet spot" for now, as The Economist says. Economic and earnings forecasts are being revised upwards, yet central banks and governments are keeping their feet on the accelerator. The Fed said last week that rates would remain "exceptionally low for an extended period".

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The fact that governments and central banks are still having to prop up the economy suggests that a sustainable recovery is far away, says Stephan Ruhkamp on FAZ.net. But investors expect a quick rebound: global earnings are expected to jump by 29% next year, while America's S&P 500 index is on a 2009 p/e of 20, compared to a long-term average of 15. Last week's slide in US durable goods orders and housing sales should be "a wake-up call" for anyone expecting a smooth transition to a strong economy, says Capital Economics.

Markets are extremely vulnerable to disappointment when they realise that the rebound won't be V-shaped, but for now cheap money and the herd instinct of fund managers could well keep the party going. Jeremy Grantham of GMO thinks the S&P could hit 1,130 by the end of the year, implying a rise of almost 10% from here. But beware: as UBS points out, rallies driven largely by liquidity rather than fundamentals "have a habit of reversing violently without warning".

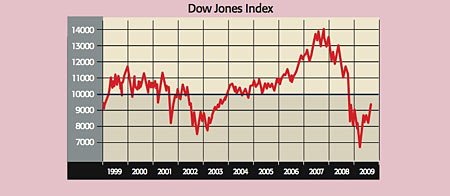

The big picture: the Dow's lost decade

It's been a really bad ten years, says David Bianco of Bank of America Merrill Lynch. The Dow Jones index is approaching the 10,000 level again, having spent the last decade fluctuating around it; it first rose through the barrier in March 1999. But an investor who bought then would still be in the red in inflation-adjusted terms, says Jack Healy in The New York Times: 10,000 ten years ago is the equivalent of 13,200 now. The index also seems unlikely to rise decisively above 10,000 any time soon as consumers are deleveraging and the banking system faces further losses on commercial property and credit cards.

Statistic of the week

Foreign direct investment (FDI) the purchase of assets such as companies and factories in other countries is set to slide to $1.2trn this year, down 35% from 2007, says the UN Conference on Trade and Development. FDI is unlikely to regain 2007 levels until 2011. But in emerging markets it has suffered less than flows to the industrialised world, due to the hunt for natural resources. Flows to Africa, for instance, hit a new record last year.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton