Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Bears who reckon that overheated stocks are set for an autumn dip have market history on their side.

In America, investors have lost an average of almost 1% in every September since 1926. In each of the other 11 months, they gained almost 1%, says Brett Arends in The Wall Street Journal.

It's a similar story here, says Chris Dillow on Investorschronicle.co.uk. Since 1966 the All-Share index has returned 0.9% on average in September. And that's not just down to "a few awful months".

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Strip out the three worst Septembers and the month's average return is still 0.16%, worse than any other month bar June.

The big picture: the banks' debt binge

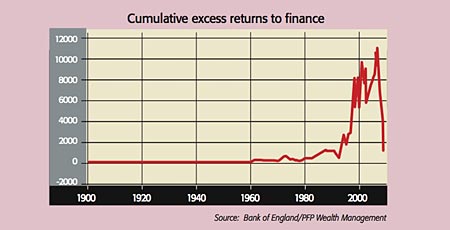

This chart from the Bank of England's Andrew Haldane is a stark illustration of the banking debt bubble, says Tim Price of PFP Wealth Management. It shows the results of a hypothetical bet, made in 1900, on banks outperforming non-bank sectors.

One hundred pounds was invested in banks and £100 in shorting the rest of the market. Until 1985, this would have returned 2% a year; by the end of 2006 the figure soars 16% before falling to under 3% in late 2008.

Banks boosted their return on equity, a key gauge of profitability, to spectacular levels by loading up on leverage, an effect that went into reverse when the bubble burst.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Inheritance tax investigations net HMRC an extra £246m from bereaved families

Inheritance tax investigations net HMRC an extra £246m from bereaved familiesHMRC embarked on almost 4,000 probes into unpaid inheritance tax in the year to last April, new figures show, in an increasingly tough crackdown on families it thinks have tried to evade their full bill

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.