Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

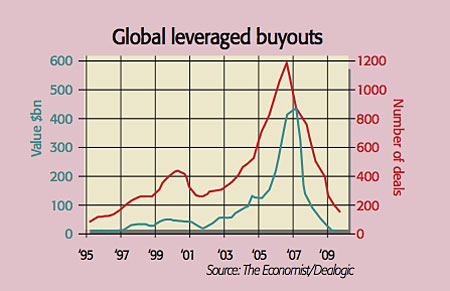

Earlier this decade, the private-equity industry saw the biggest leveraged buyouts in history. But don't count on those days returning soon, says The Economist.

One obstacle to recovery is that the industry is having trouble selling its investments. The revival in stocks has helped, but now seems to be faltering.

With investors "more focused than ever on buying healthy balance sheets", as Timothy Montfort of Jefferies & Co told Bloomberg.com, flogging debt-laden firms is tricky. It hardly helps that there are currently $4.2bn of private-equity sales in the US IPO pipeline.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Making investments has become harder too, says The Economist. Bank debt is more expensive and demand from collateralised loan obligations (CLOs), funds that eagerly bought up leveraged loans in the boom, is mostly gone.

The steep fees the industry charged "look indefensible now", while around $378bn of private-equity debt will need to be refinanced over the next four years.

The upshot is that the number of firms in the industry could shrink by 70%, according to some estimates. "Private equity is not dead. But its best days look behind it."

The big picture: outstanding value among defensives

Back in June, Citigroup noted that a basket of ten major European defensive stocks were seriously cheap on an average forward p/e of less than ten. The only time that had happened in the past 25 years was in the early 1990s recession.

Now, even although the stocks (Nstle; Vodafone; GlaxoSmithKline; Telefonica; Sanofi-Aventis; E.On; BAT; GDF Suez; Unilever and ENEL) have gained an average of 15% since June, they're still in the bargain basement, highlighting how solid stocks have been left behind in the rally.

They now trade at an average forward p/e of just 11. "There appears to be outstanding value here".

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how