It's not the right time to invest in India

With Bombay's Sensex Index up 110% since its bottom, Cris Sholto Heaton is ready to admit he called India wrong back in the Spring. Here, he looks at the reasons for the country's remarkable turnaround, and explains why he still has reservations about investing in India.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

table.ben-table table { border: 3px solid #2b1083;font: 0.928em/1.23em verdana, arial, sans-serif;}

th { background: #2b1083; padding: 10px 5px;color: white;font-weight: bold;text-align: center;border-left: 1px solid #a6a6c9;}th.first { border-left: 0; padding: 5px 2px;text-align: left;}

tr {background: #fff;}

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

tr.alt {background: #f6f5f9; }

td { padding: 5px 2px;text-align: center;border-left: 1px solid #a6a6c9;color: #000;vertical-align: center;}td.alt { background-color: #f6f5f9; }

td.bold { font-weight: bold; }td.first { border-left: 0; text-align: left;}td.right{ border-left: 0; text-align: right;}

Time for a mea culpa. While most MoneyWeek Asia ideas have performed reasonably well so far this year, I'm aware there is one outstanding blot in my copybook: India.

I've been unfashionably and wrongly bearish on India for a very long time. Back in the spring, I thought there was a real risk of a hard landing for the economy and felt the Sensex could go below 8,000. It never did.

Then in May, I agreed that the economy was turning up and the election result was excellent news, but felt there could be a relapse later in the year. I concluded the index was overstretched at 14,000 and there would be a chance to buy in cheaper. So far this hasn't appeared.

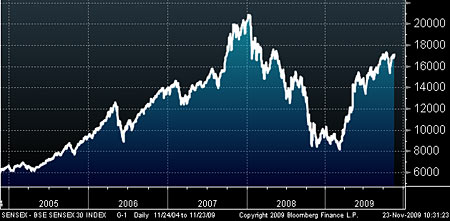

At 17,000, the Sensex is up 110% from the bottom. While some of my other calls have done as well or better, being negative on this was clearly a big miss on my part. So I want to look at why I got this one wrong and to tell you why I still have reservations about India

India's impressive turnaround

First, let's put into context why the Indian stock market has performed so well. Notice the huge jump in mid-May on the chart below. That's foreign investors piling into the market the day that the Congress party won a dominant share of the seats in parliament.

Figure 1. India's Sensex benchmark

The victory was a game-changer that almost no-one expected. Going into the election, the Congress-led coalition was favoured to stay in power, but it was far from certain. And it definitely wasn't clear that Congress would be in a position to sideline many of their troublesome allies. So when they won convincingly, investors became much more optimistic about how well India will be governed and the prospect of reforms.

Around the same time, the economy turned around sharply, as the chart below of industrial production shows. A bad monsoon season has hurt the agricultural sector this summer, but annual GDP growth is still probably running at around 6%.

Figure 2. India industrial production, year-on-year percentage change

Why has India done better than expected? A big government spending push played a major role, while at least part of the answer lies in the credit markets. India's expansion over the last few years was accompanied by very robust growth in lending, as the chart below shows.

Figure 3. India commercial bank credit, year-on-year percentage change

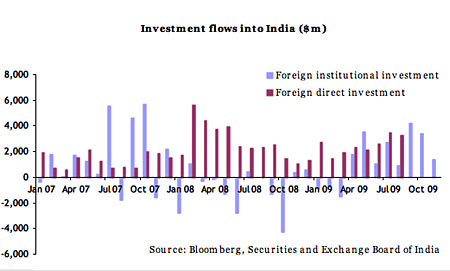

What's more, in contrast to much of Asia, the country had also been heavily dependent on foreign capital, with around 40% of new money raised by companies coming from abroad.

With global markets still very shaky, I didn't expect credit to begin flowing as quickly as it did and when things began to improve in April/May, I thought there was a real risk that things would tighten up again in a further leg of the crisis later in the year. That never happened. In fact, foreign inflows into India have picked up very strongly post-election.

Figure 4. India inward foreign direct investment and foreign institutional investment

The speed with which conditions improved probably saved India from some quite serious problems. A large number of overstretched property developers managed to raise new equity just in time. Some major heavily indebted industrial groups were able to roll over their loans.

Had things remained frozen for a little longer, I suspect we may have seen some high-profile failures or at least government-directed bail-outs. As it was, the only major blow-ups to come out of the crash were the enormous fraud at IT firm Satyam and the collapse of overextended discount retailer Subhiksha (rather ironically given what went wrong in each case, 'Satyam' means truth and 'Subhiksha' means prosperity in Sanskrit).

I'm still cautious on India

But that's behind us now. The economy is back on track. Growth should pick up over the next year or so, and corporate earnings recover strongly. So why am I still cautious on India?

Mostly it's about valuation. India always seems slightly expensive relative to the rest of Asia. The country's potential is enormous, but you can say that about the whole of Asia. Investors seem to be more willing to gloss over the risks when it comes to India.

I've lost track of the number of people in the investment business who've told me that India is their favourite market for the long term. Often, this turns into an India versus China comparison and while they're rightly quick to list the many difficulties that China faces, they ignore the equally large issues in India.

Infrastructure remains appalling even in the wealthier cities. Yes, the country is starting from a low base and there's lots of room for improvement but it's not proving very efficient at getting those improvements done. The crisis over preparations for next year's Commonwealth Games where there's a good chance that facilities will not be completed in time is sadly typical.

Then there's education. Adult literacy is just 66%. The current generation should be better. But this huge unskilled workforce presents a vast problem when it comes to migrating them from subsistence farming into higher value work. This becomes even harder when you have an economy that has tried to vault over the industrial phase as much as possible and promote its very impressive IT and business services sector.

Severe poverty remains high and persistent to an extent that shocks most first-time visitors. The gulf between rich and poor is far greater than in most other comparable Asian countries. You don't see slums on the scale of India's in major cities elsewhere in the region.

Finally, there's a major security issue. More than 2,000 people are killed each year in terrorist violence. Racial and religious clashes are frequent. Naxalite terrorists a Maoist guerrilla group - are active across a third of the country and the problem seems to be spreading and worsening.

Sometimes democracy can be a disadvantage

Oddly, most of these need not be problem. Development is all about overcoming the disadvantages, so fixing these issues can actually be a source of growth. The question is whether India can deal with them appropriately. And there are difficulties here, many of which are related to what's often wrongly seen as India's trump card: democracy.

History doesn't support the fashionable idea that democracy is necessary for development, at least in the early-to-middle stages. Every developed Asian country began as a dictatorship, a single-party state or a colony. Only after becoming wealthier did they become democracies. Going back further, it's hard to argue that most Western countries were democracies in the modern sense when they industrialised voting rights were usually restricted to groups such as land-owning males.

And in India's case, there are reasons to think it could actually be a disadvantage. Bear in mind that this is an almost feudal system, with key families exerting huge power, especially at local level. Corruption is endemic, including the top officials in many states (see this breaking scandal in Jharkhand, for example). Standards are very poor: almost 30% of those in parliament have criminal records, some for very serious crimes.

The high level of autonomy at state level and the fact that they can shrug off central government pressure is part of the reason why India is fragmented into regional markets (the other part being transport infrastructure). A patchwork of different laws, systems and taxes means it can be difficult for companies to operate across regions. Development is uneven because different states pursue different policies, some much more helpful than others.

Even when central or local governments are pursuing sensible policies, there's the matter of how to pay for them. India's public finances are not good. The debt to GDP ratio is around 80%. The overall budget deficit will be around 10% of GDP this year.

More importantly, the deficit looks structural rather than cyclical in other words, the government does not balance the budget over the economic cycle. I'm not suggesting that India is heading for a sovereign debt crisis yet, but this is a problem that will need to be tackled at some point or fears will grow.

India is expensive compared to the rest of Asia

All this said, India has a huge amount going for it, such as entrepreneurial companies, a culture of free speech and discussion, and excellent demographics. The trouble is that just as China will eventually stall if it doesn't incrementally increase civil freedoms, India could fail if it doesn't fix its culture of inefficiency, bureaucracy and graft.

Investors don't seem to recognise this. They are paying too much of a premium for India's good points, without applying a discount for the very real governance issues. The Sensex trades on a price/earnings ratio of more than 20 times next year's forecast earnings, exceeded only by the Chinese A-share market, which is a casino not an investment.

Figure 5. Valuations in India and comparable emerging Asia markets

| China A shares (CSI 300) | 22.81 | 3.46 |

| China HK listed (HSCEI) | 17.33 | 2.67 |

| India (Sensex) | 20.33 | 3.40 |

| Indonesia (JCI) | 15.45 | 2.70 |

| Vietnam (VN Index) | 14.78 | 1.95 |

| Source: Bloomberg |

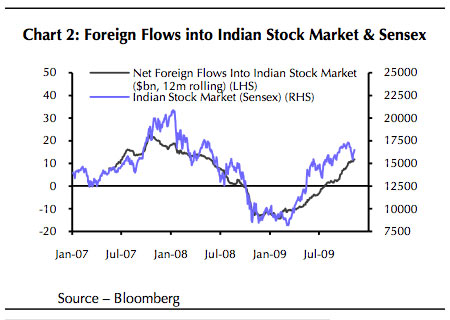

Much of this seems to be due to foreigners, who appear to have a significant impact on the Indian market. As the chart below shows, there is a strong correlation between flows into India and the direction of the Sensex.

Figure 6. India Sensex versus 12-month average investment flows (sourced from Capital Economics)

And foreigners often show signs of getting carried away. Shares in three big listed India funds the Blackstone India Fund, the JP Morgan India Investment Trust and the Morgan Stanley India Investment Fund - have sometimes traded at a premium to net asset value (NAV) recently. Closed-end funds should usually trade at a discount; when they reach a premium it suggests investors are getting a little over-optimistic.

And if you prefer to buy shares directly rather than invest in funds, the picture becomes even worse. Foreign individuals except those of Indian descent - can't invest directly in the domestic Indian market, so the 100 or so India-related companies listed abroad have a scarcity value and tend to trade at quite steep valuations.

So while I think it makes sense to have part of your portfolio in India, it's very hard for me to justify adding to it when it seems expensive compared to the rest of Asia. To be clear, I'm not suggesting that long-term investors should sell positions in India; the market is not expensive enough to justify that. But I don't regard this as a good time to make a big investment, despite the growing bullish consensus on the country.

However, for anyone who disagrees and in preparation for any sell-off and buying opportunity I'm including a list of India ETFs below. The Sensex, Nifty and MSCI India are very similar indices, while the WisdomTree fund tracks a fundamental index that weights stocks according to their earnings, not market capitalisation. The two rupee funds are currency ETFs and are US dollar based, so they're probably of little interest to most of you.

I've also listed all the closed-end equity funds that I know of, but haven't included open-ended funds because the list would be far too long; almost every major fund group has an India fund. You can find a list using a screening tool like Morningstar.

Figure 7. India ETFs and closed end funds

| Axa-BNP EasyETF DJ India 15 | 0.65% | FR |

| CASAM MSCI India | 0.80% | FR, FR$ |

| DB x-trackers S&P CNX Nifty | 0.85% | CH, DE, FR, GB, GB$, HK, IT, SG |

| iPath MSCI India ETN | 0.89% | US |

| iShares BSE Sensex India | 0.99% | HK |

| iShares MSCI India | 1.05% | SG |

| Lyxor S&P CNX Nifty | 0.85% | GB, GB$, SG |

| Lyxor MSCI India | 0.85% | CH$, DE, ES, FR, HK, IT, SG |

| PowerShares India | 0.78% | US |

| Van Eck Market Vectors Rupee | 0.55% | US |

| WisdomTree Dreyfus Indian Rupee | 0.45% | US |

| WisdomTree India Earnings | 0.88% | US |

| Aberdeen New India Investment Trust | 1.80% | LN:NII |

| Blackstone India Fund | 1.28% | US:IFN |

| DPF India Opportunities Fund | 3.78% | TSX:DPF.UN |

| Excel India Trust | 1.70% | TSX:EXI.UN |

| India Equities Fund | 4.30% | ASX:INE |

| JP Morgan India Investment Trust | 1.80% | LN:JII |

| Morgan Stanley India Investment Fund | 1.46% | US:IIF |

There are also a number of specialist funds listed in London. Some could provide an interesting alternative, but please bear in mind that most are small funds that charge high performance fees, invest in illiquid assets and depend heavily on manager skill, making them higher-risk investments.

Figure 8. India specialist Aim-listed funds

| Dhir India | Distressed investments | LN:DHIR |

| Elephant Capital | Private equity | LN:ECAP |

| Eredene | Infrastructure | LN:ERE |

| Evolvence India Holdings | Private equity | LN:EIH |

| Hirco | Real estate | LN:HRCO |

| India Capital Growth | Mid/small cap and unlisted | LN:IGC |

| Infrastructure India | Infrastructure | LN:IIP |

| Ishaan Real Estate | Real estate | LN:ISH |

| Naya Bharat Property | Real estate | LN:NBPC |

| Trikona Trinity Capital | Real estate | LN:TRC |

As I mentioned previously, I'm aiming to do a feature on Asia investment trusts/closed-end funds once I've managed to compile a full list of what's available. So if you know of an especially interesting fund that I've missed out, please drop me a line on crish@moneyweek.com.

Finally this week, there's now a page on the MoneyWeek website with the MoneyWeek Asia emails and my shorter articles collected together. We'll work on ways to improve this and bring you more coverage of Asia in the next few months.

This article is from MoneyWeek Asia, a FREE weekly email of investment ideas and news every Monday from MoneyWeek magazine, covering the world's fastest-developing and most exciting region. Sign up to MoneyWeek Asia here

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

Ayatollah Ali Khamenei: Iran’s underestimated chief cleric

Ayatollah Ali Khamenei: Iran’s underestimated chief clericAyatollah Ali Khamenei is the Iranian regime’s great survivor portraying himself as a humble religious man while presiding over an international business empire

-

'AI will change our world in more ways than we can imagine'

'AI will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China