Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

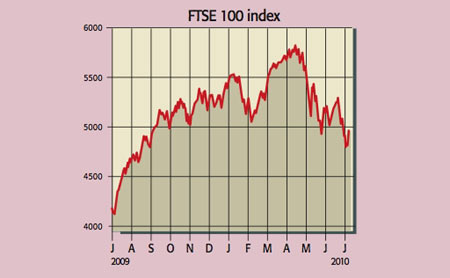

Investors continued to retreat from risk this week. After last week's sharp slide the S&P 500 and FTSE 100 lost 5% and 4% respectively. Both indices are now close to nine-month lows. Meanwhile, the dollar has bounced off a six-week low against the euro as investors seek a safe haven.

Yet more poor data on both sides of the Atlantic is fuelling fears of a double-dip recession. Indices tracking activity in the services sector in Britain and America retreated to an 11- and four-month low respectively and American job figures disappointed again. Investors have also been fretting that Europe's bank stress tests, due to be published later this month, are not rigorous enough.

What the commentators said

"The balance of risk has shifted towards renewed recession," said the FT. In much of the world the bounce has been fuelled by the inventory cycle. In the US that has been responsible for 66% of GDP growth in the last two quarters. Underlying demand in the economy is weak.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

It's a similar story on this side of the pond. The services sector, which comprises the lion's share of GDP, just isn't recovering fast enough, said the British Chambers of Commerce. Expect an 'L-shaped' recovery, added the Institute of Directors (IoD). Growth may be stagnant in the next two years, leaving us to dip in and out of recession.

Two major problems are the ongoing credit squeeze and indebted consumers rebuilding their savings rather than spending. "After a very abnormal recession, it would be foolish to rule out... a very abnormal recovery," said the IoD's chief economist, Graeme Leach.

But Wall Street has yet to take this on board. As James Mackintosh pointed out in the FT, the consensus among analysts is that US profits will increase by a "stunning" 83% from 2009 to 2012.

But government stimuli are wearing off, while macroeconomic data have been steadily deteriorating. So these forecasts will be revised down as it becomes clear that America faces "at best, slow growth". There is, therefore, ample scope for disappointment in US, and hence global, markets. You needn't believe in a double dip "to think equities remain overpriced".

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

RICS: UK housing market showing signs of 'tentative recovery'

RICS: UK housing market showing signs of 'tentative recovery'RICS members are becoming less negative about property sales and house prices. What does the latest data mean for the property market?

-

Last chance to invest in VCTs? Here's what you need to know

Last chance to invest in VCTs? Here's what you need to knowInvestors have pumped millions more into Venture Capital Trusts (VCTS) so far this tax year, but time is running out to take advantage of tax perks from them.