Ignore the bulls and steer clear of America

Bullish types are cheered by the fact the the US is enjoying positive growth. The theory being that the US may be closer to a recovery than the rest of the world. But in reality, wherever you turn in the US, things are grim and getting grimmer.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Is this the time to "buy American", wonders Tom Lauricella in The Wall Street Journal? US stocks have declined less steeply than their major counterparts over the past year and bulls have been emboldened by the fact that growth has remained positive in the US while turning negative abroad; the US may be closer to an eventual recovery than other areas of the world. Well, "bulls will be bulls", as Alan Abelson puts it in Barron's. In reality, wherever you turn credit, housing, the overall economy things are grim and getting grimmer.

One near-term danger is rising tension in the credit markets, with spreads the difference in yields between risk-free Treasuries and debt instruments such as corporate bonds and interbank lending rates on the up again. Recent jitters over the financial system have been fuelled mainly by the ailing giant mortgage lenders Freddie Mac and Fannie Mae. Spreads have been at their widest since March's Bear Stearns rescue lately, as ES Browning says in The Wall Street Journal. Mounting tension in credit markets, notably corporate bonds, has been a leading indicator for equities of late, says Merrill Lynch's David Rosenberg narrower spreads in June predated the latest equity rally by a month and this casts doubt on the sustainability of the 6% market upswing in the S&P from mid-July.

The broader macroeconomic picture is also deteriorating. Expect growth, hitherto positive, to turn negative in the third and fourth quarters, says Capital Economics. An unprecedented number of banks are now seeking to restrict credit, with lending criteria tightening across the board, which bodes ill for growth.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

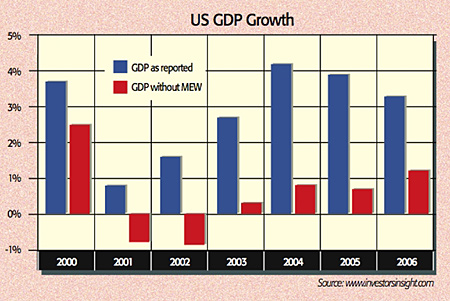

Housing, a key source of wealth for consumers, will keep falling for some time given higher mortgage rates and an inventory overhang still near-historic highs. Savings-short consumers will no longer be able to tap their houses for cash. Mortgage equity withdrawal is dwindling now that "your home ATM is starting to spit out negative 20-dollar bills", as Paul McCulley of PIMCO puts it. MEW added over 2% to annual GDP growth in 2003-2006, says John Mauldin on Investorsinsight.com. And we can't count on lower oil to give GDP a boost, says Rosenberg. It's falling because of lower demand following record prices that have broken the back of the consumer. Oil sliding thanks to recessionary pressures, as was the case in the 2001 recession, is hardly good news.

Note, too, that what makes the earnings outlook especially unpleasant in this cycle is that profits as a percentage of GDP, a proxy for margins, hit a record 14% at the peak of the credit bubble. Financial leverage helped beef up returns to an unprecedented degree as even companies such as GM and GE dabbled in finance. The profit share of GDP usually falls to 7% in an earnings trough, and is currently at 12%. Meanwhile, the boost to profits from foreign trade and the heavyweight energy sector is subsiding.

The upshot, says Rosenberg, is that earnings could fall by up to 50% in this cycle, double the typical peak to trough figure. Next year's estimates, however, foresee a jump of over 20% in the S&P 500's profits on 2008. Get set for waves of earnings disappointments until housing and credit finally show signs of bottoming by which time the S&P's slide from its peak could be double its 20% fall so far.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn