How to use ETFs to invest in Asia

One of the best ways to get exposure to Asia's exciting markets is via exchange traded funds (ETFs). But the range on offer is mind boggling. Here, Cris Sholto Heaton explains what you should look for when choosing an ETF, and picks a selection that would make a good Asia portfolio for any investor.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

We're not big fans of the fund management industry at MoneyWeek. Too many products charge huge fees, often for doing nothing more complicated than tracking a market index as closely as possible.

If it's a market tracker you want, you might as well pay as little as possible for it. That's why we like exchange-traded funds (ETFs), which have much lower costs than 'actively' managed funds.

So here I've compiled a list of Asia-focused ETFs.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

I've also considered what you should look for when choosing one, and highlighted a few that together I believe would make a good Asia portfolio.

What's on offer

Since there are now so many Asia ETFs available, I'll break them out by listing to make the tables more manageable.

First, here are the 19 London-listed ones.

TABLE.ben-table TABLE {BORDER-RIGHT: #2b1083 3px solid; BORDER-TOP: #2b1083 3px solid; FONT: 0.9em/1.2em verdana, arial, sans-serif; BORDER-LEFT: #2b1083 3px solid; BORDER-BOTTOM: #2b1083 3px solid}TH {PADDING-RIGHT: 5px; PADDING-LEFT: 5px; FONT-WEIGHT: bold; BACKGROUND: #2b1083; PADDING-BOTTOM: 10px; BORDER-LEFT: #a6a6c9 1px solid; COLOR: white; PADDING-TOP: 10px; TEXT-ALIGN: center}TH.first {PADDING-RIGHT: 2px; PADDING-LEFT: 2px; PADDING-BOTTOM: 5px; BORDER-LEFT: 0px; PADDING-TOP: 5px; TEXT-ALIGN: left}TR {BACKGROUND: #fff}TR.alt {BACKGROUND: #f6f5f9}TD {PADDING-RIGHT: 2px; PADDING-LEFT: 2px; PADDING-BOTTOM: 5px; BORDER-LEFT: #a6a6c9 1px solid; COLOR: #000; PADDING-TOP: 5px; TEXT-ALIGN: center}TD.alt {BACKGROUND-COLOR: #f6f5f9}TD.bold {FONT-WEIGHT: bold}TD.first {BORDER-LEFT: 0px; TEXT-ALIGN: left}

| China | Deutsche Bank | FTSE/Xinhua China 25 | LN | XX25 | 0.60% |

| China | iShares | FTSE/Xinhua China 25 | LN | FXC | 0.74% |

| China | Lyxor | China Enterprise (HSCEI) | LN | LCHN | 0.65% |

| India | Deutsche Bank | S&P CNX Nifty | LN | XNIF | 0.85% |

| India | Lyxor | India S&P CNX NIFTY GBP | LN | LNFT | 0.85% |

| Japan | Deutsche Bank | MSCI Japan | LN | XMJP | 0.50% |

| Japan | iShares | MSCI Japan Smallcap | LN | ISJP | 0.59% |

| Japan | iShares | MSCI Japan | LN | IJPN | 0.59% |

| Japan | Lyxor | Japan TOPIX GBP | LN | LTPX | 0.50% |

| Korea | Deutsche Bank | MSCI Korea | LN | XKS2 | 0.65% |

| Korea | iShares | MSCI Korea | LN | IKOR | 0.74% |

| Real Estate | iShares | FTSE EPRA/NAREIT Asia Property Yield | LN | IASP | 0.59% |

| Region | Deutsche Bank | MSCI AC Asia ex Japan | LN | XAXJ | 0.65% |

| Region | Deutsche Bank | MSCI EM Asia | LN | XMAS | 0.65% |

| Region | iShares | MSCI AC Far East ex-Japan Smallcap | LN | ISFE | 0.74% |

| Region | iShares | MSCI AC Far East ex-Japan | LN | IFFF | 0.74% |

| Taiwan | Deutsche Bank | MSCI Taiwan | LN | XMTW | 0.65% |

| Taiwan | iShares | MSCI Taiwan | LN | ITWN | 0.74% |

| Vietnam | Deutsche Bank | FTSE Vietnam | LN | XFVJ | 0.85% |

For non-UK investors, most of these are available on other exchanges too. Many can also be bought in both sterling (GBP) and US dollars (USD) in London I've given the GBP ticker in all cases.

The US is by a long way the biggest overall ETF market, with a significantly larger selection than the UK. The range includes several specialised ETFs that track non-standard indices and I'll look at a few of these later on.

| China | Claymore | AlphaShares China Real Estate | US | TAO | 0.95% |

| China | Claymore | AlphaShares China Small Cap | US | HAO | 1.00% |

| China | iShares | FTSE China (HK Listed) | US | FCHI | 0.74% |

| China | PowerShares | Golden Dragon Halter USX China | US | PGJ | 0.73% |

| China | ProShares | Ultra FTSE/Xinhua China 25 | US | XPP | 0.95% |

| China | State Street | SPDR S&P China ETF | US | GXC | 0.59% |

| China (short) | Proshares | UltraShort FTSE/Xinhua China 25 | US | FXP | 0.95% |

| Currency | WisdomTree | Dreyfus Chinese Yuan Fund | US | CYB | 0.45% |

| Currency | WisdomTree | Dreyfus Indian Rupee Fund | US | ICN | 0.45% |

| Currency | WisdomTree | Dreyfus Japanese Yen Fund | US | JYF | 0.35% |

| Hong Kong | iShares | MSCI Hong Kong | US | EWH | 0.52% |

| India | PowerShares | India [Indus India] | US | PIN | 0.78% |

| India | WisdomTree | India Earnings Fund | US | EPI | 0.88% |

| Indonesia | Van Eck | Market Vectors Indonesia Index | US | IDX | 1.08% |

| Japan | PowerShares | FTSE RAFI Japan | US | PJO | 0.75% |

| Japan | ProShares | Ultra MSCI Japan | US | EZJ | 0.95% |

| Japan | State Street | SPDR Russell/Nomura Small Cap Japan | US | JSC | 0.55% |

| Japan | State Street | SPDR Russell/Nomura PRIME Japan | US | JPP | 0.50% |

| Japan | WisdomTree | Japan Total Dividend Fund | US | DXJ | 0.48% |

| Japan | WisdomTree | Japan SmallCap Dividend Fund | US | DFJ | 0.58% |

| Japan (short) | ProShares | UltraShort MSCI Japan | US | EWV | 0.95% |

| Malaysia | iShares | MSCI Malaysia | US | EWM | 0.52% |

| Real estate | iShares | FTSE EPRA/NAREIT Developed Asia | US | IFAS | 0.48% |

| Region | iShares | MSCI AC Asia ex Japan | US | AAXJ | 0.74% |

| Region | State Street | SPDR S&P Emerging Asia Pacific | US | GMF | 0.59% |

| Singapore | iShares | MSCI Singapore | US | EWS | 0.52% |

| Thailand | iShares | MSCI Thailand Investable Market | US | THD | 0.63% |

Elsewhere, Japan has a growing choice of sector funds which allow you to focus on industries such as banks and real estate. The Tokyo Stock Exchange keeps a list of what's available on its website.

Aside from this, there are plenty of ETFs in the European markets and several in Singapore and Hong Kong. The list below isn't exhaustive; I've generally only included those that track something not available through a UK or US listing.

| China | iShares | Dow Jones China Offshore 50 | DE | DJCHOEX | 0.62% |

| China | Axa- BNP | EasyETF FTSE Xinhua China 25 | FP | EXCEUR | 0.60% |

| China | BOCI - Prudential | WISE - CSI HK 100 Tracker | HK | 2825 | 0.99% |

| China | BOCI - Prudential | WISE - CSI300 China Tracker | HK | 2827 | 1.39% |

| China | BOCI - Prudential | WISE - SSE50 China Tracker | HK | 3024 | 1.39% |

| Hong Kong | Lyxor | Hong Kong (HSI) | FP | HSI | 0.65% |

| Hong Kong | State Street | Tracker Fund of Hong Kong | HK | 2800 | 0.05% |

| India | Lyxor | MSCI India | FP | INR | 0.85% |

| India | iShares | MSCI India | SP | INDIA | 1.05% |

| Japan | Axa- BNP | EasyETF Topix | FP | EJP | 0.50% |

| Korea | Axa- BNP | EasyETF DJ South Korea Titans 30 | FP | EEKEUR | 0.55% |

| Malaysia | Lyxor | MSCI Malaysia | FP | MAL | 0.65% |

| Real estate | iShares | DJ STOXX Asia Pacific 600 Real Estate | DE | SREPEX | 0.72% |

| Region | Axa- BNP | Easy ETF DJ Stoxx Asia/Pacific ex-Japan | FP | ETAEUR | 0.55% |

| Region | State Street | ABF Pan Asia Bond Index Fund | HK | 2821 | 0.21% |

| Singapore | DBS | Singapore STI | SP | DBSSTI | 0.20% |

| Singapore | State Street | streetTRACKS Straits Times Index | SP | STTF | 0.30% |

| South Korea | Lyxor | MSCI Korea | FP | KRW | 0.65% |

| Taiwan | Axa- BNP | EasyETF TSEC Taiwan 50 | FP | EEWEUR | 0.60% |

How to choose an ETF

So now that we have an idea what's available, what do you have to consider when picking an ETF?

1) Understand what they're tracking. Some of these indices are very different to others, just as the Dow Jones Industrial Average is a different beast to the S&P 500. This is particularly an issue with China, since almost every fund tracks a different index (I'll take a look at which are best later on).

Also, be aware of problems with market tracking: certain sectors can form a disproportionately large chunk of the index. For example, property and financials combined make up around 60% of the MSCI Hong Kong. I'm not too concerned about this both of those sectors will benefit greatly from a richer Asia but it's a lesson to investors, that while ETFs are great for diversifying across countries, they're not always so hot at diversifying across industries. In general, more modern indices from providers such as MSCI are more diverse than the traditional benchmarks like the Hang Seng and the Straits Times Index, but they're not perfect.

2) Decide whether you want an ETF that pays regular dividends or one that capitalises them (rolls up the dividends and adds them to the fund price). Dividend payments are more common, especially among the larger providers, but some in particular Deutsche Bank capitalise all dividends.

3) Remember that ETFs are not a perfect mirror of the market. Look at tracking error - how closely the ETF tracks its benchmark index. Many ETFs reduce costs by buying a representative basket of stocks in the index rather than all of them; this means that the performance of the fund and the index can diverge quite markedly, especially in the short term.

Also take into account the liquidity of the ETF. While the biggest funds such as iShares are very actively traded and have only small spreads between bid and offer prices, not all are. Both tracking error and liquidity will be more important if you plan to trade in and out of ETFs very actively, than if you intend to hold a position for the long term.

4) Know how it works. As you may know, there are two types of ETFs 'in specie' and 'swap-based'. The first holds the underlying securities that make up the index. The second has a swap contract with a counterparty that means it will get paid (or have to pay) any gain (or loss) in the index, rather than owning the securities. Obviously, if the counterparty were to fail, the ETF wouldn't get paid on its swap.

This caused chaos last autumn when AIG a big counterparty was on the edge of collapse. For more on this, you can read a piece that David Stevenson wrote at the time: Are your ETF investments safe?. I'm not too worried about this I think the chances of any major counterparty being allowed to fail are now minimal. But if you're concerned, check which type an ETF is before investing.

5) Be careful when using leveraged ETFs (the ProShares Ultra and Ultrashort ones). Make sure you understand exactly what these do. For example, the Ultrashort China aims to provide "daily investment results, before fees and expenses, that correspond to twice (200%) the inverse (opposite) of the daily performance of the FTSE/Xinhua China 25 Index".

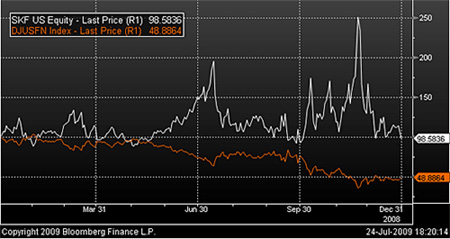

The wording is crucial here. Returns are based on daily percentage moves, not long-term performance. So over the long term, some counter-intuitive things can happen. The chart below shows the Dow Jones US financials index (orange line) versus SKF, the Ultrashort Fincials ETF based on it (white line). As you can see, while the index finished 2008 down more than 50%, SKF did not finish the year up 100%. In fact, it lost 2%.

ProShares has a detailed explanation on its website here as to why this happens. As a result, leveraged ETFs are only really suitable for short-term trades. Over the long term, they may produce returns that are far away from what you expect especially when markets are very volatile.

6) Remember that you are exposed to currency risks that may be less obvious than you think. For example, the iShares UK MSCI-based funds are priced in GBP, but track a USD-priced total return index of Japanese stocks. As a result, the performance of the iShares Japan ETF, the MSCI Japan in USD terms (which is what the ETF tracks) and the MSCI Japan in yen terms can be very different, as the chart below shows. (ETF is yellow, index in USD is white, index in yen is orange).

In this case, trends favoured the UK based investor, to the point where they'd actually be up on a year ago but this won't always be the case. In the long run, I expect both the dollar and sterling to weaken against most Asian currencies, so UK investors should benefit. But it's easy too for currency gyrations to lose you money on short-term trades.

Building an Asia portfolio out of ETFs

With all this in mind, how should you go about building an Asia portfolio with ETFs? Obviously this will depend on which markets and themes you favour above others. But if I were building an ETF portfolio from scratch, it would probably look something like this.

1) China is the hardest when it comes to choosing an index. The only two ETFs that directly follow the mainland market are the BOCI CSI300 and SSE50 ones (although Van Eck has also talked of launching one). Both have high fees and with the mainland market looking expensive and bubbly, neither appeal to me.

Most of the rest invest wholly or mostly in Hong Kong-listed Chinese stocks, but even here there's a lot of variation in what they cover. The Halter USX China covers only China-centred firms listed in the US. The two Claymore funds invest in a mix of US and Hong Kong-listed stocks, while the S&P China BMI also includes some Singapore-listed stocks.

In my view, the least attractive are the FTSE/Xinhua 25 trackers, which follow a pretty narrow index of 25 large stocks. On balance, I would go for the SPDR S&P China (US:GXC) as it's cheap and covers a broad range of stocks, including many smaller ones.

2) I'd choose to invest a fair amount of the overall China allocation indirectly, using the MSCI Hong Kong (US:EWH) and Taiwan ETFs (LN:XMTW or LN:ITWN). Hong Kong will benefit from a wealthier China (especially the property stocks, which are a big component of the local market) and closer ties with the mainland are also likely to boost Taiwan, as I outlined here: Taiwan: the next big China play.

As mentioned above, I'd favour the MSCI Hong Kong trackers over Hang Seng ones. The same applies to Singapore I'd pick the MSCI Singapore fund (US:EWS) over the Straits Times Index ones. The Singapore market is fairly cheap and as a key regional hub will benefit from the rise of all its neighbours.

3) I think Indonesia is one of Asia's most promising stories (see this recent piece: Indonesia: one emerging market you can't afford to ignore) and I'd want a substantial weighting there. Investors have no option except the Van Eck fund (US:IDX), although with the country getting a lot more attention these days, I think we'll have more choice in the future.

4) India is also a key holding, but the domestic Indian market is not cheap in my view. We don't have as many alternative ways to play it as we have with China, but we could use the Wisdom Tree India Earnings Fund (US:EPI). This tracks a proprietary index that's wider than the Nifty and MSCI India (around 150 stocks compared to 50-60). More significantly, it's one of a new type of indices called fundamental indices, which weight stocks according to fundamentals in this case by earnings instead of market cap.

In theory, this will mean that you hold less of the more overvalued stocks in the market (the price/book of the Wisdom Tree fund is around 2.5, compared with around 3.3 for the Nifty). Whether this approach will deliver better returns over the long-run remains to be seen back-testing of that strategy suggests yes, but this approach is fraught with errors. However, it's a new approach that seems worth trying.

5) I also think Japan's multi-year shake-out is reaching its conclusion and that the market has finally bottomed, as I discussed here: Don't abandon Japan. You could buy a broad-market tracker, but I think smaller firms (LN:ISJP), banks (JP:1615) and real estate investment trusts (JP:1343) will be among the bigger beneficiaries and it's worth tracking them directly (the Nomura ETFs for the latter two are only listed in Tokyo).

6) Elsewhere, Vietnam is another one of my favourite long-term prospects; we only have the DB tracker at present (LN:XFVT). The iShares Malaysia (US:EWM) is a way to bet on the economy being restructured successfully, as I also outlined in the Taiwan piece mentioned above.

Personally, I would have no weighting in Korea or Thailand for reasons I mentioned here: One Asian stock market you should avoid, and here: Thailand looks cheap so is it time to buy? And as yet, there's no ETF for the Philippines; some investors use Philippine Long Distance Telephone, which accounts for about 25% of the local benchmark, as a proxy for the overall market, although this is obviously very imperfect. If you decide to go down this route, it has an ADR listed in New York (US:PHI).

Finally, I should stress this is not a 'one size fits all' solution, but a summary of what my top picks and preferred ideas are. If you decide to go down the ETF route, you should adjust this selection in line with your own willingness to take risks and hold it as part of a balanced portfolio of global equities and other assets.

In other news this week...

| China (CSI 300) | 3,668 | +4.2% |

| Hong Kong (Hang Seng) | 19,983 | +6.3% |

| India (Sensex) | 15,379 | +4.3% |

| Indonesia (JCI) | 2,186 | +3.2% |

| Japan (Topix) | 920 | +5.6% |

| Malaysia (KLCI) | 1,156 | +3.1% |

| Philippines (PSEi) | 2,676 | +4.8% |

| Singapore (Straits Times) | 2,533 | +4.2% |

| South Korea (KOSPI) | 1,503 | +4.3% |

| Taiwan (Taiex) | 6,973 | +1.8% |

| Thailand (SET) | 614 | +3.0% |

| Vietnam (VN Index) | 455 | +6.0% |

| MSCI Asia | 98 | +5.1% |

| MSCI Asia ex-Japan | 421 | +4.9% |

With the summer lull well underway, there was little substantial news in the markets. However, new Chinese initial public offerings are beginning following the lift on a 10-month freeze on new floats in the mainland market. China State Construction Engineering, the largest housing contractor, filed for a RMB50bn (US$7.3bn) IPO that would value it at 50 times 2008 profits, banking on investor enthusiasm for the rebounding property sector.

Similarly, a HK$5.95bn (US$768m) initial public offering for Chinese building materials group BBMG has been one of the most popular Hong Kong new listings ever. Institutional investors were reported to be 95 times oversubscribed and retail investors 330 times as investors bet that the firm will be a major gainer from the government construction stimulus plans and the property market rebound. The stock priced at HK$6.38, around 14 times earnings forecasts for this year.

This article is from MoneyWeek Asia, a FREE weekly email of investment ideas and news every Monday from MoneyWeek magazine, covering the world's fastest-developing and most exciting region. Sign up to MoneyWeek Asia here

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Plan 2 student loans: a tax on aspiration?

Plan 2 student loans: a tax on aspiration?The Plan 2 student loan system is not only unfair, but introduces perverse incentives that act as a brake on growth and productivity. Change is overdue, says Simon Wilson