Inflation or deflation? Who cares!

With inflation double the Bank of England's target rate at 4%, many investors are looking for ways to hedge themselves against the risk of even higher inflation. Bengt Saelensminde reveals a bond with an incredible ability: it hedges itself against both inflation and deflation.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Today I want to tell you about a great new opportunity - a bond with a coupon that could pay off handsomely whether we're heading towards inflation, deflation, or even a bit of both!

Unlike most bonds, the bond I'm going to recommend to you today can be bought through your regular stockbroker. Its traded on the London Stock Exchange's Order Book for Retail Bonds (ORB) the new bond market for private investors - better still you can tuck it away in your Isa for tax free gains. And if inflation takes off - that tax break could be a massive boon.

Today, most investors seem to have set up camp on the inflation side of the fence. The deflation that followed the credit crunch is long forgotten. There are some notable exceptions - not least of which is my favourite macro-economist, James Ferguson.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But deflation can strike without warning as it did in the credit crunch. As you may know, I still have plans for deflation.

And I'll tell you something else. My money is also on some serious inflation down the road.

So you may well be thinking "Come on then Bengt. Tell, me... what's the timescale here? When's the deflation coming and when's that serious inflation going to strike?"

Ahhh, wouldn't we both like to know? But then again, maybe it's not so important. With the investment I've got in mind, the timing doesn't really matter.

How can that be? Most investments benefit from either inflation, or deflation, notboth.

But, there may just be an exception that should protect your savings right up until 2022. Now that's 11 years; we could have some serious lurches from inflation to deflation and back again in the meantime - and that makes this bond a seriously good bet. Here's how it works.

An offer you can't refuse

In November last year RBS, our government-sponsored zombie bank, decided to raise a few quid. They launched a bond. With the bank rate stubbornly stuck at 0.5% you'd have thought that they'd have no problem getting a bond away at around 4%, especially when you consider that its major shareholder is the government.

Well, it turns out that 4% and pseudo-government backing wasn't enough.

You see, investors feared the inflation genie. With inflation at around 4% (as it was then), a fixed 4% coupon starts to look pretty lousy.

Okay, said RBS - here's an offer you can't refuse. You can have your 4% (the coupon is 3.9% - but let's not split hairs) and if inflation goes above that, we'll pay you the inflation rate.

Whatever's higher - 4%, or inflation, you'll get that paid out. And quarterly at that!

And none of that CPI rubbish - you can have RPI - which tends to be higher. And with RPI currently at 5.3%, it's not a bad return.

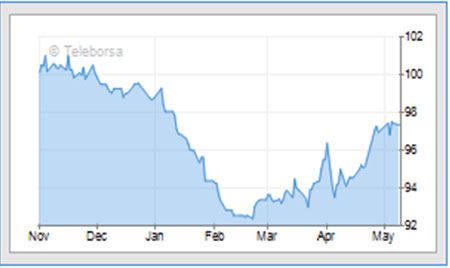

ROYAL BANK OF SCOTLAND PLCPP INF LKD NTS 01/11/22

Source: London Stock Exchange

As the chart shows, the bonds are trading below par (£100), which means your yield is even higher. This morning the bond was £97.57 to buy (ISIN:GB00B4P95L57) which puts the yield at nearer 5.4%.

And if inflation dips, the basic 3.9% coupon delivers a yield of just over 4%. In the event of deflation, you'll be very happy to pick up a guaranteed 4% yield.

So there you have it. A bond to suit inflation or deflation.

But what's the catch? Let's take a look.

Three things you need to know

First,this bond isn't covered by the FSCS - the Financial Services Compensation Scheme. The FSCS may pay compensation if an authorised company gets into trouble - but it's not guaranteed. With this bond, there's no FSCS cover, so if RBS goes bust, you may not get all your money back.

Secondly - The Bank of England may suddenly turn hawkish. Say inflation stays around 5%, but the bank decides to come down on it like a hawk. Bank rates could easily go to 7%. Okay, your 5% yield looks great in comparison to many of today's bonds. But interest on cash will be even higher - possibly towards 10%.

The third thing to be aware of is if we do hit inflationary times, then remember it's only the coupons that get inflation protection. The capital itself suffers the normal effects of inflation.

But do you really think the Bank of England is going to change tack on rates? I don't. It would put house prices and the economy into a tailspin - much too risky.

And with the government as a majority shareholder, RBS has an inbuilt safety net. It seems likely this 'too big to fail' bank will keep plodding on.

Of course, you should never bet the ranch on any one investment, but I'd say an allocation in this bond could help balance your portfolio whichever way the 'flation game plays out.

Important information

Your capital is at risk when you invest in shares - you can lose some or all of your money, so never risk more than you can afford to lose. Always seek personal advice if you are unsure about the suitability of any investment. Past performance and forecasts are not reliable indicators of future results. Commissions, fees and other charges can reduce returns from investments. Profits from share dealing are a form of income and subject to taxation. Tax treatment depends on individual circumstances and may be subject to change in the future. Please note that there will be no follow up to recommendations in The Right Side.

Managing Editor: Frank Hemsley. The Right Side is issued by MoneyWeek Ltd.

MoneyWeek Ltd is authorised and regulated by the Financial Services Authority. FSA No 509798. https://www.fsa.gov.uk/register/home.do

This article was first published in the free investment email The Right side. Sign up to The Right Side here.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Bengt graduated from Reading University in 1994 and followed up with a master's degree in business economics.

He started stock market investing at the age of 13, and this eventually led to a job in the City of London in 1995. He started on a bond desk at Cantor Fitzgerald and ended up running a desk at stockbroker's Cazenove.

Bengt left the City in 2000 to start up his own import and beauty products business which he still runs today.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how