Currency Corner: what the Tory landslide means for the pound

Sterling loved the Conservative election victory. In this week#s Currency Corner, Dominic Frisby looks at just how high the pound could go next.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

There is really only one story in the foreign exchange markets today and that has to be the pound.

Boris Johnson's Conservative Party was re-elected yesterday with a larger than expected majority.

Whether it's John Bercow, Philip Hammond, Dominic Grieve, Chukka Umunna or Anna Soubry, those who would block the democratic process have either stood down before the kick came or been booted out. Brexit will now happen.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Not only that, Johnson's majority means he now has an opportunity to institute any other reforms he might have been planning and let us pray our system of tax is one of them (though I doubt it will be).

In short, for the first time in what seems like an eternity, we have a strong, democratically-elected government with a clear mandate and a substantial working majority in Parliament.

In Johnson, love him or loathe him, we have a prime minister whose politics centrist with classical liberal sympathies are clear.

The pound loved it.

The return of the Frisby Flux

I have been banging on for goodness knows how long on these pages and taking more stick for it than for anything I have ever written about how sterling is significantly undervalued, but that it has been held back by political, not economic forces.

Well, those forces have, over the past six months, been gradually eradicated. Now the coast is clear.

And that's why the pound hit $1.35 overnight, having been below $1.20 just a few months ago.

My idea that we have passed Peak Politics may also be correct in this country at least and now business can get back to normal.

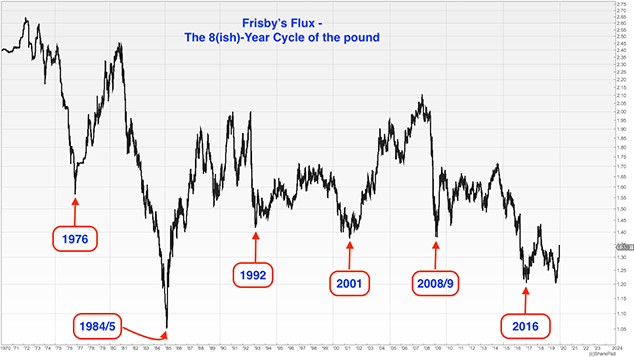

I want to refer you back to the notorious Frisby Flux. This is a cycle in the pound that I have identified and written about many times. The idea is that, for whatever reason, every eight or so years, the pound seems to make a multi-year low.

1976 was the year of the IMF crisis, when the Labour government borrowed $3.9bn, at the time the largest loan ever requested. At one point inflation reached 24%. Imagine! From high to low, sterling lost around 40%. But it recovered.

The 1984-1985 low followed the Falklands War and then the miners' strike, while the US dollar was extraordinarily strong so strong that France, Germany, Japan, the US and the UK colluded to depreciate it with the Plaza Accord of 1985.

1992 was Black Wednesday, when the Bank of England took the UK out of the European Exchange Rate Mechanism (ERM).

The 2000-2001 low came after the dotcom collapse, and the Global Financial Crisis gave us the 2008-2009 low. Eight years on from that collapse takes us to the infamous Flash Crash of 2016, shortly after Theresa May's speech at the Conservative Party Conference, when she lost her voice.

After each low, the pound enjoyed a multi-year bull market.

My view remains that the Flash Crash was the latest low in the cycle. The typical bull market that follows each eight-year low was held back by all political infighting. That is now over. Those who would stop Brexit have lost. The pound is now in a bull market.

Look to be long until maybe 2021 or 2022, at which point be positioning yourself on the short side in anticipation of the next cycle low around 2024.

How high can sterling go from here?

How high will this bull market take us?

The answer to that depends considerably on the US dollar. If Donald Trump gets his way and it goes lower, who knows? The pound may even get back to $2.00. If the dollar stays strong, then sterling's rally will be more muted.

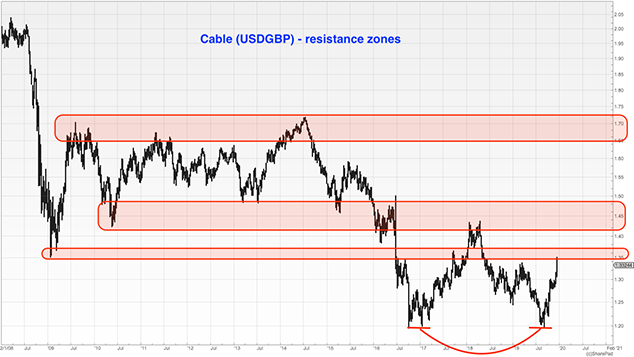

On the chart below which is 12 years of the pound I have drawn some shaded bands around areas that will surely be resistance areas. Around $1.35 which is where we are now. A couple or three cents on either side of $1.45. And finally at $1.70 and just below.

I also draw your attention to the textbook double bottom around $1.20.

A pull back to $1.30 or so looks possible in the short term, but next year I think we could see $1.45 or just below. By 2021 we could be breathing down the neck of $1.70.

A long way to go, folks. But the picture looks rather better than it did this time last year.

Dominic's new book Daylight Robbery: How Tax Shaped Our Past And Will Change Our Future, published by Penguin Business, is available at Amazon and all good bookshops. Audiobook at Audible.co.uk. Signed copies are available at dominicfrisby.com

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how