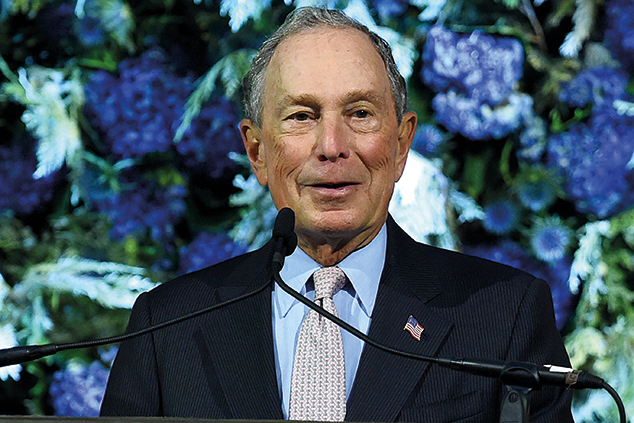

Michael Bloomberg: a master of many guises

Michael Bloomberg launched his financial data company after getting fired from Wall Street. Could the billionaire media magnate and former New York mayor now become president?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

"No-one is more closely associated with New York City's 21st century renaissance than Michael Bloomberg," says The New York Times. Despite some personal flaws "crankiness, a tin ear" and a few "policy fiascoes", the Boston-born technocrat and self-made multibillionaire (worth $54bn) was a transformative mayor between 2002 and 2014. "Crime plummeted, schools improved, racial tensions eased, the arts flourished, tourism boomed and city coffers swelled."

New York to Washington?

Yet for all his accomplishments, he remains an enigma. Small in stature, with "a leaden tongue for public speaking and a business background based in dull analytics", he is "fascinating as a study of multi-sector success without star quality". "I offer myself as a doer and a problem-solver not a talker," says Bloomberg, 77. That much is evident from his career path, says Joshua Chaffin in the Financial Times. Born into a working-class family, he showed no great early academic promise but nonetheless got into the prestigious John Hopkins University and then Harvard Business School.

On graduation in 1966, Bloomberg headed for Wall Street, joining Salomon Brothers where he "earned a reputation for smarts, sharp edges and occasional crassness". That came back to bite him: "To his surprise but not that of his colleagues he was sacked after a 1981 merger." Bloomberg, then 39, rebounded from this setback in style. The following year, he ploughed his $10m severance into a new company called Innovative Market Systems. The plan was to sell financial data using a dedicated hardware terminal, initially called Market Master, noted The Fast Company in 2015.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Making it big

By the end of the decade, sales of the renamed Bloomberg Terminal were growing at some 30% a year. "By definition, any computing platform invented in the first half the 1980s" that has continued to survive "has accomplished something remarkable".

Bloomberg seriously "upset" established incumbents Dow Jones and Reuters a David-and-Goliath feat that impressed many of his fellow tycoons, says Chaffin. Rupert Murdoch once described him as "the most creative media entrepreneur of our time". Now he is "wielding his $54bn fortune like a bludgeon". Grabbing the White House might still seem "far-fetched" but then so has most of his career so far.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Emily has worked as a journalist for more than thirty years and was formerly Assistant Editor of MoneyWeek, which she helped launch in 2000. Prior to this, she was Deputy Features Editor of The Times and a Commissioning Editor for The Independent on Sunday and The Daily Telegraph. She has written for most of the national newspapers including The Times, the Daily and Sunday Telegraph, The Evening Standard and The Daily Mail, She interviewed celebrities weekly for The Sunday Telegraph and wrote a regular column for The Evening Standard. As Political Editor of MoneyWeek, Emily has covered subjects from Brexit to the Gaza war.

Aside from her writing, Emily trained as Nutritional Therapist following her son's diagnosis with Type 1 diabetes in 2011 and now works as a practitioner for Nature Doc, offering one-to-one consultations and running workshops in Oxfordshire.

-

Last chance to invest in VCTs? Here's what you need to know

Last chance to invest in VCTs? Here's what you need to knowInvestors have pumped millions more into Venture Capital Trusts (VCTS) so far this tax year, but time is running out to take advantage of tax perks from them.

-

ISA quiz: How much do you know about the tax wrapper?

ISA quiz: How much do you know about the tax wrapper?Quiz One of the most efficient ways to keep your savings or investments free from tax is by putting them in an Individual Savings Account (ISA). How much do you know about ISAs?