Don't abandon Japan

The scale of Japan's economic collapse is jaw dropping. But, while news may look grim on the surface, it's not all doom and gloom, says Cris Sholto Heaton. Here, he describes why the outlook for investors could be better now than it's been for years.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

'The bigger they come, the harder they fall' us not supposed to apply to economies. As a country gets richer, it's supposed to be less prone to boom and bust, to twisting in every passing trade wind. So what do we make of Japan?

After all, this is the world's second-largest economy and one of the richest and most advanced countries in the world. Yet Japanese GDP fell at an annualised rate of 12.1% in the last quarter of 2008. January to March 2009 is likely to be as bad. In comparison, the 6.2% plunge in US GDP at the end of last year looks very mild.

So what's happening? Whilst it's tempting to see the country's latest woes as merely an inevitable extension of its 'lost decade' or even 'lost score' that would be wrong.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Sure, today's problems are still related to the bursting of the 80's bubble, but the situation is more complex than that. And although the news looks grim on the surface, the underlying outlook for investors is better than it's been in years.

A shocking plunge in Japan and Germany

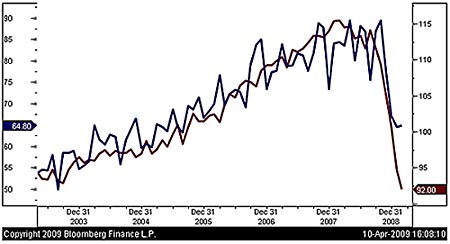

The scale of Japan's collapse is jaw dropping. As you can see on the chart below, industrial production and exports have plunged 40% and 50% year-on-year respectively (exports are in blue and industrial production in red).

Yet Japan isn't alone. Plenty of other Asian exporters have posted similar falls. Among larger economies, Germany has also been hard hit, although with a slight lag. German exports and industrial production are both down by down by 20%. Meanwhile GDP fell at an annualised rate of almost 8% in the fourth quarter and is likely to be worse for January-March.

Consumers are not stepping up to the plate

This export problem is not specific to Japan, although things are unusually bad there because the rising yen has made Japanese exports much less competitive. In fact, it's being driven by the global collapse in trade a collapse that's been far larger and happened faster than even most pessimists expected. This has hit economies with a large trade surplus harder than anyone else not just because of the collapse in exports, but because of the impact this has on business confidence and investment.

What of the theory that countries whose consumers carried less debt than the spendthrift nations such as America and Britain would do better in this downturn? In short, it's been proved wrong. Even in countries where consumers save plenty, expecting them to boost spending at a time of uncertainty is unrealistic.

Indeed it takes a long time to change consumer behaviour. So Germany's near-12% household savings rate for example (see chart below) is not going to power a spending boom there any time soon. Meanwhile those who expect the Chinese consumer to save the world should note that this is even less likely in a society with fewer social safety nets and more uncertainty.

What about Japan? Well, it often surprises investors to find out that Japan isn't really a saving nation. It used to be but during the lost decade, as wages stagnated and the economy went nowhere, consumers used up some of their savings to keep the economy going, as you can see below.

It wasn't just the banks no one wanted to borrow

Why did they need to do this? Because businesses stopped playing their part. During the bubble years, many firms ran up huge debts, often through investing in real estate and equities. Once the bubble burst, asset prices fell while debts didn't. Many firms were technically insolvent, had they marked their assets to market.

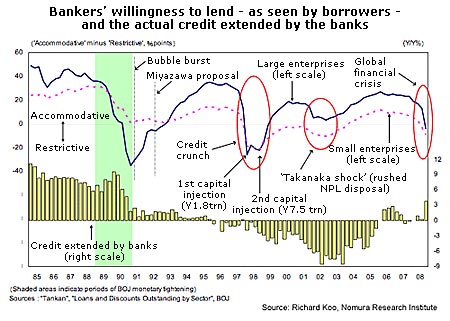

So while it's often argued that Japan's problems came from the unwillingness of insolvent banks to lend, analysis by Richard Koo of Nomura Research Institute suggests that the key factor was that businesses weren't interested in borrowing. Instead they buckled down and made paying down their debt the top priority. (I summarised Koo's arguments in an article here - What can we learn from Japan?- and there are a number of presentations by him on the internet, such as this one - Richard Koo on balance sheet recessions).

One key chart from Koo's work is shown below. The blue line shows that banks were seen as 'accommodative' (i.e. willing to lend) other than immediately after the bubble burst and in 1997-1998 (when their bad loans came to the fore and they had to be recapitalised). However, new borrowing collapsed as the bubble burst and shrank outright between 1995 and 2005. Credit might have been available but businesses were simply not interested.

As business investment collapsed, the economy was kept from imploding by massive government spending and consumers lowering their savings rates with a little help from an export boom driven by American consumers. Business confidence and willingness to borrow and invest picked up again in 2006 and at that point it looked as if the Japanese recovery was finally on track. And then the global economy tanked, taking Japan with it.

Japan's strengths

So where does the economy go from here? Global trade needs to stabilise. We've seen some early hints of improvement elsewhere in Asia as I discussed here Why Asian investors are more upbeat than Europeans. If this is not a false dawn, we should see month-on-month improvements in Japanese exports soon (although the headline year-on-year numbers will look terrible for some time yet).

There are some other hopeful signs. While Japanese debt levels are not as low as in developing Asia, they're substantially better than the West and have been falling, not rising in recent years.

Japanese banks have certainly suffered losses through bad investments and probably need to raise more capital.But their loan books should be in better shape than Western counterparts, leaving them in a better position to keep lending (albeit with substantial liquidity support from the Bank of Japan). Indeed, as rates in the commercial paper market for short-term corporate borrowings soared late last year, many Japanese businesses were able to turn to borrowing from banks to get a lower rate.

That's important, because now that many businesses have repaired their balance sheets, they should be willing to invest and they'll need access to loans to do so. This won't happen until the global collapse stabilises, but when it does, Japanese firms should be well placed to get the economy going again.

Two problems: population and politics

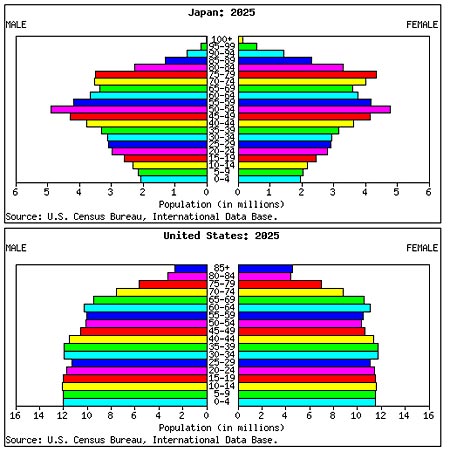

On the downside, Japan has a rapidly aging population (as the next chart shows) compared to say America and within a couple of decades it will have a very high proportion of retirees. Supporting an older, non-working population will be a drag on the economy.

Politically, big upheavals are possible, which could be good or bad. The ruling Liberal Democratic Party (LDP) has been in power for all but 11 months since 1955. However, the opposition Democratic Party of Japan (DPJ) took control of the (less-powerful) upper house of the Diet in the last election and looks likely to win the full control of government in the next one.

The trouble is, although Prime Minister Taro Aso is an unimpressive, anti-reform figure, his replacement won't necessarily be an improvement. Ichiro Ozawa, head of the DPJ, is a former chief secretary of the LDP without a convincing agenda for reform.

Still, evicting the LDP from the seat of power may bring about long-term changes as the most reformist faction in the LDP protgs of former prime minister Junichiro Koizumi - tries to take the party in a new direction and failing that may even splinter to form a new party.

So Japan faces plenty of demographic and political troubles over the next few years. And there are other worries. As China's manufacturing evolves, it will present more of a challenge to Japanese firms currently higher up the value chain. To deal with this, Japanese industry will have to continue innovating as successfully as they have in the past. And the country must eventually tackle its high public debt, a consequence of all the fiscal stimulus programmes that kept a recession from turning into a depression once the bubble burst.

Markets are cheap enough to compensate

But what does this mean for investors? Is an economy with as many headwinds as Japan best avoided?

As ever, it's a question of value. The best growth story in the world can be priced at the point where it's a poor investment. Similarly, a struggling turnaround story can be great value.

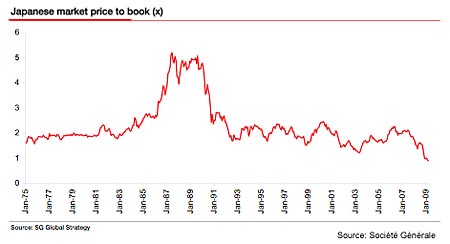

And on today's valuations, I'd say Japan falls into the second group. The Topix now trades on a price/book value of just one one of the lowest in the world. On this measure, Japan hasn't been cheaper in three decades.

Meanwhile the cyclically-adjusted P/E ratio is back below pre-bubble levels from the 1980s, as I discussed last week: It's almost time to turn bullish on stocks. Japanese firms have always paid low dividends, but today the Topix offers a yield of 2.3%. That's over twice what we've been used to (although still not eye watering).

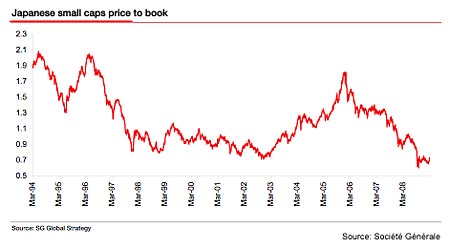

And while small caps everywhere have been battered, Japanese ones have been hammered down to the point where they probably offer the cheapest assets in the world. That's the view of James Montier at Socit Gnrale who notes that they trade on an average price/book of under 0.7.

However there are risks - Japanese firms for example have a record of putting shareholder interests second. Many of the largest companies are banded together into business groups called keiretsu, reinforced by cross-shareholdings, which can insulate underperforming firms from business and shareholder pressures. This situation has improved in recent years, but there is a risk that reforms will slow or even reverse.

That said, even for investors (like me) who prefer to avoid markets that offer low dividends and structural drags, Japan looks like a good long-term bet. Investors could look for individual stocks there are plenty of best in class firms to go for but a broad bet on the recovery of the economy is even simpler at these valuations. One of the many Japan exchange traded fund such as the iShares MSCI Japan would be a low-hassle option (LON:IJPN is the ticker for the UK-listed sterling-denominated version).

If you like smallcaps, there is the relatively new UK-listed ETF - the iShares MSCI Japan SmallCap (LON:ISJP) - as well as the US-listed Wisdom Tree Japan Small-Cap Dividend Fund (US:DFJ) and the SPDR Russell/Nomura Small Cap Japan Fund (US:JSC). Another alternative, for the adventurous, would be an ETF investing in one of the cyclical sectors that should lead the economy up: the Tokyo-listed Nomura Topix Banks ETF (JP:1615) is one possibility.

In other Asian news this week

TABLE.ben-table TABLE {BORDER-RIGHT: #2b1083 3px solid; BORDER-TOP: #2b1083 3px solid; FONT: 0.92em/1.23em verdana, arial, sans-serif; BORDER-LEFT: #2b1083 3px solid; BORDER-BOTTOM: #2b1083 3px solid}TH {PADDING-RIGHT: 5px; PADDING-LEFT: 5px; FONT-WEIGHT: bold; BACKGROUND: #2b1083; PADDING-BOTTOM: 10px; BORDER-LEFT: #a6a6c9 1px solid; COLOR: white; PADDING-TOP: 10px; TEXT-ALIGN: center}TH.first {PADDING-RIGHT: 2px; PADDING-LEFT: 2px; PADDING-BOTTOM: 5px; BORDER-LEFT: 0px; PADDING-TOP: 5px; TEXT-ALIGN: left}TR {BACKGROUND: #fff}TR.alt {BACKGROUND: #f6f5f9}TD {PADDING-RIGHT: 2px; PADDING-LEFT: 2px; PADDING-BOTTOM: 5px; BORDER-LEFT: #a6a6c9 1px solid; COLOR: #000; PADDING-TOP: 5px; TEXT-ALIGN: center}TD.alt {BACKGROUND-COLOR: #f6f5f9}TD.bold {FONT-WEIGHT: bold}TD.first {BORDER-LEFT: 0px; TEXT-ALIGN: left}

| China (CSI 300) | 2,596 | +0.7% |

| Hong Kong (Hang Seng) | 14.901 | +2.4% |

| India (Sensex) | 10.804 | +4.4% |

| Indonesia (JCI) | 1,466 | -2.3% |

| Japan (Topix) | 846 | +1.8% |

| Malaysia (KLCI) | 941 | +3.8% |

| Philippines (PSEi) | 2,073 | +4.5% |

| Singapore (Straits Times) | 1,829 | +0.4% |

| South Korea (KOSPI) | 1,336 | +4.1% |

| Taiwan (Taiex) | 5,782 | +4.6% |

| Thailand (SET) | 454 | +2.5% |

| Vietnam (VN Index) | 325 | +9.3% |

| MSCI Asia | 79 | +1.2% |

| MSCI Asia ex-Japan | 315 | +1.7% |

Thailand is in crisis once more after protestors supporting exiled former Prime Minister Thaksin Shinawatra forced the cancellation of an Association of South East Asian Nations summit. So far, the army and police appear to be backing the embattled government of current Prime Minister Abhisit Vejjajiva and moving against protestors in parts of Bangkok. This is in contrast to December, when the army refused to crack down as rival protestors succeeded in forcing out the Thaksin-supporting government that was in power at that point.

Asian credit markets continue to improve, although they are still far away from normal levels. On Friday, The JP Morgan Asia Credit Index stood at 569 basis points (bps) for investment grade debt and 702 bps for high yield (riskier) debt, up from around 100bps and 200bps respectively pre-crisis. South Korea sold $3bn in US dollar-denominated government bonds to bolster its foreign exchange reserves, priced to yield around 400bps more than comparable US treasuries. Interest from investors was seen as encouragingly strong.

Hong Kong conglomerate Hutchison Whampoa also attracted strong interest for a $1.5bn offering, the second Asian corporate dollar bond offering this year after steelmaker Posco two weeks ago. Construction materials manufacturer KCC Corporation issued a $200m equity-linked bond, also the second of its type this year after SK Telecom last month.

This article is from MoneyWeek Asia, a FREE weekly email of investment ideas and news every Monday from MoneyWeek magazine, covering the world's fastest-developing and most exciting region. Sign up to MoneyWeek Asia here

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.