Proof that the tech-unicorn IPO bubble is bursting

The valuations of WeWork, Peloton and little-known Australian unicorn iSignThis all point to the fact that the IPO bubble for so-called "tech" firms is bursting.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Is the unicorn IPO bubble bursting? It might be. If it is, the turn will have been marked by the attempt to start the process of listing WeWork (technically The We Company) for a silly sum this month.

The firm, as Bloomberg points out, is the reductio ad absurdum of the era. It has a mystifying business model; has an odd management cult system that gives Godlike powers to its founder (his shares have 20 times the voting rights of everyone else's); it has wrapped it's business effectively an old school office management service into a "goofball mission statement" (elevating the world's consciousness, in this case); and, of course, it has no obvious pathway to profit.

Softbank, one of We's private investors, was hoping for an IPO at a value of at least $47bn (the price at which they last invested). But investors are beginning to get wise to this kind of nonsense (perhaps because they've already lost a packet on the likes of Lyft and Uber see this week's magazine for Matthew Lynn's brilliantly contrarian take on this as well).

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The communications office has upped sticks to Amex and the new number being floated as a possible IPO valuation (by would-be buyers) is more like $15bn than $50bn.

Still, We is not the only company that will be able to say it was the marker for the turn in our era of totally insane valuations for only slightly interesting companies. There is for example a little-known Australian company a fund manager friend alerted me to only this week that I think has an excellent claim to the title. It's called iSignthis. You can read all about it here.

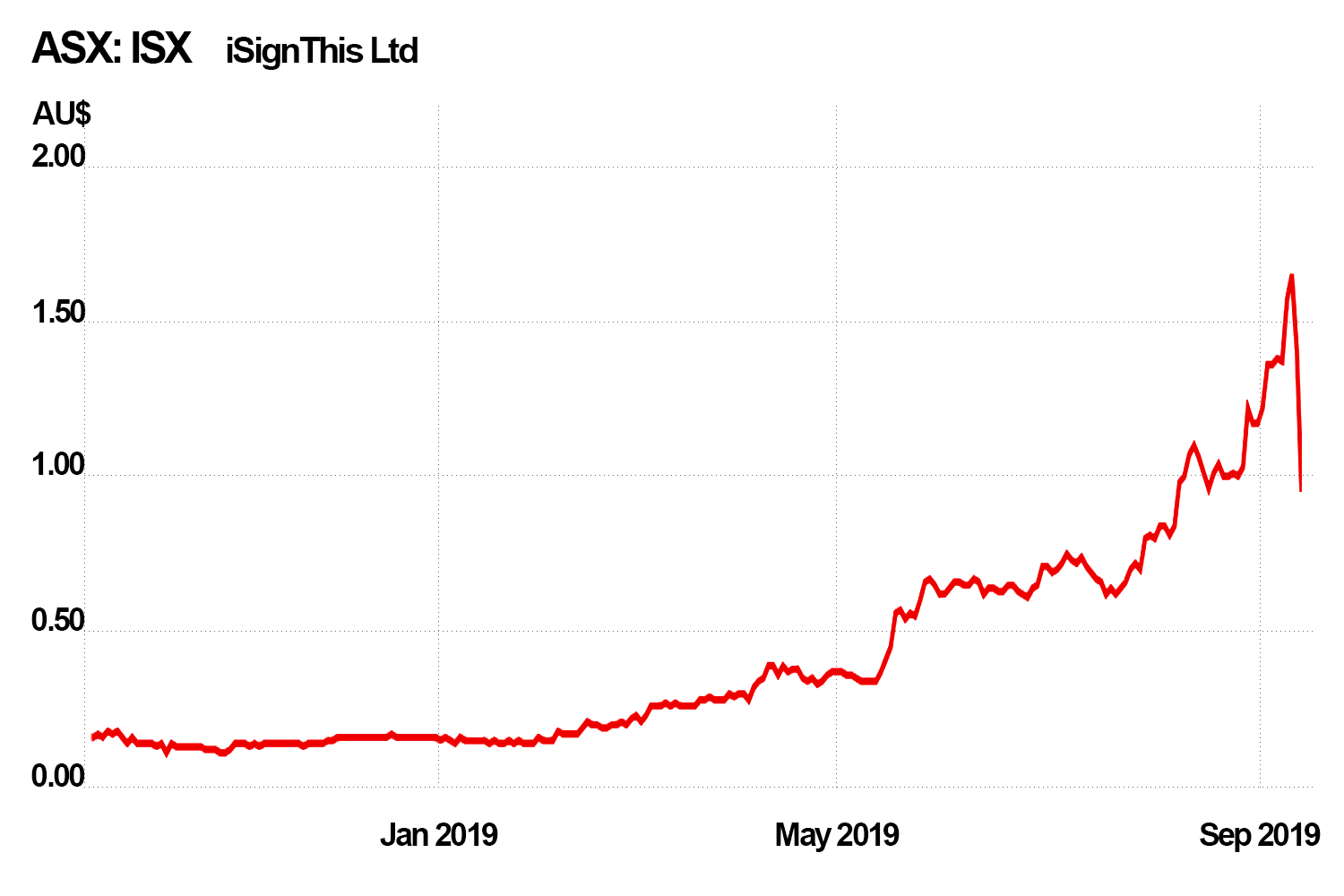

The interesting thing about it is not so much the business itself (global payments and digital identity confirmation) but the valuation of that business. iSignthis was reverse-listed in Australia in 2016, but this has really been its year: by last Tuesday the shares had risen tenfold from A$0.15 to a high of A$1.65.

Look at the metrics, however, and it is quite hard to see why. The firm's revenues were just under A$7m in 2018 (albeit rising to A$8m in the first half of 2019). Yet the sharp share price rise means that, by last week, its market capitalisation had hit just over A$1.7bn. Yes, you did read that right. One point seven billion. On historic sales below A$7m and with the most optimistic forecasts for this year having them still hitting only A$40m. Eye-watering stuff.

No surprise, then, that the whole thing came to what looks like the beginning of a sticky end this week when the market cap fell by around $700m in two days. Why?

The trigger seems to have been news about the awarding of $500m in shares (at the time... rather less now) to its top management. Particularly given that the award was made based on hitting revenue targets which were (a) barely hit (the target number was apparently exceeded by $1,347) and (b) almost immediately followed by a sharp fall in revenue.

That looks like bad governance something investors can't really put up with when the shares are priced for so much more than just payment perfection. But the key thing to note here is that, just as the reason the We flotation isn't quite working isn't because of the various governance shenanigans, the collapse at iSignthis isn't really about governance either. It's about price and investors finally beginning to engage the parts of their brains that usually deal with valuations.

With this dynamic in mind you might want to watch some of the other firms still thinking about IPOs (it's probably over for We Softbank will have to save face by putting in more money itself).

We are particularly interested in static bike company Peloton. It at least sells a lot of stuff just under $1bn worth in the 12 months to June 2019, with $200m of that being workout subscriptions. It's also not losing as much as some other new listings (a mere $245m or so to June).

It is, however, guilty of most of the unicorn sins mentioned above taking an old fashioned business (making exercise bikes) and calling it a tech company (because of the internet connectivity and the subscription sales); silly language ("a media company that changes lives, inspires greatness and unites people"); and, of course, insiders such as co-founder John Foley holding shares with 20 times the voting rights of ordinary shares.

How much is it worth? The plan is to offer 40 million shares at between $26 and $29 each. That would value the company at just over $8bn. A loss making company valued at eight times its sales? Let's wait and see, shall we?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.