Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

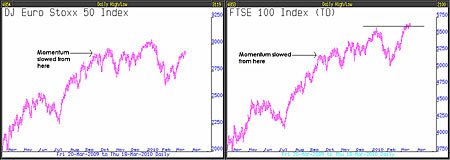

The loss of momentum that most of the world's stock markets suffered since last October has been followed by potential top formations which could result in a return to equity markets travelling south.

For the time being, on low volume, stock markets continue to consolidate; like the Sirens of Greek mythology they offer considerable but potentially fatal temptations. It is evident that the "Big Story" is not sufficiently imposing itself upon the minds of investors, although volume is light and, as Michael Kahn said in Barron's on 17th March: "Ignore the market's low volume at your peril."

He also quoted from the bible of technical analysis, Edwards & Magee's Technical Analysis of Stock Trends, which says "Volume is of the utmost importance in all technical phenomena." Volume tells us of the conviction of the marketplace. We recently identified that the high volume days since October were mostly associated with selling. Such a situation is indicative of distribution; investors moving out of the market. Hence the loss of momentum.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Mohamed El-Erian of PIMCO recently wrote an article in the Financial Times headlined "How to Handle the Sovereign Debt Explosion". He opened with the following statement: "Every once in a while the world is faced with a major economic development that is ill-understood at first and dismissed as of limited relevance, and which then catches governments, companies and households unawares." PIMCO runs the world's biggest bond fund and bond investors are very savvy. PIMCO's top guns quite clearly see the gorilla in the room (the "Big Story") which other investors conveniently ignore but which, when it is ready, will manifest itself.

Low interest rates continue: both the UK and US have yet again held them unchanged. A signal of economic fragility, not economic recovery.

In spite of the Federal Reserve over the last year expanding the monetary base by 35%, M2 grew by only 2.1% as commercial and personal loans contracted an unprecedented 20%. Moreover, the key indicator M3, which the US government chooses no longer to calculate but which is calculated by John Williams of Shadow Government Statistics, shrank 3%. Historically every time M3 has contracted, the economy has turned lower. The approaching double dip is like a performer in the wings waiting to go on for an encore. For effect he keeps the audience waiting longer than seems comfortable, timing his entry to gain the maximum impact. Likewise the double dip but, when it happens, it will overwhelm.

There has been a distinct weakening of the housing market on both sides of the Atlantic. These last two weeks in the US it was reported that pending house sales had fallen in January by 7.6% and in February housing starts fell 5.9%, although the weather might have had something to do with that.

The US market for new houses remains plagued by the large inventory of distressed properties for sale with prices less than construction costs - and more foreclosures to come. If there was one key indicator for both the US and the UK economies it would be the house market, which was until 2007 the lynchpin for households' finances.

Most stock markets today are like houses without foundations built in a flood area; whilst the weather remains OK, the risk is invisible but it will, in due course, have its way, and that moment is getting nearer.

Might Japan be different? David Rosenberg, of Gluskin Sheff & Associates, recently wrote, "By the way, the Japanese economy is turning into the 'sleeper' of the year very quietly turning in some very impressive data of late and it has been the best performing economy in the industrialized world since the bottom a year ago and few realise this there are press reports out of the Nikkei that the government is about to lift its assessment of the economy. Investors take note that the Japanese equity market is one of the few in Asia that is in the green column year-to-date".

Unquestionably, Japan is different. The Nikkei today is just below 11,000 - almost 75% below its high of 20 years ago. On scanning the history books for any kind of comparison we come up with America in 1929. In 1929 the Dow fell 90% and did not regain its 1929 level until 1954 25 years later. When the Nikkei Dow regains its old high of almost 40,000 it will have climbed almost 300% on its current levels.

Above is the long term chart for the Nikkei, showing the huge support level. Two arrows indicate a possible long-term double bottom. If ever this market is to recover, it would at first look a bit like that.

The five year weekly price chart (above) shows that the downtrend from 2007 has been overcome and is followed by a period of consolidation. A breakout above 11,000 would be a positive signal.

This article was written by Full Circle Asset Management ,and was published in the threesixty Newsletter on 19 March 2010.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Three Indian stocks poised to profit

Three Indian stocks poised to profitIndian stocks are making waves. Here, professional investor Gaurav Narain of the India Capital Growth Fund highlights three of his favourites

-

UK small-cap stocks ‘are ready to run’

UK small-cap stocks ‘are ready to run’Opinion UK small-cap stocks could be set for a multi-year bull market, with recent strong performance outstripping the large-cap indices