Chart of the week: a tale of two century bonds

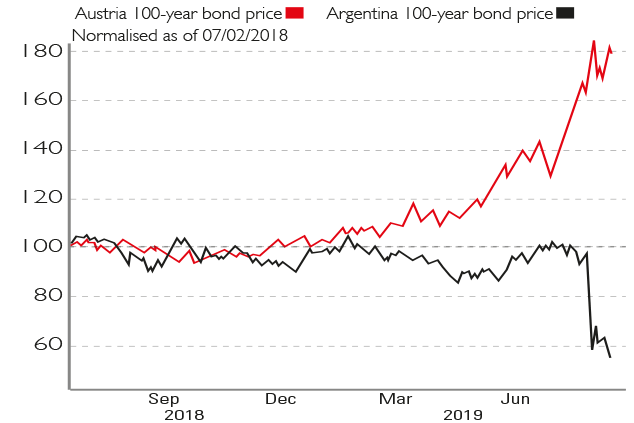

Investors keep buying Argentinian debt even though they really should know better. The price of Argentina’s century bond has slumped by 45% as concern over the latest debt crisis has grown. At the same time, Austria’s 100-year bond has surged this year.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

This chart "illustrates several truths about the bond market", says Tracy Alloway on Bloomberg. Investors keep buying Argentinian debt even though they really should know better. The price of Argentina's century bond has slumped by 45% as concern over the latest debt crisis has grown. At the same time, Austria's 100-year bond has surged this year.

It's not that Austria has covered itself with glory lately; indeed, its governing coalition recently collapsed. But as yields on other, shorter-duration bonds slumped amid the latest bond rally, Austria's yield started to look relatively juicy. "Even if fundamentals matter, no investment stands out on its own. It's all relative to something else."

Viewpoint

David Rosenberg, Gluskin Sheff

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

ISA fund and trust picks for every type of investor – which could work for you?

ISA fund and trust picks for every type of investor – which could work for you?Whether you’re an ISA investor seeking reliable returns, looking to add a bit more risk to your portfolio or are new to investing, MoneyWeek asked the experts for funds and investment trusts you could consider in 2026

-

The most popular fund sectors of 2025 as investor outflows continue

The most popular fund sectors of 2025 as investor outflows continueIt was another difficult year for fund inflows but there are signs that investors are returning to the financial markets