Currency Corner: a frustrating lesson in trend-following from the US dollar

The point of a trading system is that it forces you to ignore your hunches, says Dominic Frisby. And sometimes, that can be a frustrating experience.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

In this week's Currency Corner, I want to come back to the US dollar, arguably the most important price in the world.

The reason I want to come back to it is that my simple trend-following system has issued another signal.

The beauty of trend-following systems is that they keep you in a market when it is trending. If the market's going up, it'll keep you long; if it's going down, it'll keep you short.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The problem with trend-following strategies is when a market isn't trending. Sometimes markets are range-bound. When they are, trend-following, as a strategy, can unravel. You get whipsawed out, you get false signals, stops get triggered.

The system I have devised looks at weekly moving averages (so as to avoid having to follow markets on a daily basis). When the moving averages are sloping in a particular direction and cross, that is your signal.

Back in late June we got a sell signal on the US dollar. It was a nice clean signal too.

It was quite easy to find arguments as to why the US dollar should not fall, but rise. However, such arguments are irrelevant in trend-following. The point is to follow the trend, not the fundamentals or your hunches.

Wouldn't you know it? Almost as soon as we got the signal, the US dollar reversed. To make matters worse, about three weeks later, the system issued a "buy" signal.

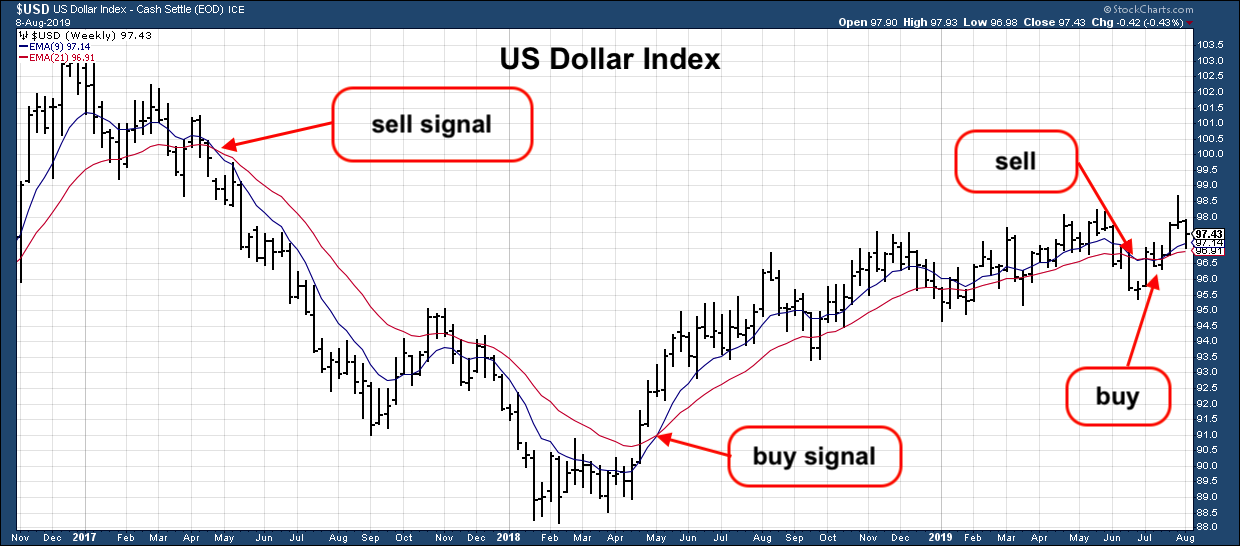

We are looking at the US dollar index here, which measures the US dollar against a basket of major currencies (mainly the euro, but also the yen, the pound, the Swiss franc, the Canadian dollar and the Swedish krona).

Also plotted are the nine- and 21-week exponential moving averages (EMAs). The nine-week EMA is in blue, the 21-week EMA is in red.

When the blue line crosses down through the red line (and the price is below), that is your sell signal. And vice versa when the blue line crosses up through the red, and the price is above, that is your buy.

I've marked the sell signal we got in April 2017, which caught a nice trend down, and the buy we got in April 2018, which caught a nice trend up.

I've also marked the "sell" signal we got in late June. Annoyingly, that has now reversed and two weeks ago we got a "buy" signal. So the trade lost money.

To make this system work, you have to follow the rules. That means in a non-trending, range-bound market you will lose money. And, frustratingly, sometimes range-bound markets can go on for over a year.

However, as I say, the beauty of trend-following, is that it ensures that once you set off on a trend, you will be onboard.

It is easy to look at the price action and think that over the past fortnight, with the falls there have been in the dollar, that we are reversing back down again. And so the latest "buy" signal is another duff call. We may well be reversing back down. If so, why buy?

"Because systems don't work unless you stick to them", is the answer.

I rather suspect we are in a similar range-bound market to that which we saw in 2015 and early 2016, when the US dollar didn't really go anywhere. But the point of technical systems is that you eliminate suspicion. Not just suspicion, but all other human emotions. Emotions are are your worst enemy, if you are speculating in forex.

What do you think? Are we in a range-bound market, or is the US dollar about to set off on a run? What's your system for trading it?

My instinct says range-bound. But the computer says buy ...

PS Coming to the Edinburgh Festival?

Come and debate the big issues of the day with MoneyWeek editor-in-chief Merryn Somerset Webb and me. In The Butcher, The Brewer, The Baker and the Commentator, we debate the issues of the day with leading thinkers from the world of politics, economics and finance and answer any big questions you may have. I host from 3-16 August, Merryn hosts 17-25 August.

In addition there is my lecture Adam Smith: Father of the Fringe about the history of the Fringe and its relationship with the teachings of Adam Smith, given in the very room in which Smith completed Wealth of Nations.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how