Currency corner: what’s really behind the slide in the pound

The prolonged Brexit limbo is pounding sterling. But the slide began well before the EU referendum. Dominic Frisby explains what’s behind the pound’s demise, and where it might go from here.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

In this week's Currency Corner we are looking at the big story in the forex markets the slide in the pound.

It is like a broken record. How many times have we talked about the falling pound over the last three years?

We'll carry on talking it about until Brexit is resolved. That's what the problem is it almost doesn't matter how Brexit is resolved, just that it is resolved we don't leave, we leave with a withdrawal agreement, we leave without a withdrawal agreement but until the thing is over and there is some certainty of direction we'll be stuck in forex limbo.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Getting us out of Europe is the top priority

The pound has been sliding since early June, when Boris Johnson won the first round of MPs' votes and it became clear he would be the next prime minister. Then it was $1.27.

What was not clear was what his approach to Brexit would be. What would the make-up of his Cabinet be? What compromises would he make?

The unforgivable omission of Steve Baker aside, his Cabinet was probably more geared to Leave than many expected. But the pound ended his first week in charge pretty much where it was at the beginning: $1.24.

The slide came in the early part of this week, with all the developments that you will already know about. Today we sit not far off the lows of the week at $1.21.

For now, as far as the PM is concerned, getting Brexit done takes precedence over propping up the currency.

Mark Carney takes the prize

There is only one winner of the coveted and hotly contested prize of Hypocrite of the Week. That is the Bank of England's Mark Carney lecturing the PM about currency strength. At every turn since he took over as governor in 2011 he has undermined sterling. Despite repeated forward guidance promising one thing, he has repeatedly done another and trapped the UK in a low-interest-rate mire.

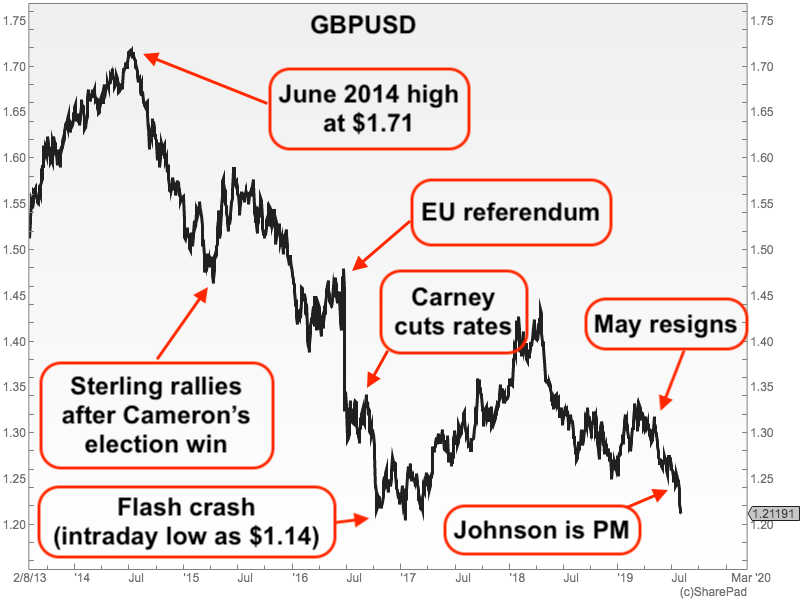

Below is a chart of sterling going back to 2013.

The slide actually began in 2014 long before Brexit was ever a thing. $1.71 was the high.

Sterling had a bit of a bounce with Cameron's "surprise" win in 2015, but that soon petered out.

After the referendum vote, sterling crashed hard, of course. The forex markets had expected Remain to win, and were caught with their trousers down.

Then we got Mark Carney's often overlooked intervention in August 2016 when he slashed rates when he didn't need to and so drove a currency that was trying to stabilise further into the ground.

The low came with the infamous Flash Crash of October 2016. The chart doesn't show the intraday low of $1.14 (it was actually intranight).

There was something of a rally in the months after Theresa May's famous Lancaster House speech in January 2017, but as the world woke up to the fact that she didn't know what she was doing, the slide recommenced.

Mad as it sounds, this could be a multi-year buying opportunity

Johnson became PM with the pound at $1.24.

It has been clear that he is serious about getting the UK out by 31 October, and so the pound has slid.

We are now re-testing those 2016-2017 lows around $1.20.

If they can hold, we'll get a lovely double bottom from which we can stage a bull market and all my theories about the eight-year-cycle in the pound can come right. On a purchasing power parity basis, the pound is sorely undervalued, after all.

If not, it looks like we retest the flash crash lows.

I remain a long-term bull. It sounds ridiculous, I know. But even a year from now, once Brexit is done, if we are moving towards a low-tax, trading hub, "Singapore of Europe" typed model that has been touted and Johnson is making the right noises then the volatility we are going through now and will continue to go through over the coming months will look like a great multi-year buying opportunity.

But we have to get through that wretched Brexit thing first.

Coming to the Edinburgh Festival?

Come and debate the big issues of the day with MoneyWeek editor-in-chief Merryn Somerset Webb and me. In The Butcher, The Brewer, The Baker and the Commentator we debate the issues of the day with leading thinkers from the world of politics, economics and finance and answer any big questions you may have. I host from 3-16 August, Merryn hosts 17-25 August.

In addition there is my lecture Adam Smith: Father of the Fringe about the history of the Fringe and its relationship with the teachings of Adam Smith, given in the very room in which Smith completed Wealth of Nations.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how