The charts that matter: the Fed gives the market the green light

This week, the Federal Reserve reassured investors that an interest rate cut is coming. John Stepek looks at how that has affected the charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back. Quick reminder if you haven't bought your ticket to the MoneyWeek Wealth Summit on 22 November, do make sure to do so before the early bird discount runs out you can find out more here.

No new podcast this week (managing four weeks in a row would be bad for our reputation), but if you missed last week's on currency wars, Neil Woodford, and ethical investing, then have a listen here. Also, I've been experimenting with a very short (60 seconds) daily market preview you can have a listen and see what you think here (all feedback welcome as I said, it's an experiment).

And if you're in the market for investment-related listening material, you can get a free trial on Audible with an audio copy of my book, The Sceptical Investor. Here's the link you need if you're a UK reader and here's the equivalent for US readers.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

If you missed any of this week's Money Mornings, here are the links you need:

Monday: Three ways to avoid your fund manager "doing a Woodford"

Tuesday: Should you be worried about Deutsche Bank?

Wednesday: Why I'm betting on a return of the copper bull market

Thursday: The Federal Reserve will do whatever it takes to keep this boom going

Friday: Lend to Germany at 0%? We've seen even stranger things in the bond market

Currency Corner: What will it take for sterling to turn around?

Subscribe: Get your first six issues of MoneyWeek free here

And on her blog this week, Merryn looks at how our confused and confusing pensions system is wreaking havoc in the NHS, and also has more on Scotland's plans for a local, ethical stock market.

Now, to the charts. This is the week that the Federal Reserve tipped its hand and reassured investors that an interest rate cut is coming at the end of the month. So what has that done to the outlook?

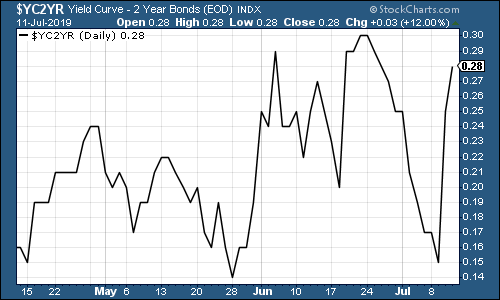

First, let's look at the yield curve that is, the difference (the "spread") between what it costs the US government to borrow money over ten years and what it costs over two. Once this number turns negative, the yield curve has inverted, which almost always signals a recession (although perhaps not for up to two years).

The curve between the three month and the ten year is still inverted, but it's getting close to turning up again. And as the chart below shows, the gap between the two-year and ten-year has widened sharply, which will relieve the Fed somewhat, as it suggests that the US central bank is acting quickly enough to convince markets that a recession isn't a sure thing.

(The gap between the yield on the ten-year US Treasury and that on the two-year, going back three months)

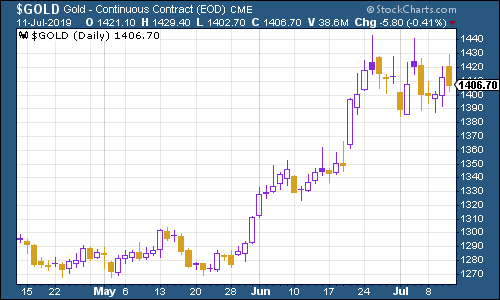

Gold (measured in dollar terms) is getting used to the giddy heights around the $1,400 an ounce mark. With the Fed in cutting mode, it seems likely that more gains lie ahead for gold but given all the disappointments and false alarms of recent years, it's understandable that investors might be wary.

(Gold: three months)

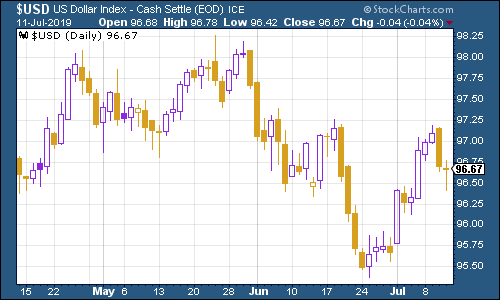

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners fell back as the Fed's dovish views took some of the steam out of the rebound that followed stronger-than-expected jobs data. The main rival currency to watch is the euro. The European Central Bank (ECB) is keen to talk down its currency too but that's a lot harder for the ECB to pull off.

(DXY: three months)

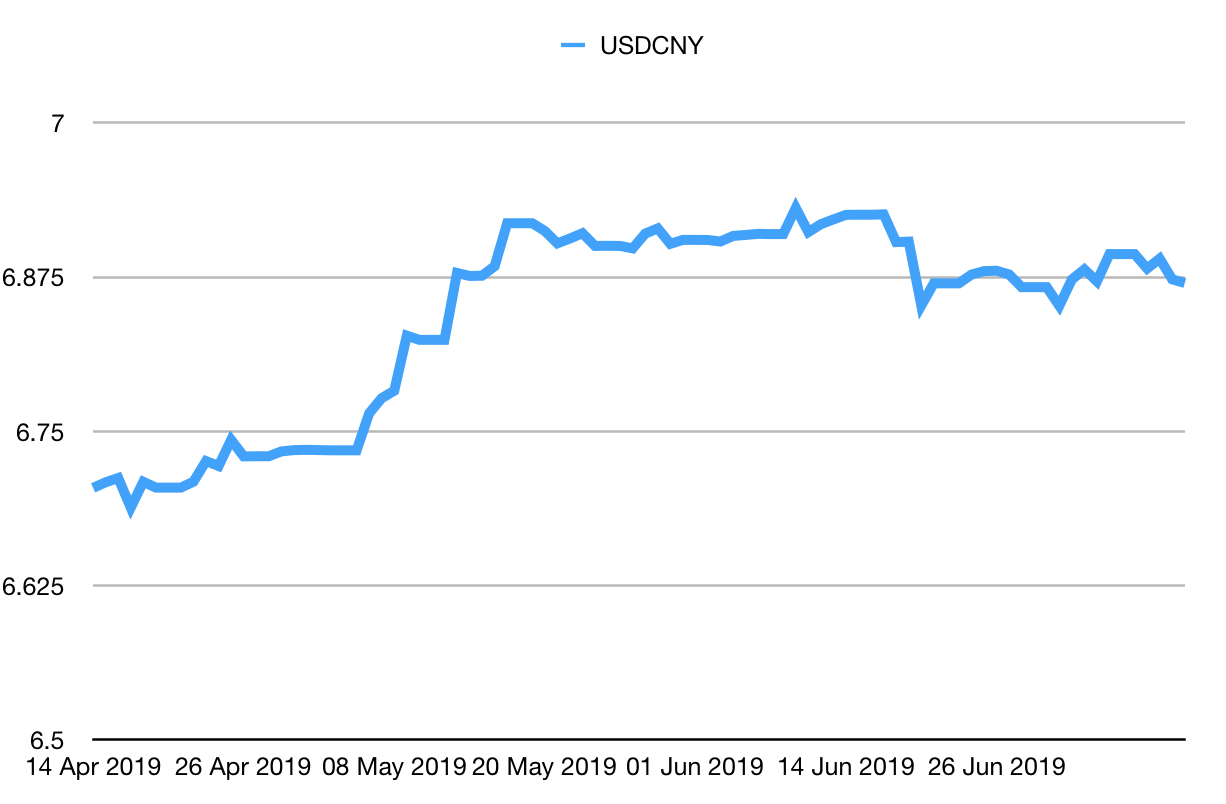

The number of yuan (or renminbi) to the US dollar (USDCNY) remains comfortably below the critical 7.0 level that would suggest China might be on the verge of a deflationary devaluation of its currency.

(Chinese yuan to the US dollar: three months)

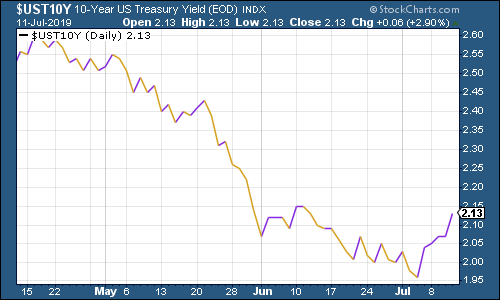

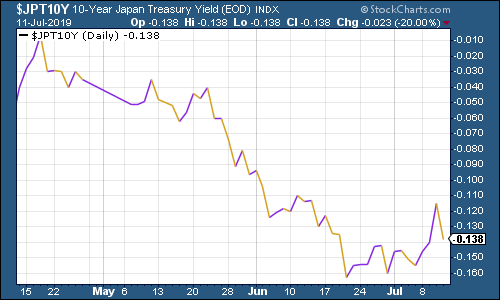

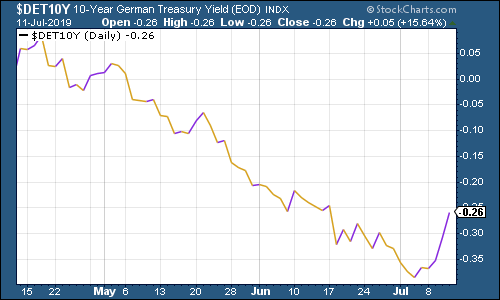

Ten-year yields on major developed-market bonds are still at ridiculously low levels, but they have started to rebound this week, primarily because not only are central banks talking about loosening monetary policy, but economic data just doesn't look quite as bad as the market had feared.

So the ten-year US Treasury is now yielding more than 2% again (ie, you're just about getting some return after inflation).

(Ten-year US Treasury yield: three months)

As for the deflation twins Japan and Germany their yields are still negative, but a little less negative than they were.

(Ten-year Japanese government bond yield: three months)

(Ten-year Bund yield: three months)

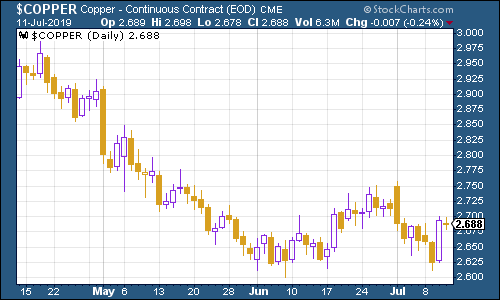

Copper got a bit of a jolt higher from the weaker US dollar. And now that monetary policy is in loosening mode again, I wonder if this might be a temporary bottom for copper. My colleague Dominic is certainly bullish on the metal.

(Copper: three months)

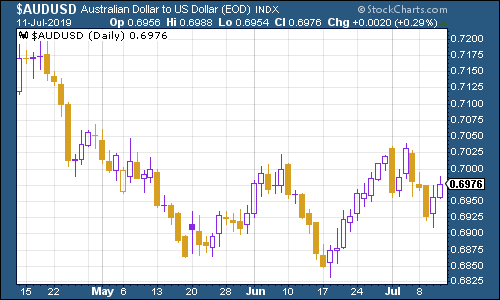

The Aussie dollar fell early in the week, then rebounded as the US dollar weakened.

(Aussie dollar vs US dollar exchange rate: three months)

Interestingly, cryptocurrency bitcoin surged on the dovish Fed this week and then settled back down. I say this is interesting because bitcoin hasn't always reacted like this, so I'm wondering if investors are starting to see it as something of a genuine alternative "hard" asset.

(Bitcoin: ten days)

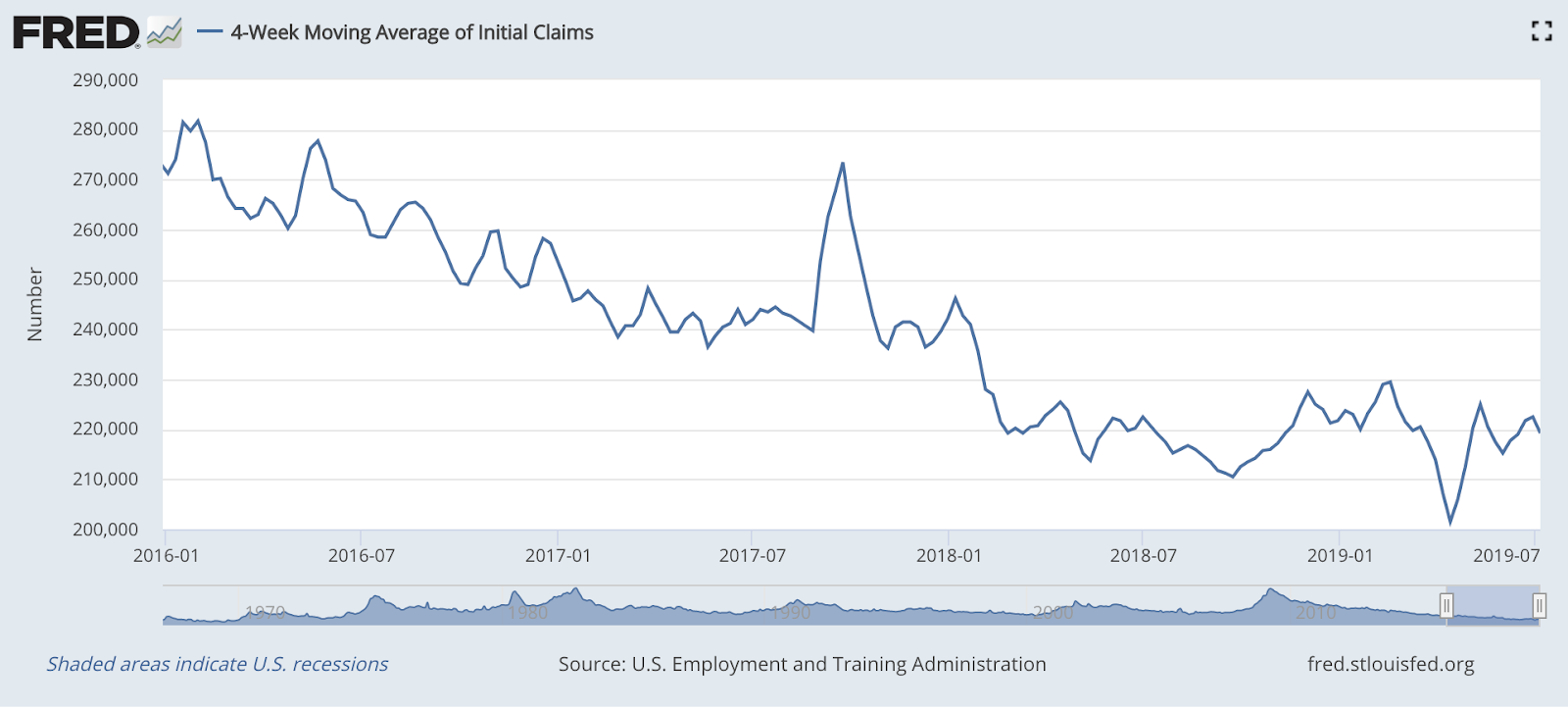

It's been about two and a half months since US jobless claims last hit a fresh low on the four-week moving average measure, dropping to 201,500. Some time ago, David Rosenberg at Gluskin Sheff, noted that US stocks typically don't peak until after this four-week moving average has hit a low for the cycle, and a recession tends to follow about a year later (remember that this is not scientific it's a tiny sample size).

This week, the moving average fell to 219,250, while weekly claims came in much lower than expected at 209,000 (versus expectations for 221,000). We've also seen a new high in the stockmarket this week.

Meanwhile, we certainly can't rule out the possibility of another trough in the moving average, though it would take quite a big ongoing drop in the weekly claims from here to achieve that. It's worth watching.

(US jobless claims, four-week moving average: since January 2016)

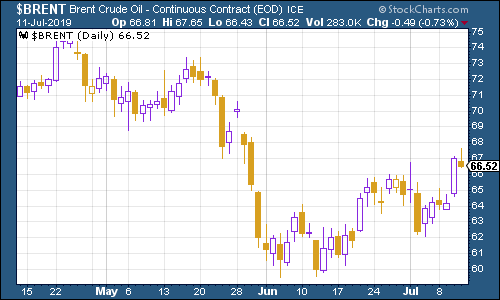

The oil price (as measured by Brent crude, the international/European benchmark) rose this week, driven partly by the weaker dollar and partly by general risk appetite.

(Brent crude oil: three months)

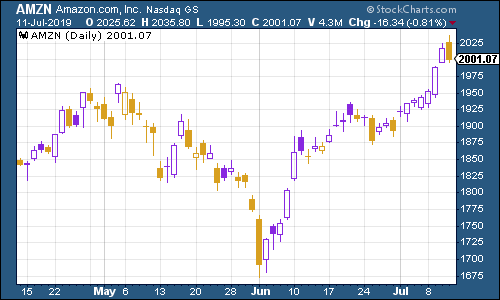

Internet giant Amazon headed higher along with the rest of the market this week. It's now not far off its all-time high.

(Amazon: three months)

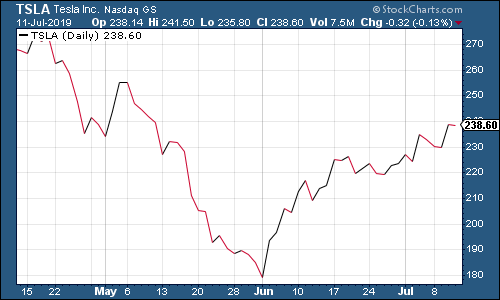

Electric car group Tesla had a calm and relatively uncontroversial week for the company; its share price edged a little higher.

(Tesla: three months)

That's all for this week. Remember don't put off buying your tickets for the MoneyWeek Wealth Summit make sure you secure your seat now.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn