Why I’m betting on a return of the copper bull market

After peaking in 2011, the copper price experienced a painful bear market. But recently, we have been in something of an uptrend. Dominic Frisby is betting that will strengthen. Here’s why.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Today I want to take a look at what some would consider the most important metal in the world: copper.

Humans have been making stuff out of copper for probably more than 8,000 years. The oldest man-made object in the world was also made of copper about 7,000 years ago a tiny awl found in a grave in what today is Israel. Copper would become, of course, a key component of the bronze age.

This has continued throughout history. Today, after iron and aluminium, copper is, according to the US Geological Survey, the most-consumed metal in the world. Around three quarters of consumption is taken up in electrical wiring, telecom cables and electronics. It is cheap, versatile and conductive.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But it also finds uses for purposes as diverse as birth control or killing bacteria and yeast (it has microbial properties). We even need to eat the stuff, though only in small doses (we get what we need from our veg).

The world's largest copper consumer is, by some margin, China. It eats up almost 50% of global supply. The rest of Asia takes up 21%; Europe 18%; and the Americas 12%. Africa and Oceania between them account for barely 1% of global demand.

If ever there was a more telling statistic about the relative state of economic expansion around the world, I'd like to know what it is. That's why copper is often seen to be a barometer of the economy Dr Copper, the metal with a PhD in economics.

The world's largest producer, also by some margin, is Chile. Globally, some 21 million tonnes were produced last year, 28% of which was mined in Chile. The next-largest producer is Peru on 11%; then China (7%); then the US and the Democratic Republic of the Congo, both on about 5.7% each.

The world's largest copper-producing companies, on the other hand, are Codelco, owned by the Chilean government (about 19% of global reserves), followed by Freeport McMoran (NYSE: FCX), BHP Billiton (LSE: BLT) and Glencore (LSE: GLEN). Other notable producers for UK investors are Antofagasta (LSE: ANTO) and Rio Tinto (LSE: RIO) both make the top ten.

The best times to buy copper in the last 20 years

Ultimately, the copper price is determined by supply and demand the amount that gets used relative to how much there is available. But there are so many factors that affect the perception of that balance.

When interest rates are low and borrowing costs are cheap, the result is often some kind of economic expansion and so you see copper demand. Pretty much every home in the world will contain copper in some form or other, and you will see the most demand wherever there is the greatest economic expansion.

When emerging markets are strong, the copper price tends to be strong and vice versa. The same goes for commodities in general. So one is often a bet on the other.

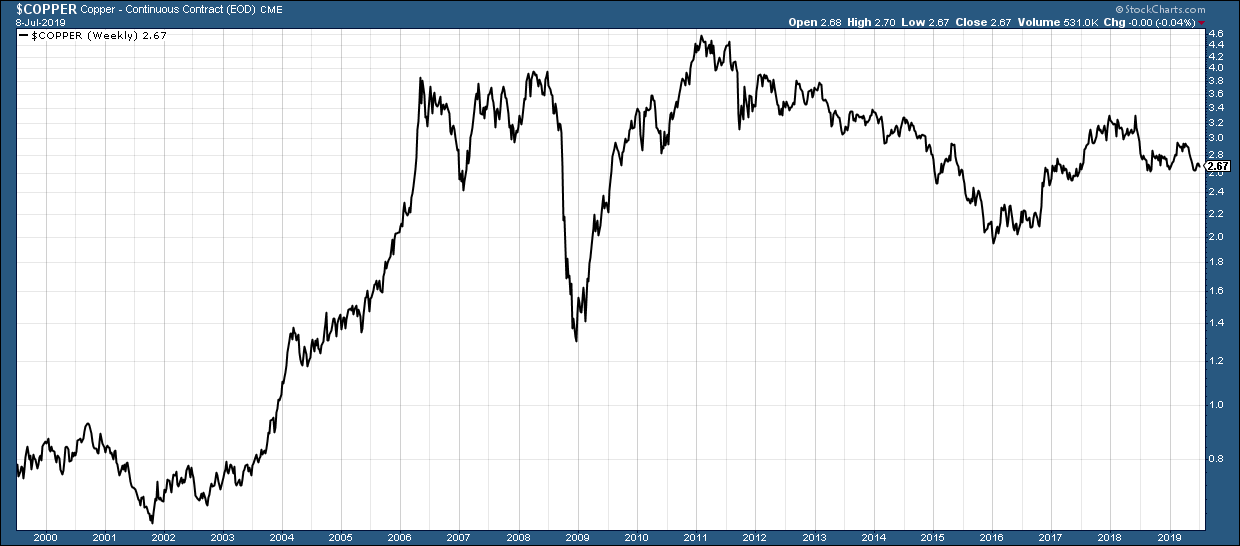

The real boom years for copper came during the decade to 2011. The price rose almost eightfold from $0.60/lb to $4.60/lb. (You will find some measure the copper price in pounds, while others in tonnes, which can be a little off-putting at times.)

Today the price sits somewhere in the middle of those two extremes at $2.65/lb.

Here's the long-term chart for your reference:

The two great buying opportunities for copper were 2001 to mid-2003, and then 2008.

However, it is also worth noting that since early 2016 we have been in something of an uptrend. 2011 to 2015 saw five years of steady, grinding, painful bear market. But since then, things have looked rather rosier.

In fact, I can't help noticing the chart action over the last three years has been very similar to that between about 2001 and late 2002. A strong run off oversold levels, followed by a pull back. That bodes rather well for the current markets, though for the time being we are at the lower end of a three-year range that runs between about $2.50 and $3.30.

If you think the world is set for another infrastructure glut, or any kind of inflationary boom, then you should buy copper. The easiest way for UK investors to do that is via the above-mentioned mining companies. Or you can play the metal directly via a spreadbet (not recommended unless you are absolutely sure that you know what you're doing), or an exchange traded fund try ETFS Copper (LSE:COPA).

I must confess to being quietly bullish, and I am playing it via two smaller-cap situations, both of which are listed in Canada. If interested, you will need a broker who deals in Canadian stocks.

First, there's a company I have mentioned on these pages before, Regulus Resources (TSX-V: REG). Regulus has a market cap around C$130m and is developing a project in northern Peru known as Antakori. Its price, like that of copper, has gone nowhere for more than two years now. If copper has a run, it will too, with the added spice of the potential of a significant discovery.

Second, I own Amerigo Resources (TSX: ARG). This is a producer in Chile, which operates by processing fresh and historic tailings from Codelco's El Teniente mine. Its production is increasing, while its costs are falling, and my hope is that the markets will give this C$122m market-cap company a re-rating, when it gets some more good quarters under its belt.

Fingers crossed.

PS don't forget your ticket for the MoneyWeek Wealth Summit in November!

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton