Currency Corner: what’s next for the Canadian dollar?

The Canadian dollar – or loonie – is a “commodity” currency. At the peak of the commodities supercycle it was king. But it's been sliding for years. Dominic Frisby looks at where it might go next.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Today in Currency Corner, we look at the Canadian dollar.

Just before we do that, please do remember to sign up for our webinar, on Tuesday 11 June. At 1pm, you'll be able to go online and watch MoneyWeek executive editor John Stepek, currency specialist Alex Edwards from OFX, as well as my good self discuss what's going on in global trade and currency markets, and how it all affects British businesses.

If you are at all interested in currency markets, and particularly if you run your own business or are involved in managing currency exposure for businesses, you'll find it extremely useful. Sign up now. (Even if you can't watch it live, sign up so you have the option to watch it later it's free after all!)

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

So, back to the Canadian dollar. The loonie, as it's known, after the bird which used to appear on the one dollar coins, is seen as one of the "commodity currencies", along with the likes of the Australian dollar, the Chilean peso and the Norwegian krone.

The reason for this is, of course, that so much of Canada's economy is built around the production of commodities whether fossil fuels, mining metals or agriculture.

As such, the loonie tends to be strong when the commodity markets are strong and weaker when they aren't. We saw this demonstrably in the great commodities supercycle in the early part of this century.

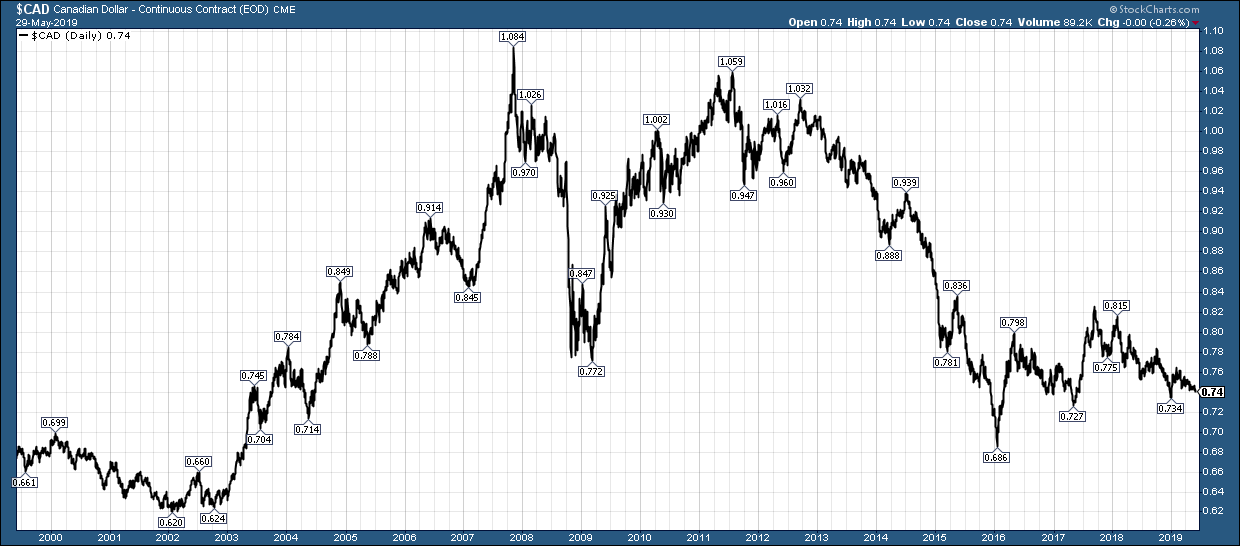

At the turn of the century, when oil was as low as US$10 a barrel, gold was at US$250 an ounce, and metals and grain prices were all badly beaten up and at multi-decade lows, a mere US$0.62 bought you one Canadian dollar.

But at the end of the cycle, around the time oil reached US$147 a barrel in 2007, the loonie went above parity with the US dollar. It took US$1.10 to buy you a loonie.

I can remember going to mining conferences and hearing Canadian mining CEOs laughing about how cheap US real estate was, as they bought up prime pads on golf courses amid the US property crash.

Even in 2011, the Canadian dollar was still at US$1.05. It seemed like the loonie's strength would never end. But it did. The slide got going in 2013, and the downtrend has been pretty inexorable ever since.

Today US$0.74 gets you a loonie, and the trend is down, as the chart below shows.

As long as commodity prices remain weak, so will the Canadian dollar.

Despite this relationship, the Canadian dollar by the standards of many other countries is still a relatively stable currency. Canada remains the tenth-largest economy in the world. Its GDP is some US1.8trn.

The Canadian dollar is the fifth-most widely-held reserve currency after the US dollar, the yen, the euro and the pound. It accounts for about 2% of global foreign exchange reserves. Central banks tend to like it because of Canada's relative political, economic and legal stability.

Nevertheless a downtrend is a downtrend and a bear market is a bear market and, against the US dollar, that is what the loonie is in. If commodity prices don't turn around, that 2015-2016 low of US$0.68 beckons.

How does the Canadian dollar stack up against the pound?

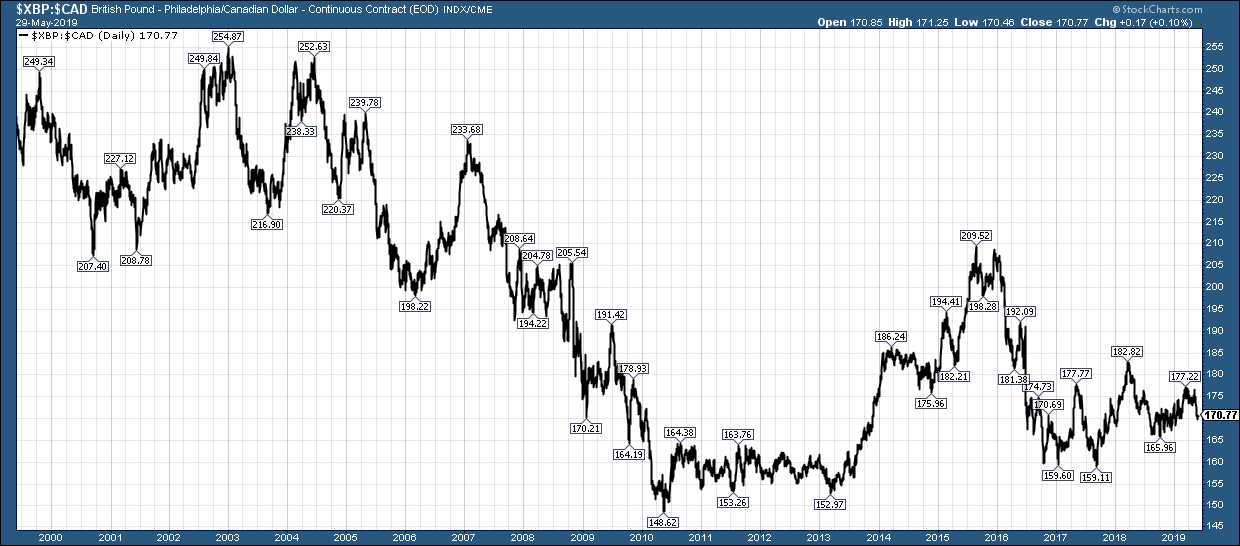

This next chart shows the loonie against the pound over the past 20 years (NB when this chart is falling, the pound is falling, and the loonie is strengthening).

It's amazing to think that in the early part of the century a pound could have bought you more than C$2.50. How times have changed.

At the peak of the commodity supercycle, a pound would have bought just C$1.50. Then of course, after 2013, as commodity prices started to go into free fall, the pound saw relative strength so that by 2015, in the relative stability of the pre-Brexit era, the pound was above C$2 again.

Brexit has changed that, of course. In each year since that 2015 high, the pound has seen a lower high. As for where this goes now? Much of that will depend on how Brexit resolves.

The longer we remain in Brexit limbo, the longer we go nowhere. I'm not a commodities bull but nor do I see an immediate resolution to the Brexit impasse on the horizon.

So I'm inclined to think that the pound will trade in a range between about C$1.80 and C$1.60 (and probably with a downward bias first, to re-test those 2017 lows at C$1.59).

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge