The bitcoin rollercoaster has started up again – hang on tight!

Sentiment on bitcoin has made an about turn and the cryptocurrency is back on the rise. Dominic Frisby explains why, and whether it's time to buy bitcoin again.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Wow! When bitcoin moves, it really does move.

And how quickly does sentiment change!

Just a few short months ago crypto was at the end of the world. Now it's going to save the world.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Yup. We are talking bitcoin in today's Money Morning.

We hate to say this but we told you so

Don't say we didn't warn you. Less than a month ago, I was banging the drum on these very pages to buy bitcoin. We had a buy signal the likes of which had only occurred three times since 2011. Two of those times bull markets of the "life-changing variety" followed.

What was down in the dumps below $3,500 in February, steadied and crept up to $4,000 in March. On one day in April, what was $4,000 became $5,000. And this week, what was $5,000 has become $8,000.

It's the way of bitcoin. It goes quiet, dead even. It gives the impression it wants to go lower. Then it rockets.

The way it moves makes investing in it extremely difficult.

One method is "hodl" otherwise known as buy and hold. Bitcoin is an epic opportunity, a new technology that is going to change money for good. Opportunities like this do not come along very often.

Forget the fact that you did not take as big a position as you should have all those years ago when you first heard about it and it was trading at $10 or $50 or $100. Swallow the fact that that opportunity has now passed. Invest an affordable amount now and be done with it.

Then watch as it soars, collapses, soars and collapses. At least you'll know that if it does go to the moon, you've got a seat on the rocket.

The problem with that method is years like 2018.

Another method is to trade in and out. Buy when it's cold, sell when it's hot. Easy to say, not so easy to do. It's hot now, for example should you be selling? How do you make these kinds of decisions reliably? What if you're not following the markets every day or, for whatever other reason, you miss the boat?

Or there's method three, which is a sort of third way: have a core position, and then another position which you trade in and out of.

Why is bitcoin going up?

One likes to have an explanation for a particular market move. Why is the market going up? Why is it falling? I tend to find such explanations can be a bit facile.

Today's story can be the same as tomorrow's and yet the market moves in a different direction. The market is falling today because of trade tensions with China. The market is rising today, despite trade tensions with China.

Nevertheless, the standard explanation for the present rally is that Fidelity in the US, one of the largest asset managers in the world, with something like $2.5trn under management, is about to offer crypto trading. Institutional buying has kicked in.

The US CME Group which, together with the Chicago Board Options Exchange (CBOE), became the first provider of bitcoin futures back in December 2017 (right at the top of the market) saw a record 33,700 contracts traded on Monday. That's around 170,000 bitcoins, worth around $1.35bn. Meanwhile, bitcoin's own trading volumes also set daily records, two days in a row.

Bitcoin could see an up-month of more than 50% this May, if these levels hold which would be the best month since November 2017, at the peak of bull market.

There are two ways to read these kinds of stats. One it's all a bit hot. Two it's a sign of things to come and it's only going to get hotter.

But one thing is for sure: there has been a lot of buying.

There has been all sorts of worrying news for crypto over the past few weeks, not least the allegations that US exchange Bitfinex had lost $850m of funds needed for redemptions, and was using capital from Tether, a "stablecoin" affiliated to Bitfinex, to cover the shortfall.

Similar such events in the past have been enough to crash the bitcoin price. This time around, however, bitcoin just shrugged off concerns and started rising again within a few days.

So what should you do now?

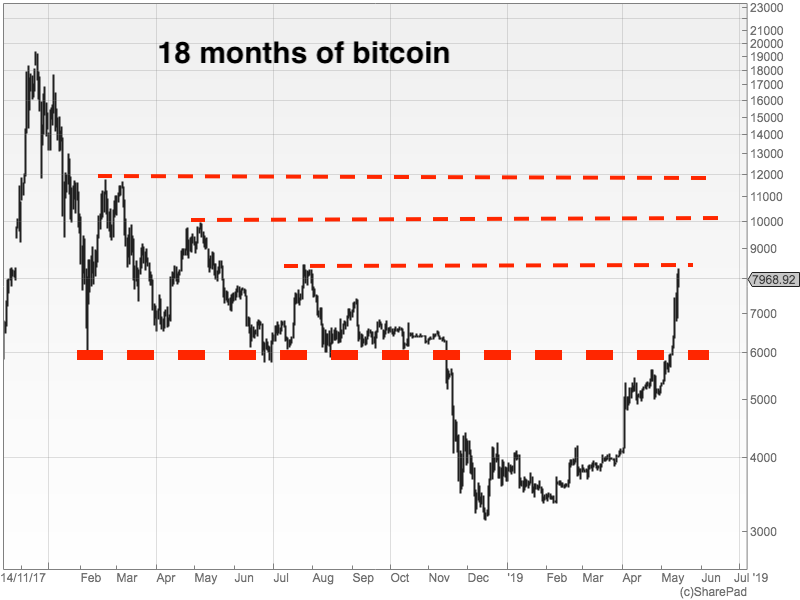

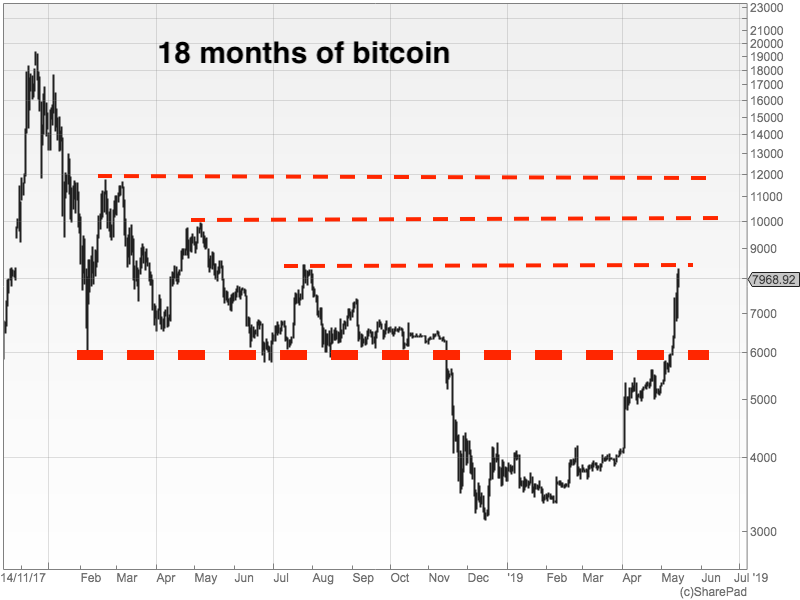

My grand theory of bitcoin earlier this year, when we were back around the $3,000 area, was that it would stage a rally to the mid $6,000s by the summer, before coming back and re-testing the low in the autumn and making a great big double bottom.

But bitcoin has burst through what I thought would be resistance like it wasn't there. There's another layer of resistance here at $8,500, and the next stop after that is $10,000. When bitcoin gets like this, there is no knowing where it will stop. Surprises are almost always on the up side.

It would be typical action in a bear market after a bonanza year like 2017 for the market to come back and test the lows, but bitcoin is not typical.

So if you want to know "do I buy now? Or do I wait for a pullback?" I just can't answer that question. The prudent investor in me says "wait, it'll probably come back to the $6,000 area". The gung ho, says "buy, buy, buy" or you could miss out.

It's on a long-term buy signal, as I reported last month. But in the short term it may have got ahead of itself.

Here's a chart for your reference. The thick dashed line around $6,000 is where I see support and where I thought there would be some resistance. The three thin dashed lines are future levels of resistance, based on previous highs $8,500, $10,000 and just below $12,000.

It's at resistance now, as I write. But it's also closing in on 12-month highs.

The rocky rollercoaster ride of bitcoin has started up again. Enjoy the trip. And hang on to your hats.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how