Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

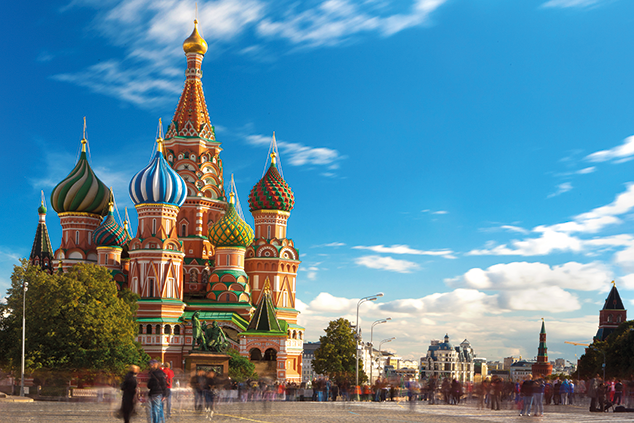

The 40% jump in the oil price so far this year has been treated with indifference by global investors, but, at the other end of Europe, it is very good news. While Russia has been diversifying its economy away from a dependency on oil and gas and insulating it from price volatility, hydrocarbons (eg crude oil and natural gas) still account for 10% of GDP,21% of 2017 government revenue, and 58% of export earnings, according toAlexey Krivoshapko, a director of Prosperity Capital.

Under Russia's tax system, 90% of the extra revenue from higher prices goes to the government, which accumulates the windfall in a stabilisation fund, mostly in foreign currency. This means that the benefit flows broadly into the Russian economy, rather than providing excess profits to energy firms.

Baring Emerging Europe

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

trust

(LSE: BEE)

"Entrepreneurial spirit is helping the Russian economy"

Growth in Poland reached 5% last year, bringing significant increases in real incomes and retail sales.Siller favours the banks, which are benefiting from demand for mortgages and for loans to developers, while their excess capital finances healthy dividend yields.

Turkey is in recession and its currency has fallen sharply, but Siller believes that the Turkish lira is now cheap, the current account is positive, and the economy has rebalanced. The portfolio includes mobile-phone operator Turkcell, and Tupras, an oil refiner close to the Aegean, which means it has good access to export markets.

Both have strong balance sheets, so they "can withstand economic and financial stress", but "there are opportunities in many sectors". Inevitably, Russian companies, especially the oil and gas producers, dominate the portfolio, with more than 10% invested in Lukoil, 8% in Novatek and 7% in Gazprom.

Prosperity is a fan of Lukoil, because of its "visible corporate governance improvements" and modest valuation it trades at less than seven times earnings and yields nearly 6%, with dividends expected to rise sharply. Novatek, as one of Russia's largest producers and exporters, benefits from growing demand for liquefied natural gas.

Putting politics aside

While media attention on the region focuses on politics, Siller is finding plenty of high-quality growing companies on reasonable valuations to invest in. As he points out, "emerging Europe has outperformed western Europe over one, three and five years, so there is a good story to tell". With the shares yielding 4.3% and trading on a discount to net asset value of nearly 10%, the risks are well discounted.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Max has an Economics degree from the University of Cambridge and is a chartered accountant. He worked at Investec Asset Management for 12 years, managing multi-asset funds investing in internally and externally managed funds, including investment trusts. This included a fund of investment trusts which grew to £120m+. Max has managed ten investment trusts (winning many awards) and sat on the boards of three trusts – two directorships are still active.

After 39 years in financial services, including 30 as a professional fund manager, Max took semi-retirement in 2017. Max has been a MoneyWeek columnist since 2016 writing about investment funds and more generally on markets online, plus occasional opinion pieces. He also writes for the Investment Trust Handbook each year and has contributed to The Daily Telegraph and other publications. See here for details of current investments held by Max.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how