Share tips: keep track of Quartix

Quartix, the Aim-listed maker of devices to track vehicles, looks attractively valued, says Richard Beddard.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The idea of investing in Quartix (Aim: QTX) may not seem appealing at first glance. But dig a bit deeper and the opportunity becomes clear. The company supplies vehicle tracking systems to businesses operating fleets of vans and to insurance companies tracking young drivers. The fleet business has grown every year since chief executive Andy Walters founded the company in 2001, but the insurance division is contracting.

Quartix is spending money to establish itself in largely unproven markets in the USA and Europe, but there is a cloud on the far horizon. In the coming decades vehicles will do an increasing amount of driving themselves, perhaps reducing the need for a system that makes sure drivers go where they are supposed to and drive safely and efficiently.

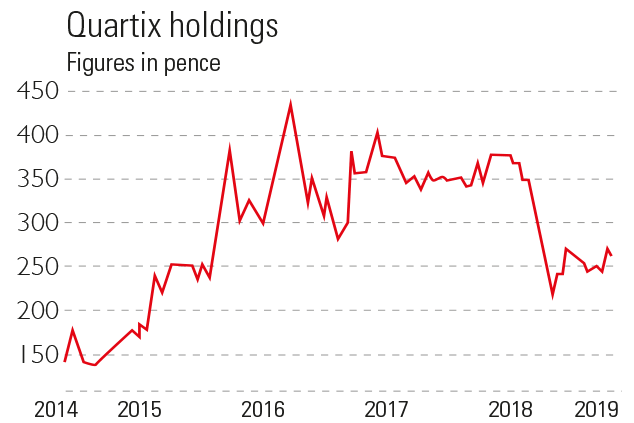

So there are short-term threats to sales and profits; as Quartix is a one-product company, there is also a distant possibility of extinction. Traders have been selling the shares, and the stock has fallen more than 40% from Quartix's all-time high in 2016.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

A brighter future

Once the shrinking insurance business has ceased dragging on revenue and profit, and Quartix has established itself abroad, sustained growth may well follow. It is already profitable in France, the first overseas market it entered.

Quartix's fleet business was designed from the outset to expand easily. The company supplies a generic device that meets the needs of small and medium-sized fleets. It keeps things simple, generally avoiding developing new features unless it believes the majority of customers want them. This gadget is cheap and does the important things well. It was originally designed to be fitted by an engineer, but a new version can be installed by the customer.

A generic low-cost tracker is attractive to small and, increasingly, larger fleets as Quartix adapts the software. Combined, the customer base comprises millions of vehicles in the UK alone, which gives Quartix a large and reasonably homogeneous market underserved by many rivals. Over nearly 20 years, the company has optimised the product and how it sells it, developing a unique position in the market. Unusually, Quartix does not charge fleet customers money upfront and only locks them in for the first year, but even so the company says its attrition rate is below the industry average. Simple and transparent pricing is one of its selling points.

The insurance arm looks less appetising. Quartix supplies its tracking devices to a firm called Wunelli, which in turn supplies the insurers. While up to 90% of fleet systems are retained by customers every year, insurers generally only track young drivers for their first year. Quartix is exploring niches in the insurance market, but sales to Wunelli have declined markedly from a peak of 36% of total revenue in 2016 to about 20% in the year to December 2018. The decline is accelerating. Insurance installations were 35% lower in the first three months of 2019 than in the same period a year earlier.

Expanding abroad

The delayed impact of new installations on profit Quartix recognises the cost immediately but only counts revenue as it earns its in monthly fees will have the same effect. The bottom line, according to Quartix, will be a 20% fall in annual profits in 2019. This is clearly not comforting for traders with a short-term disposition.

Quartix's versatile widget

To its credit, Quartix addresses the risk of technological obsolescence briefly in the "principal risks and uncertainties" section of its annual report. It is probably the most important chapter of the document after the financial statements, but it is often overlooked by investors.

The disclosure is short, but revealing, making clear that the company sees itself more as an information service than the supplier of a widget. Quartix says it reviews technological developments with a view to "adopting any which will provide a better channel for the information services which Quartix provides." Nearly two decades ago Quartix began to see the promise of networked devices, well before the "Internet of Things" (IoT) the interconnection of everyday gadgets via the internet became a byword. I gain confidence from the case studies on the Quartix website.

They show how customers such as flooring contractors, breweries, regional breakdown services and some well-known names such as Calor Gas use the software not just to check up on drivers, but for route planning, responding in real-time to urgent jobs and collisions, and keeping their customers and warehouses informed about arrival times. The reporting functions help with costing, invoicing and payroll.

At present, that service is best provided by a small tamper-proof device mounted discreetly behind a vehicle's dashboard that sends information back to base over the mobile phone network. Technology will bring change, but the imperative for fleets to reduce costs, serve customers more efficiently, and be more accountable are unlikely to disappear even if the vans eventually drive themselves.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Richard Beddard founded an investment club before joining Interactive Investor as an editor at the height of the dotcom boom in 1999. in 2007 he started the Share Sleuth column for Money Observer magazine, which tracks a virtual portfolio of shares selected for the long-term by Richard. His career highlights include interviewing Nobel prize winners, private investors and many, many company executives.

Richard is freelance writer who invests in company shares and funds through his self-invested personal pension. He has worked as a teacher and in educational publishing, and is a governor at University Technology College, Cambridge. He supports the Livingstone Tanzania Trust, a charity supporting education and enterprise in Tanzania.

Richard studied International History and Politics at the University of Leeds, winning the Drummond-Wolff Prize for "distinguished work in the field of international relations".

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?