Victrex’s versatile polymer

Victrex makes most of the world’s supply of PEEK, the material it invented 40 years ago.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Imagine a company that invented a new material 40 years ago. This material is so light and durable it is used to manufacture vital components for many of the things we take for granted. Imagine the firm sold more than £300m worth of the material in its most recent financial year, earning a return on capital of 27%. Imagine it is British, listed in London, and valued at about 18 times debt-adjusted profit.

That company exists. It is called Victrex (LSE: VCT). And even though Victrex's patent on Polyether ether ketone (PEEK), the material it invented, ran out in 2000, it still manufactures most of the world's supply. Its three polymer manufacturing plants produce in excess of 7,000 tonnes of the stuff, more than 60% of the world'stotal capacity.

Top of the polymer pyramid

Vacuum cleaner manufacturer Dyson selected a PEEK/carbon-fibre composite made by Victrex for the fans in its cleaners because the material can withstand the G-forces generated by its high-speed motors.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

While a handful of other chemicals companies have learned to manufacture PEEK since Victrex's patent ran out, Victrex is the only specialist. It has more expertise, it continues to patent new manufacturing processes, and produces higher grades of PEEK and more varieties: polymer resins, blends, compounds of PEEK and carbon and glass fibre, and basic products such as film, pipe, and coatings. Victrex's incredibly thin but tough film is used in the speakers and receivers of more than a billion mobile phones.

The challenge facing Victrex is to spur industries to adopt a polymer when they are used to using metal. The company says it must deliver the "burden of proof" developing prototypes and parts and testing them. It must submit medical devices to clinical trials, and work with parts manufacturers or acquire them to accelerate the development of PEEK parts for its "mega-programmes" the biggest opportunities in its new product pipeline.

From each of five current mega-programmes, Victrex anticipates at least £50m in annual revenue in their peak sales year, but it does not forecast when that will be.The speed of progress is perhaps illustrated by the fact that sales of new products, defined as those on sale since 2014, made up 4% of total sales of £326m just four years later.

Although the core business of polymer production is still growing, albeit lumpily, Victrex's hopes are pinned on programmes in the early stages of commercialisation: gears for cars, brackets for aeroplane fuel tanks, subsea oil pipelines, and dental and knee implants.

The move from polymer to parts has been a long time coming. Victrex has manufactured film and spinal implants for many years, but the complexity of the business is growing. It is an opportunity to differentiate the company further from rivals who are less able and ambitious, but it requires investment, and the payoffs are uncertain. Management is spinning more plates.

An exemplary record

Shareholders received 2018's special dividend in February. But there may be a hiatus next year. While Victrex is operating below capacity, the company needs to be ready to manufacture whenever demand arises from its new programmes, which could spike quite suddenly. It is likely to use some of its cash to build more manufacturing capacity within the next five years.

Meanwhile, to mitigate disruption to trade if the UK leaves the EU, Victrex is stockpiling PEEK on the continent and imported raw materials here. If the terms of trade worsen after departure from the EU, European customers do not have many alternative suppliers to choose from. None manufactures in the EU.

Kicking the tyres keeping prices high

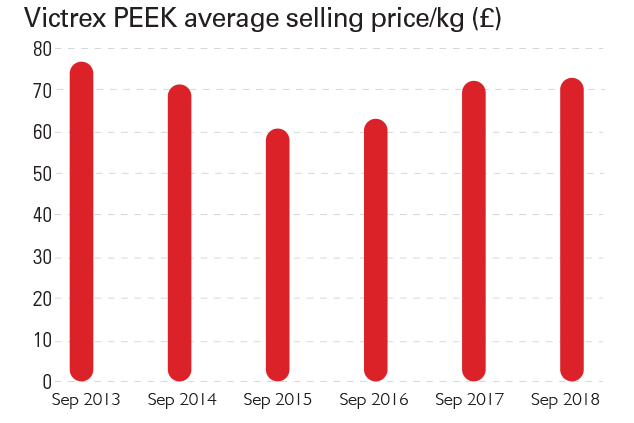

Victrex's strategy aims to keep the average selling price of PEEK high by developing unique variants and products competitors cannot manufacture. It routinely comments on the average selling price in its annual report, calculated by dividing annual revenue by the volume of PEEK produced in the same year.

Measured in pounds per kg, the average selling price has been stable in recent years, but Victrex earns nearly all its revenue abroad. It makes slightly more than a quarter of sales in the Asia-Pacific region, a little more from the Americas, and more than 40% of revenue from the rest of Europe. The decline in the value of the pound has flattered the value of overseas sales and masked a 17% decline in the average selling price in US dollars and Japanese yen since 2013, as well as a 5% decline in terms of euros.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Richard Beddard founded an investment club before joining Interactive Investor as an editor at the height of the dotcom boom in 1999. in 2007 he started the Share Sleuth column for Money Observer magazine, which tracks a virtual portfolio of shares selected for the long-term by Richard. His career highlights include interviewing Nobel prize winners, private investors and many, many company executives.

Richard is freelance writer who invests in company shares and funds through his self-invested personal pension. He has worked as a teacher and in educational publishing, and is a governor at University Technology College, Cambridge. He supports the Livingstone Tanzania Trust, a charity supporting education and enterprise in Tanzania.

Richard studied International History and Politics at the University of Leeds, winning the Drummond-Wolff Prize for "distinguished work in the field of international relations".

-

Should you get financial advice when organising care for an elderly relative?

Should you get financial advice when organising care for an elderly relative?A tiny proportion of over 45s get help planning elderly relatives’ care – but is financial advice worth the cost?

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio