The charts that matter: the European Central Bank’s handbrake turn

With the ECB throwing in the towel on tightening fiscal policy, John Stepek looks at what effect this has had on the charts that matter most to markets and the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back. I'm very excited this weekend, and not just because it's Saturday.

My book, The Sceptical Investor, is out on Monday. Here's a shot of the front cover (or quite a few of them).

Now, I need to shift all these books that are currently cluttering up the house, so if you could see your way clear to ordering copies for yourself and all of your relatives, I'd really appreciate it.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Wait, you want to know what's in it first?

It's all about contrarian investing (or "sceptical investing", as I have somewhat cheekily rebranded it), it's aimed at investors of all levels of experience, and it's got a fantastic foreword by Merryn. Pre-order your copy now, so you can be among the first to read it! (Not to mention the big discount on the cover price...)

And now back to our usual service...

We have a new podcast for you this week Merryn talks gold with Alasdair McKinnon of The Scottish Investment Trust, and we look at the specific reasons why you might want to make sure you have some in your portfolio just now. We also ponder how it compares to bitcoin as a defence against capital controls.

If you missed any of this week's Money Mornings, catch up now.

Monday: Interest rates around the world are quietly creeping higher why

Tuesday: Why China has to spend to boost growth, whether it wants to or not

Wednesday: Platinum looks strikingly cheap but will it ever recover?

Thursday: I hate this cheap data mining trick don't fall for it

Friday: Why Europe's U-turn has panicked investors

And subscribe to MoneyWeek magazine if you haven't already you get your first six issues free, so what are you waiting for?

And now, over to the charts.

The big news this week was that the European Central Bank (ECB) joined the rest of the world's central banks in throwing in the towel. Mario Draghi won't be raising interest rates before he steps down later this year. And he's making sure that even if his successor is closer to the German than to the Italian view of monetary policy, that he has sufficiently tied their hands.

You might think that would be good news for markets. But investors were rattled. A weaker euro means a stronger dollar, which investors don't like. There's also the worrying question of "if we can't get out of this after a decade, will we ever get out of it?" It's all becoming worryingly reminiscent of Japan circa 2000.

So what are we seeing in the market reaction?

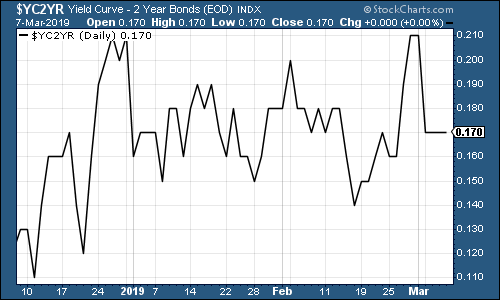

The yield curve (here's a reminder of what it is) retreated again. It's still very much in the danger zone, despite central banks U-turning across the globe.

The chart below shows the difference (the "spread") between what it costs the US government to borrow money over ten years and what it costs over two. Once this number turns negative, the yield curve has inverted which almost always signals a recession (although perhaps not for up to two years).

(The gap between the yield on the ten-year US Treasury and that on the two-year, going back three months)

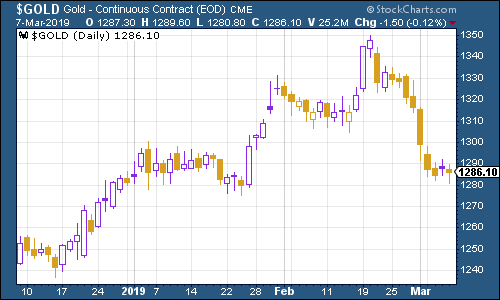

Gold (measured in dollar terms) had a tough week again. This week, though, it's because investors are starting to worry that we're heading back to deflation and that central banks won't be able to loosen monetary policy fast enough to escape it. Between that and a bouncing dollar, it's not a helpful backdrop for gold.

(Gold: three months)

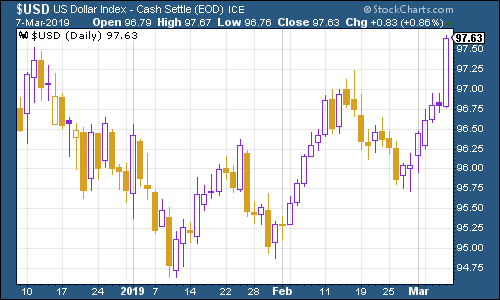

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners rocketed this week as the euro plunged (because the euro is the biggest component of this basket).

That put a real dent in risk appetite. We'll need to see how the Fed responds, because, certainly, neither Jerome Powell nor Donald Trump will welcome that rising dollar, because they know what it means for markets.

(DXY: three months)

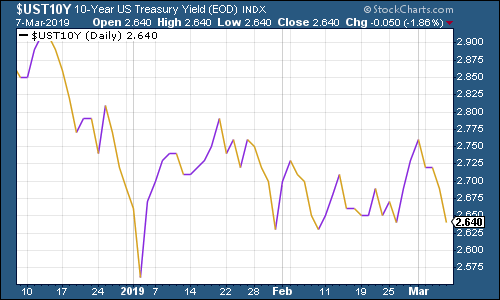

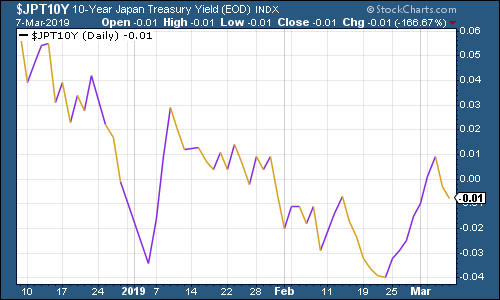

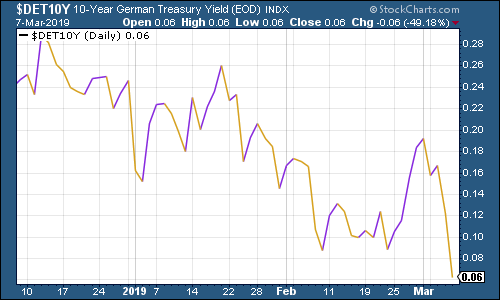

The ten-year yields on the world's major developed-market bonds the US, Japan and Germany were all lower again, as fear of deflation picked up.

(Ten-year US Treasury yield: three months)

(Ten-year Japanese government bond yield: three months)

(Ten-year bund yield: three months)

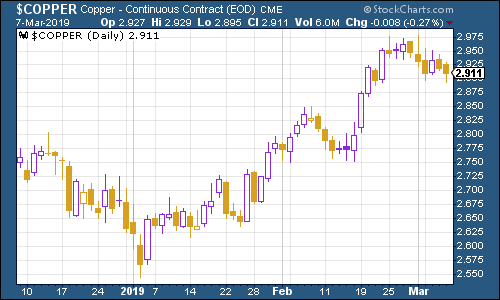

Copper slipped a little this week and I wouldn't be surprised to see it give back some of its recent gains as markets keep fretting over the ECB move.

(Copper: three months)

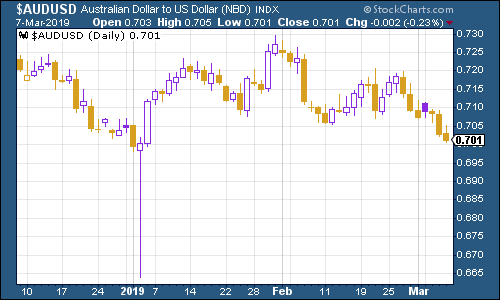

The Aussie dollar our favourite indicator of the state of the Chinese economy continued to fall. Australia has fallen into a "per-capita" recession in other words, GDP is lower than it was once you account for population growth. The "lucky country" hasn't had a recession in nearly 30 years, so this is a big deal for them.

(Aussie dollar vs US dollar exchange rate: three months)

Cryptocurrency bitcoin continued to hang around in the $3,700 $3,850 area. It'll be interesting to see whether this is the bottom for bitcoin in the longer term.

(Bitcoin: ten days)

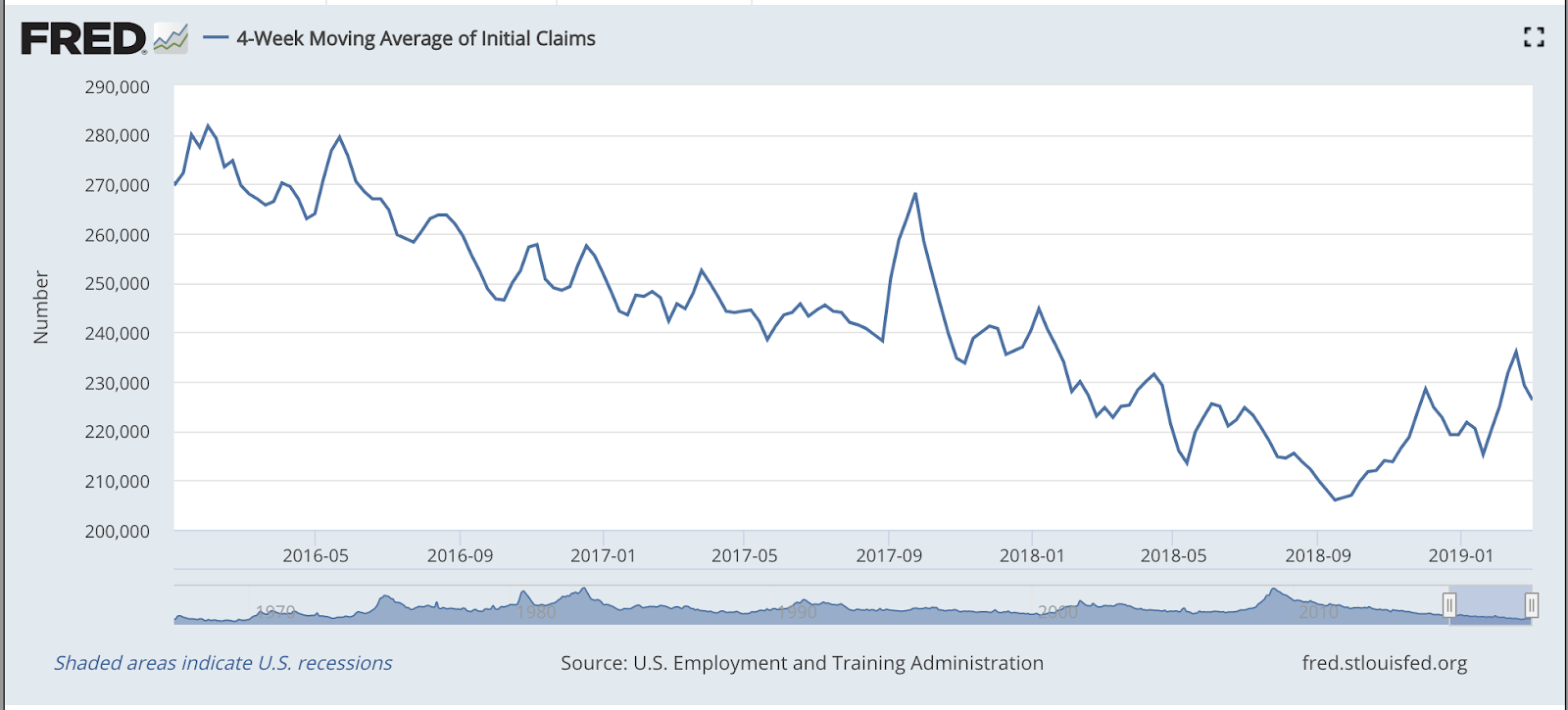

The four-week moving average of weekly US jobless claims fell back this week, to 226,250, while weekly claims slipped back to 223,000, lower than expected.

Based on the limited sample of historical recessions, David Rosenberg of Gluskin Sheff has pointed out that US stocks typically don't peak until after the aforementioned four-week moving average has hit a low for the cycle. On average, a recession follows about a year later.

The most recent trough came on 15 September, at 206,000. If that was the bottom, it implies that the market has already peaked (which happened in early October, at around 2,950 for the S&P 500), and that a recession may follow this year or in 2020.

We'll see what happens. Non-farm payrolls data for February came out on Friday afternoon, and they were staggeringly bad the US added just 20,000 jobs last month, whereas 180,000 were expected.

That said, who knows how those figures were affected by the government shutdown (technically, they shouldn't be, but it's funny how theory and reality often depart). Also, wage inflation was strong up 3.4% and January's already-strong figure was revised higher. So even now, the jury's out.

(US jobless claims, four-week moving average: since January 2016)

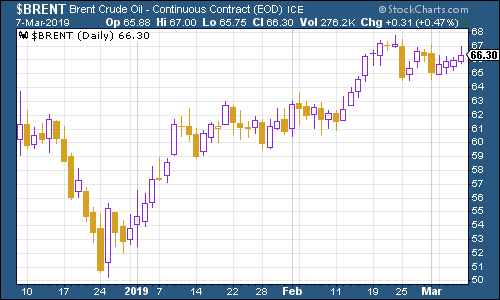

Despite the stronger dollar and burgeoning concerns over growth, the oil price (as measured by Brent crude, the international/European benchmark) managed to stay close to its recent highs.

(Brent crude oil: three months)

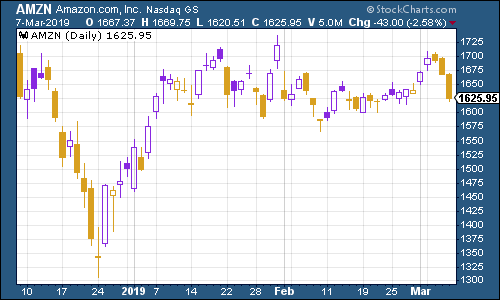

Internet giant Amazon slipped back along with the rest of the S&P 500 as the ECB move unnerved markets.

(Amazon: three months)

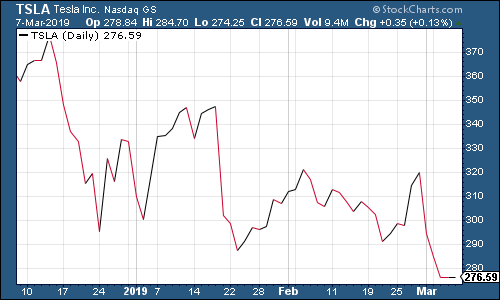

Electric-car group Tesla, meanwhile, fell hard. Investors are concerned, as always, about its ability to generate a profit and make enough cars fast enough to stay ahead of the competition. Not to mention the activities of its capricious CEO.

(Tesla: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

ISA fund and trust picks for every type of investor – which could work for you?

ISA fund and trust picks for every type of investor – which could work for you?Whether you’re an ISA investor seeking reliable returns, looking to add a bit more risk to your portfolio or are new to investing, MoneyWeek asked the experts for funds and investment trusts you could consider in 2026

-

The most popular fund sectors of 2025 as investor outflows continue

The most popular fund sectors of 2025 as investor outflows continueIt was another difficult year for fund inflows but there are signs that investors are returning to the financial markets