Platinum looks strikingly cheap – but will it ever recover?

Platinum has historically been more expensive than gold – but that’s no longer the case. John Stepek looks at the reasons behind the change and asks if it’s worth buying now.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Platinum is a precious metal. It's mentioned in the same breath as gold, silver and diamonds.

But it's become rather less precious in recent years.

Will its fortunes ever change?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Platinum looks like a raging buy but don't get too excited

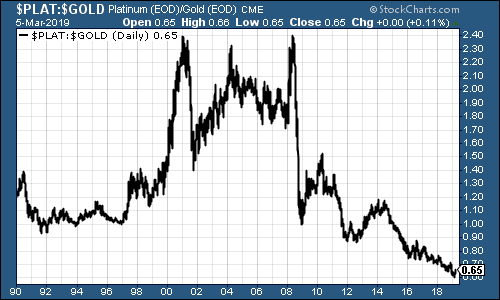

Here's the ratio of the platinum price to the gold price (it's the platinum price per ounce divided by the gold price per ounce), going back to 1990. If you look at that chart, and you have a single contrarian bone in your body, then you have to be itching to buy.

I mean, come on! Everyone knows that platinum is better than gold. You want a platinum credit card, not a gold one. You want your album to go platinum, not gold.

At its peak, platinum was more than twice the price of gold. And until the current decade, even at its depths, it had rarely sunk below the gold price.

Yet today, gold is trading at a higher premium to platinum than we've seen in most people's investing lifetimes.

Surely it's a raging buy?

Maybe it is, maybe it isn't we'll get on to that in a moment. But if it is, it's not got anything to do with the platinum-to-gold ratio.

Don't get fooled by patterns relationships change

It's easy to get fooled by patterns in markets. Human beings are pattern-spotting machines. We can't help ourselves; it's an exceptionally useful evolutionary adaptation. But like all such adaptations, there are some circumstances in which it can be downright unhelpful. Investing is one of them.

(I talk about this a lot more in my book, The Sceptical Investor, which is all about contrarian investing. It's not out until Monday, but you can pre-order it here.)

We see relationships everywhere. And it's easy to get the idea into our heads that those relationships will last such as, platinum should always be at least as expensive, if not more expensive, than gold.

These patterns can be very useful. But relationships change. And what was once a valid view can become completely irrelevant.

The real problem with the platinum-to-gold ratio is that there's no fundamental reason for there to be a desperately strong relationship between the two metals there is a correlation, but looking back over a decade, the gold price is more strongly correlated to both copper and oil than it is to platinum.

Why gold and silver are much closer than gold and platinum

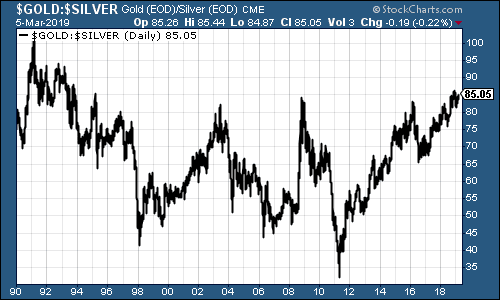

I'll explain what I mean by that with reference to another precious metal silver. Here's the gold-to-silver ratio going back to 1990 (the gold price divided by the silver price).

The gold-to-silver ratio can be useful. It's not so much because there's 15 ounces of silver for every ounce of gold (or whatever the exact physical ratio is), which is what the silver enthusiasts tend to harp on about. It's because they are influenced by many of the same factors.

Gold is a monetary metal. The price of gold is virtually all down to how people feel about the financial system and the big picture outlook. Yes, there's a bit of industrial and jewellery demand, but those aspects are simply not that important in driving the price.

Silver is both monetary and industrial. People will buy silver as a hedge against financial concerns. But it's also widely used in industry. So the price is also driven partly by economic growth.

As a result of this common driver the monetary aspect it makes a certain amount of sense that gold and silver should trade relatively closely to one another. And they do the correlation between the two (the extent to which they move together) over the past decade is far higher than for gold and copper, oil or platinum.

As a result, when the ratio between them reaches extremes, it's not unreasonable to expect it to reverse. There's potentially useful information there. (Indeed, looking at the chart above, you'd expect silver to start outperforming gold from here, although that's a story for another day perhaps one I'll ask my colleague Dominic Frisby to elaborate on).

But you can't say the same for the relationship between gold and platinum.

What really affects the platinum price

Platinum is not a monetary metal. It's a real asset, yes if we see hyperinflation or an entire collapse in the banking system, then you would certainly favour an ingot of platinum over a wheelbarrow full of fiat currency but you could say almost the same for an ingot of copper or a barrel of oil.

If it's the financial system you're worried about, investing in gold or silver is a better way to express that concern.

Platinum is an industrial metal, and it's specifically a car industry metal. So it shares no common drivers with gold, and there's really no reason why platinum should be more expensive than gold. Yes, that's historically been the case. And yes, it is rarer, and it is pretty. But if the secular story behind platinum changes (as it has) then that old relationship can change too.

The reality is that platinum's real rival now is palladium. The palladium price has rocketed even as platinum's has collapsed. The story behind it is well known now. Consumers, in Europe in particular, were conned by governments and car makers into believing that diesel cars were "greener" than petrol cars.

Now, of course, diesel is public enemy number one. Governments are acting as if they never encouraged consumers to swap in the first place, and car makers are maniacally covering up past misdeeds while talking big about launching as many electric car blends as they can.

Platinum is used in diesel cars (in the catalytic converter). Palladium is used in petrol cars. Hence as diesel has lost out to petrol, platinum has lost out to palladium.

The palladium price is now near a record, sitting at around $1,500 an ounce (you can see how unusual this situation is in the chart below).

At some point as is always the case with industrial commodities it will become profitable to substitute palladium for something cheaper. The obvious candidate is platinum.

The tricky thing is knowing when that point will be reached. In the FT yesterday, Henry Sanderson reported that platinum-backed exchange-traded funds have seen a big surge of interest this year holdings are now at a four-year high. Clearly, investors have noted the massive valuation gap.

Criminals are now pinching catalytic converters (at least, according to an anecdote from John Gapper in the FT earlier this year) in order to get hold of the palladium.

And according to Trevor Raymond of the World Platinum Investment Council, "just a 5% substitution would mean a 14% increase in platinum demand from the automotive segment." There are also suggestions that demand for fuel-cell vehicles in China could help the platinum price.

Here's the reality: you can't know when these things will change. Perhaps when we start seeing "platinum" demoted in popular culture (so your platinum credit card is replaced with a diamond one, or maybe even a palladium one), then you'll know it's turnaround time.

But prices create change. And right now, platinum looks cheap. So my suggestion would be to buy some, but to buy it in a way that means you can hold onto it for the long run. A physically-backed platinum ETF like the ones the investors noted above have been piling into is probably the simplest and best bet (there's a London-listed one, ETFS Physical Platinum, with the ticker PHPT).

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how