Cohort bulks up defence portfolio

Cohort, the defence technology group, has moved with the times and owns a compelling collection of companies.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

On the face of it, defence is not an attractive industry for investors today. Priorities are changing as perceived threats shift from conventional warfare to terrorism and cyberattacks, while the Ministry of Defence (MoD) strains to plug a widely reported "black hole" in its finances. Spending is tight and suppliers are having to investin developing new productsand services.

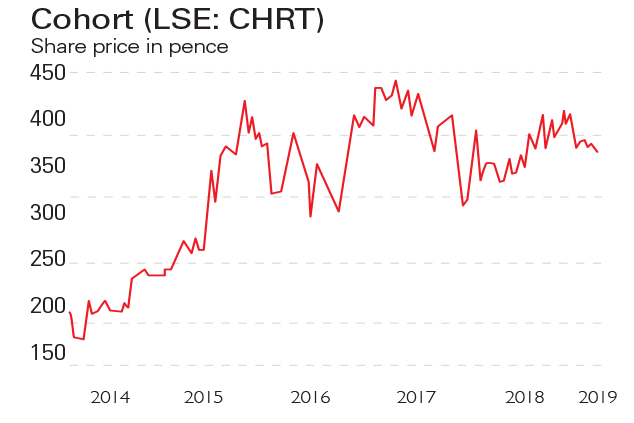

Yet Cohort (LSE: CHRT), an agglomeration of defence technology businesses, has done its fair share of adjusting. SCS, the original business, floated on the stockmarket in 2006, aiming to acquire another firm every year.

Meanwhile, the directors, who had long track records working for defence contractors, the MoD, or the military, would open doors for the newly acquired firms, who would also find it easier to win contracts as part of a larger, well-funded and listed entity.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Employees would thrive because the acquired businesses would remain autonomous and entrepreneurial. And customers would appreciate intimate relationships with professionals who did not have to go back to head office seeking approval for every decision.

Updating the shopping list

The company's approach has not changed, and neither has the close-knit management team. But the nature of the acquisitions, the work it is doing, and its client list are changing. SCS was a training consultancy, but two years ago Cohort closed it down. The MoD had brought some training contracts in house, and the remainder were distributed among SEA and MASS, two of Cohort's early acquisitions. MASS and SEA are consultancies that rent their expertise and employees, primarily to the MoD, but they also sell products. Thurbon, the jewel in MASS's crown, is an information management system for electronic warfare.Cohort's subsequent acquisitions, MCL in 2014, EID in 2017, and Chess last December, illustrate how the company is becoming more product focused and export orientated to help it expand and reduce its dependence on the cash-strapped MoD. Businesses selling products tend to be easier to grow profitably than consultancies, especially abroad, and while the MoD can train itself, it depends on the private sector for equipment.

"Cohort is growing exports to reduce its dependence on the cash-strapped MoD"

MCL is a British supplier of military technology, mostly to special forces and the security industry. EID is a Portuguese manufacturer of communications equipment. And the latest acquisition, Chess, ticks all of Cohort's strategic boxes.

Chess designs and manufactures surveillance and fire-control systems that combine video softwarewith hardware mountedon stabilised platforms to acquire, identify, and track targets for weapons systems,typically on military vehicles and ships. With the help of US partners, Chess claims to have brought "the only fully combat-proven counter-drone system" to market. Although the UKis the company's biggest market, it earns only a third of revenue here. Its second-biggest market is Europe, and it also gives Cohort a foothold inthe US.

Chess plays the long game

Chess was founded in 1993 and has grown rapidly since 2014, when it made a small loss. That year it acquired video-tracking subsidiary Vision4ce, becoming a supplier ofsystems rather than solely of electronic components.

In the year to April 2018, Chess made a profit before interest and tax of £2.4m. Cohort has paid £20.1m, just over eight times the profit figure, for an 82% stake in the company, but it is on the hook for up to £12.7m more, depending on how Chess performs in the three years from April 2018 to April 2021, and up to £9.1m more for the remaining shares.

Cohort tells me it will only have to pay these sums if Chess meets demanding financial targets. It will prove to be very good value if, as Cohort says, Chess has strong competitive advantages, such as being unique in the UK and having some customers relying exclusively on its systems. Drones too may continue to march up the military's list of priorities. Cohort's shares, meanwhile, cost about 12 times debt-adjusted 2018 profit, which could also turn out to be good value.

Orders recover from a brief decline

Cohort has remained comfortably profitable despite changing defence priorities, but it reported a sharply lower order intake in the year to April 2018.The company was confident that orders had just been delayed and it would make good the deficit in the current financial year, but the size of the shortfall was unnerving. Delays can always get longer or worse, orders can fail to materialise.

In November I attended a presentation by Simon Walther, Cohort's financial director. With half the financial year gone, he reported good progress on five major prospective orders still outstanding, including new overseas orders and the renewal of an eight-year £50m contract to provide managed services to the MoD, which it has supplied continuously since 2000. All five orders have now been secured. The presentation I attended was organised by an events company, Blackthorn Focus. These events are like speed dating for investors and companies. Four companies updated investors for twenty minutes; at half time, we had the opportunity to collar particular executives. I made a beeline for Mr Walther.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Richard Beddard founded an investment club before joining Interactive Investor as an editor at the height of the dotcom boom in 1999. in 2007 he started the Share Sleuth column for Money Observer magazine, which tracks a virtual portfolio of shares selected for the long-term by Richard. His career highlights include interviewing Nobel prize winners, private investors and many, many company executives.

Richard is freelance writer who invests in company shares and funds through his self-invested personal pension. He has worked as a teacher and in educational publishing, and is a governor at University Technology College, Cambridge. He supports the Livingstone Tanzania Trust, a charity supporting education and enterprise in Tanzania.

Richard studied International History and Politics at the University of Leeds, winning the Drummond-Wolff Prize for "distinguished work in the field of international relations".

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how