House prices in the UK are now falling – which is great news

UK house prices are falling. But don’t panic. This modest decline is the best-case scenario, says John Stepek, and a full-on crash is looking unlikely. Here’s why.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Quick thing before we start: if you haven't got your ticket for our event next week (on 12 February), book now there are only a few left!

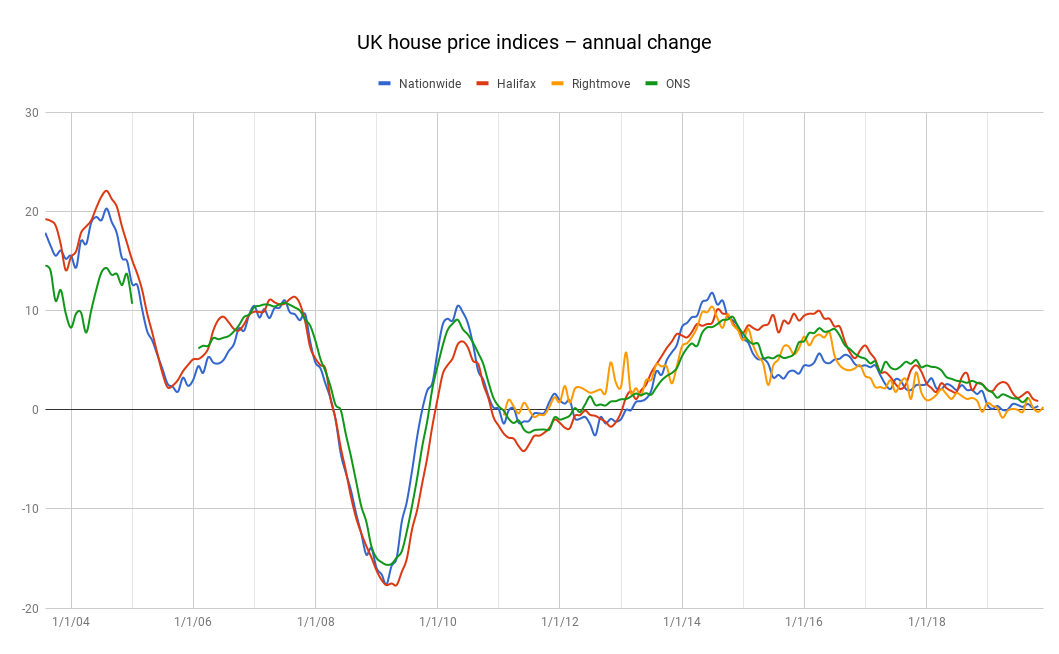

House prices in the UK are now falling.

In the three months to the end of January, prices fell by 0.6% compared to the previous quarter, according to Halifax.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

And on an annual basis, prices were up by less than 1%. Which means they are falling in "real" terms (ie after inflation).

It's good news if you're in the market for a house. And it's good news if you think Britain could do with being a little less property-obsessed.

But will the good news continue?

House prices in the UK are in decline, however you look at it

The latest figures from the Halifax are actually a bit more upbeat than the last report from its nearest rival index, published by Nationwide. According to the building society, house prices rose at an annual rate of just 0.1% in January. That's the slowest pace of growth in six years, and a "real" terms fall of more than 2% (depending on which inflation measure you prefer).

But one way or another, prices are flat or dipping.

This will be blamed on Brexit, because everything at the moment is being blamed on Brexit. But to be clear, this does not appear to be down to a massive drop in sales ("despite Brexit", as the saying goes). In December, says Halifax, there were 102,330 house sales, which is "very close to the five-year average of 101,515." Mortgage approvals are pretty close to the five-year average as well.

I'm not saying Brexit will have no effect. I'd be very surprised if we don't at least see a "Brexit blip", where people hold off making big decisions about moving until after a deal is done (assuming one does get done, of course). But the roots of the slowdown go deeper put it this way, even if we had no intention of leaving the EU, I'm pretty sure the trajectory for house prices would be the same right now.

On top of that, it has become much more expensive for certain groups of buyers to invest in UK residential property. Landlords are slowly having any tax benefits taken away from them, which has hugely reduced the appeal of property.

Indeed, I'm wondering how long it'll be before the celebrity money interviews up the back of the Sunday supplements start to reflect this (when offered the choice between "property or pension" a silly question on lots of levels 99% still answer "property", as you'll see if you follow my colleague Merryn on Twitter @MerrynSW).

But they're not the only ones. Rich buyers of all kinds, but particularly rich foreign buyers, have been hit hard too stamp duty on high-priced properties, plus an annual tax on property owned by companies (typically done by overseas buyers). As a result of all this, Savills reports that sales of properties over £5m have dropped by a third since 2014. More than anything else, this is what has hit the London market hardest.

What could make house prices crash?

Now that prices are falling, that tends to feed on itself. Just as in the stockmarket, everyone wants to buy at the bottom. When prices are rocketing, people panic to get in. When prices are falling, they take their time.

Yet, as I've said before, if the economy remains in decent shape, and employment stays as high as it is, it is hard to see any reason why prices would crash outright to get a full-on crash, you need a large number of forced sellers, and at the moment, I don't see an obvious way for that to happen.

One route to a crash is that people who own houses can no longer afford to keep them. This can occur in one of two ways. Either the mortgage holder loses their job (and thus their income) or interest rates shoot up, driving up the cost of all variable-rate home loans beyond affordability. These two are not mutually exclusive indeed, they often go hand in hand.

But there is no obvious reason right now why we should expect a surge in unemployment or a surge in interest rates. There are scenarios in which these things become possibilities a truly catastrophic Brexit for example, or a truly radical Jeremy Corbyn-led government. But for now those are low probability events.

The only potential significant contingent of forced sellers I can see is perhaps that subset of overstretched landlords who were taken by surprise by their tax bills this year. That is probably having some effect on the market, but not to the extent where we'll see 1990s-style repossessions.

Another potential route to a crash is that the availability of credit dries up. This means that buyers simply can't afford to pay the asking prices because the level of debt is not available to them. Again, though, in the absence of much higher interest rates, this seems unlikely. And in any case, a credit drought would usually lead more to a freeze rather than a crash most sellers just sit on their homes rather than sell at a big loss.

So I can't see a crash coming. But with buyers no longer gripped by property fever, and interest rates likely to rise modestly if Brexit doesn't end in apocalypse, then I reckon we can expect prices to continue moving in the right direction slowly downwards.

And that's good news. If you want to take some of the heat out of the political anger gripping the nation, then rising wages and modestly declining house prices are one good way to do it without causing a lot of disruption. Fingers crossed.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how