Judges Scientific: a scientific mini-conglomerate

Scientific-equipment maker Judges Scientific is expanding rapidly and doesn't deserve to be ignored by investors, says Richard Beddard.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Judges Scientific's collection of equipment makers is expanding rapidly

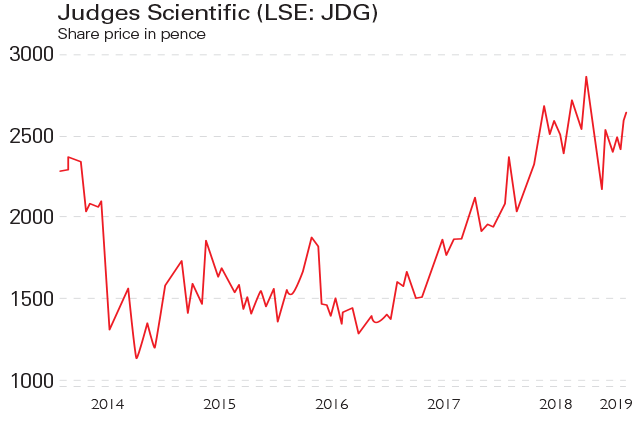

David Cicurel, the 69 year-old founder and chief executive of Judges Scientific (Aim: JDG), which designs and produces scientific instruments, must be wondering what the company has to do to win the approval of stockmarket traders. The share price has declined gently over the past few months, even though the company is clearly growing ata healthy clip.

In its half-year results published last September, Judges Scientific said it expected profit for the full year, which ended in December, to be higher than analysts had pencilled in. In November it said it expected even more profit, and last month, with the financial year concluded, it raised expectations a third time.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

References to estimates of future profit are challenging to interpret because companies rarely disclose the figures they expect to meet or beat. However, I expect profit to be substantially higher than it was in 2017, which in turn marked an improvement on the year before.

We will find out exactly how much money the company made when it publishes full-year results in March, but if the shares are trading on a reasonable multiple of 2017 earnings, they will be cheaper based on the 2018 earnings we don't yet know. At about £26, the stock is valued at 20 times 2017 earnings on a debt-adjusted basis.

A serial shopper...

Judges Scientific manufactures scientific equipment and sells it, mostly to universities around the world. Funding for education comes mainly from the public purse, and recent fluctuations in government spending in have been reflected Judges Scientific's results.

Nevertheless, the company has remained resoundingly profitable. To assess just how profitable, we need to account for the cost of acquisitions because, first and foremost, Judges Scientific acquires other businesses. Since the early 2000's, the group's business model has required it to borrow money from banks, use it to buy small but highly profitable manufacturers of scientific equipment in the private market, and run them, sucking the profit into the parent so it can pay off debt and redistribute cash to subsidiaries that need to invest it. Once the firm can afford to borrow more money, it buys another firm.It has acquired 16 so far.

It is not unique in operating this "buy and build" model; Halma, for instance, a larger and more illustrious rival, also grows through takeovers. However, each firm tends to operate in a particular niche. Judges Scientific is not particularly choosy about the branches of science it supplies, but its targets must be capable of sustaining already high levels of profitability, which are underpinned by the fact that they have few rivals. Judges also favours businesses located in the south, principally Sussex and Hampshire, which makes it easier for the small head office team to visit them.

... and a reliable borrower

The model is profitable largely because of the company's reputation for paying back the money it has borrowed and for completing deals once it has agreed to them. Good relations with its bank means Judges Scientific can borrow money cheaply compared with the profit it earns from the acquisitions. That profit creates the surplus used to pay off debt and buy the next company.

The owners of small businesses and their agents come to Judges Scientific when they want to sell up, resulting in uncontested and attractively priced deals. When Judges tries to buy bigger companies outside this niche, it comes up against private-equity buyers and other listed firms, so both prices and the deal failure rate are higher.

Since Judges Scientific's strategy depends on buying businesses we must incorporate the cost of the acquisitions in our calculation of profitability by comparing profit to total invested capital (at cost), or Return on Total Invested Capital (ROTIC). After tax, ROTIC has held up well: it only dipped below 10% in 2016.

The sources of growth

Monitoring the performance of individual companies operated by a mini-conglomerate like Judges Scientific is difficult because the annual report focuses on the performance of the group. Subsidiaries file accounts with Companies House, though, and theycan yield valuable information.

One of Judges Scientific's biggest acquisitions, Armfield, barely made a profit in 2016, the group's worst year in terms of ROTIC. Another, Scientifica, lost money. In 2017, though, when the group's profitability improved, Armfield had returned to profit, and Scientifica had reduced its losses. Although the two subsidiaries have yet to file their accounts for 2018, their continued recoveries may be behind the group's improving performance. If Scientifica reveals a third sequential loss,we might question whether the subsidiary, which makes equipment for neuroscientists, is capable of sustained profitability.

Despite his age, David Cicurel remains the company's dealmaker, whichraises some rather awkward questions. Shareholders, ofcourse, can reassure themselves that management is still up to the job at the annual general meeting.

The chief executive impresses me, but should he retire Judges Scientific has a stable board and maintains a list of potential successors. Cicurel says the subsidiaries pretty much run themselves, bound by the financial controls imposed by the group under its experienced finance director, Brad Ormsby. Mark Lavelle, Judges Scientific's chief operating officer, previously workedfor Halma.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Richard Beddard founded an investment club before joining Interactive Investor as an editor at the height of the dotcom boom in 1999. in 2007 he started the Share Sleuth column for Money Observer magazine, which tracks a virtual portfolio of shares selected for the long-term by Richard. His career highlights include interviewing Nobel prize winners, private investors and many, many company executives.

Richard is freelance writer who invests in company shares and funds through his self-invested personal pension. He has worked as a teacher and in educational publishing, and is a governor at University Technology College, Cambridge. He supports the Livingstone Tanzania Trust, a charity supporting education and enterprise in Tanzania.

Richard studied International History and Politics at the University of Leeds, winning the Drummond-Wolff Prize for "distinguished work in the field of international relations".

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how