Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

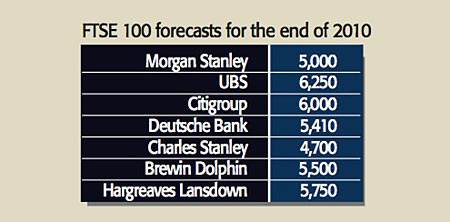

After a 54% rise since March to 5,500, the FTSE 100 is expected to eke out a further small gain in 2010. A quarterly Reuters poll of strategists reveals an average forecast of 5,800 for the end of 2010.

But according to Graham Secker of Morgan Stanley, although the index's exposure to commodities and emerging markets (the latter comprise a fifth of revenues) suggests that profits could rise sharply, much of this is already in the price.

Valuations are not compelling with UK stocks on a 2010 p/e of 14. History also shows that the withdrawal of stimulus weighs on European markets. He expects the index to retreat to 5,000.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Tight credit and overindebted consumers remain threats to the recovery, while the combination of a huge fiscal deficit and political uncertainty is a key challenge for Britain.

A hung parliament could trigger a bond sell-off, pushing yields higher and posing a threat to Britain's credit rating. Jeremy Batstone-Carr reckons the FTSE could retreat to 4,700. Wherever it ends up, "it's difficult to see 2010 as anything other than a struggle", says Neil Hume in the FT.

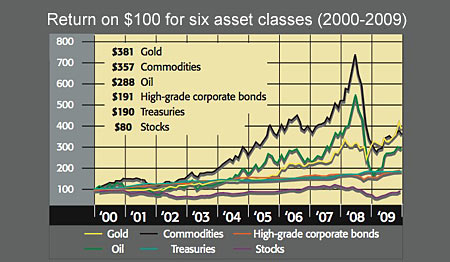

Gold was the trade of the decade

Gold has been a better bet than five other major asset classes since 2000. The chart from Bloomberg.com, which includes reinvested interest or dividends where applicable, shows that $100 invested in gold at the start of 2000 would be worth around $381 now.

Commodities and oil have also done well. But US stocks have had their worst decade on record, down almost 10%. The lesson is to buy for the long-term when assets are cheap and unfashionable, as raw materials and gold were in 2000. Equity valuations were then at record levels.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how