Gold is back in a bull market – it’s time to buy

The equity bull market is over, says Charlie Morris. But gold's is just starting.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

I have upgraded gold to a bull market for the first time since I started writing about the market regularly (in the Atlas Pulse newsletter) in 2012. Back then, the message was that a bubble was unwinding. Now, things are looking up.

My official signal hasn't yet been given, but this is my editorial, so I'm reserving the right to override it. If like me, you believe the post-2009 bull market in equities has hit a wall, then why wait to buy gold? To recap, an Atlas Pulse Bull market requires a score of three out of three on these simple tests:

1. Easy money (defined as US cash real ie, after inflation interest rates below 1.8%).

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

2. The long-term gold trend in non-dollar terms must be positive.

3. Gold must be beating the stockmarket.

I'll go through them in turn.

With US inflation (as measured by the CPI index) at 2.5% and interest rates at 2.25%, the real rates test is met, as they are negative. The risk comes from the relentless pursuit of sound money, which is possible as the Taylor Rule states that US interest rates should be 5%. However, recent talk of the Fed slowing down its tightening stance is gaining traction.

On the second condition, I use a 35-month moving average to measure gold in multiple currencies, excluding the dollar. When the gold market is quiet, it goes through periods of mirroring the dollar, and so by stripping out this source of volatility, you get a clearer picture of the underlying trend. This long-term signal remains in rude health.

The final test is that gold should be beating equities, specifically the S&P 500. While the 35-month trend isn't yet positive (as of December 2018), I am overriding the model on this point. That's because the equity trend is now negative and it seems likely that an equity bear market is now underway. That's subjective, but I'm sticking with it.

An exhausted bull market for equities

This is a tired old equity bull market that rides on high valuations, especially for companies that have embraced the modern age. The 200-day moving average for global equities is now negative; credit spreads are widening; margin debt is contracting; and economic forecasts are cooling. Those are market factors, but there's the real world too.

China trade; Brexit (the great opportunity); Italy; Mexico; France, France and more France. Putting this together, it is hard to imagine equities doing well over the next couple of years, and particularly in the developed world. For gold to beat equities has become an undemanding task.

Looking at gold relative to the S&P 500, we've witnessed gold fall by 75% relative to the S&P 500 (capital return) since the 2011 peak, which is a long way; and back to 2006 levels.

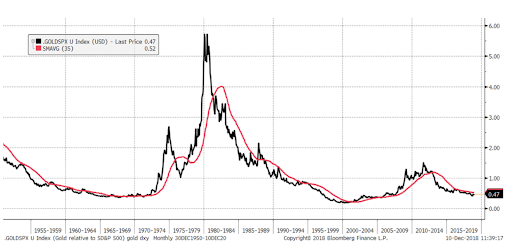

Gold relative to the S&P 500 with a 35-month moving average since 1950 (Source: Bloomberg)

Notice how the gold-to-S&P chart spends more of its time going down, which is as it should be, because equities are expected to deliver a return of inflation plus 6.5% per annum over the long term, whereas gold is only expected to deliver a real return of 0%. Gold's job is to be a reliable store of value and sometimes, zero is the best deal in town.

By delivering a zero real-return over time, that periodically means a price surge followed by a prolonged period of catch-down. Gold soared in the 1970s during a period of high inflation; it then spent the next two decades sliding back down to earth as inflation disappeared. Gold went on to do well in the noughties as real interest rates fell. And just like the 1970s, gold was too cheap to begin with, meaning the early surge was a catch-up.

Talk of monetary tightening in 2013 killed the gold price, and the subsequent unwinding of quantitative easing and interest-rate hikes has kept a lid on the price ever since. Yet, as this tightening cycle draws to a close, the gold price will be free to climb. And even if we must wait a while longer, there is light at the end of the tunnel.

For these reasons, I believe gold is well-placed to establish an uptrend versus equities. And with that third point in place, it's three out of three. I have upgraded the gold barometer from "becalmed" to "bull market", for the first time since 2012.

Better times lie ahead for the gold market.

The big-picture argument: the return of inflation

In the short term, weaker equity markets, looser monetary policy and a pick up in flows (ie, more money coming into the market in the form of buyers of exchange-traded funds, and traders attracted by the more attractive technical picture) will prove to be useful for gold.

But a sustained bull market also needs a reason to continue, once that short-term buying power has dried up. That driver is always and everywhere inflation. We have been living in a low-inflation world, with bond yields on the floor, but that could change. With wages moving higher and the collapse in oil likely to be temporary, it is not too difficult to see higher inflation over the next decade than the last.

The wise sparks will tell you that inflation amounts to little more than the price of oil. I sympathise with that view, because oil is the single most important cost the economy has to bear. Cheap oil gives us more to spend on niceties, whereas expensive oil is like a super-tax. Andy Hall, the oil guru, recently told Bloomberg that the shale-oil boom made it harder to predict the supply side of the oil market. He believed $50 a barrel was too low and you'd need to be very negative on the economy to be an oil bear. I agree.

The late stages of the economic cycle would normally see general price levels coming under pressure. But that would be offset by lower interest rates, hence monetary policy starts to ease during a slowdown. However, this isn't always the case, as the credit crisis saw tighter conditions, which caused gold to fall.

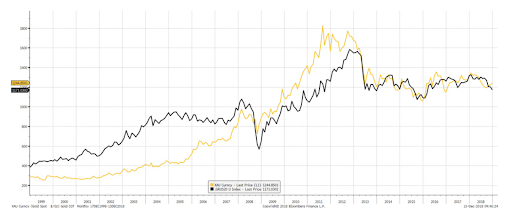

The point is to recognise the importance of real interest rates in the gold market. The Atlas Pulse fair value model (see chart below) treats gold as a 20-year, zero coupon, inflation-linked bond. Thus falling real rates are bullish and rising real rates are bearish, with historic inflation acting as the long-term tailwind.

Gold is at fair value just now but where will it go to next?

Gold in USD and the Atlas Pulse Gold fair value model, derived from US 20-year bond prices since 1998 (Source: Bloomberg)

The model puts the fair value of gold at $1,176 per ounce (as of December 2018). So at the current gold price, it is slightly overvalued. But that could change quickly and, in the grid below, I've outlined some scenarios.

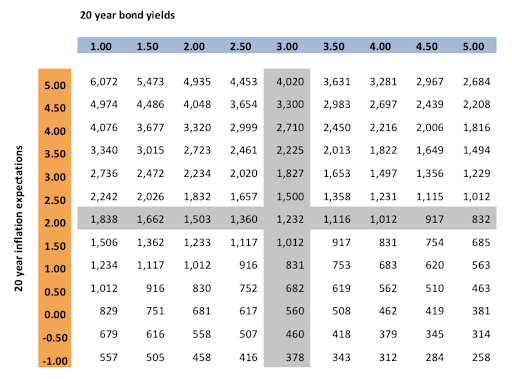

Source: Atlas Pulse predicted fair value for gold under different interest rate scenarios. Current rates in grey.

The top right quadrant is bullish for gold (as is the top left), and the bottom right is bearish. For gold to touch $1,776 an ounce, you'd need to see real interest rates return to zero. That would mean 2.5% inflation expectations with a 2.5% bond yield; or a combination between. Not beyond the impossible.

The table highlights the importance of the y-axis over the x-axis. That is, changes in inflation expectations are roughly four times more sensitive than changes in rates. A deflationary world with high rates would see the gold price destroyed, whereas the opposite would see it soar. My view is that we are heading north east, albeit slowly.

A word of warning to sterling investors

One cautionary note for British investors: bear in mind that if and when Brexit is behind us, we are likely to see a sharp rally in the pound against the dollar, and therefore also against the gold price. That, of course, could take a while, and in the meantime I expect gold's bull market to continue. But it's just a headwind to be aware of.

Charlie Morris is the head of multi-asset at Atlantic House Fund Management, and is also a regular contributor to MoneyWeek. This article was first published in the Atlas Pulse newsletter, in December 2018. Sign up for Atlas Pulse newsletters to receive them when they are released. Charlie is also CEO and founder of cryptocurrency data site, bytetree.com.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Inheritance fights are up 80% – here’s why and what to do if it happens to you

Inheritance fights are up 80% – here’s why and what to do if it happens to youFamilies are increasingly disputing inheritances, as age-related and economic factors force a tussle over the last will and testament of loved ones. What should you do if you find yourself in the middle of a fight over money?

-

The northern powerhouse city where first-time buyers are snapping up properties

The northern powerhouse city where first-time buyers are snapping up propertiesFirst-time buyers are “casting their nets” wider to find properties that match their budgets and lifestyles. We look at the top areas for first-time buyers.

-

'Investors should brace for Trump’s great inflation'

'Investors should brace for Trump’s great inflation'Opinion Donald Trump's actions against Federal Reserve chair Jerome Powell will likely stoke rising prices. Investors should prepare for the worst, says Matthew Lynn

-

Metals prices wobble on slowdown fears

Metals prices wobble on slowdown fearsNews The S&P GSCI index of 24 major raw materials has fallen back 9% since mid-June on growing fears of a recession, and copper has hit a 16-month low after losing 22% since a peak in early March.

-

How to invest in energy and metals as tech stocks crash

How to invest in energy and metals as tech stocks crashAnalysis It’s been a terrible week for stockmarkets. But not everything is crashing – “real” assets such as metals and energy are holding up well and should have a good 2022. Dominic Frisby picks the best ways to buy in.

-

Gold regains some of its shine

News The gold price perked up this week, hitting a four-week high.

-

Gold regains its shine after inflation risks resurface

Gold regains its shine after inflation risks resurfaceAnalysis Gold prices have been rising over the past month as fears of US inflation resurface. Saloni Sardana explains whether this could usher in a new bullish era for the precious metal.

-

The going looks good for gold

The going looks good for goldAdvice With inflation fears rising and interest rates nailed to the floor, the outlook for gold is bright, says John Stepek.

-

Governments’ money-printing mania bodes well for base metals

Governments’ money-printing mania bodes well for base metalsTips Money is being printed like there is no tomorrow. Much of it will be used to pay for infrastructure projects – and that will be good for metals, says Dominic Frisby.

-

Here’s how gold could rise above $7,000 an ounce

Here’s how gold could rise above $7,000 an ounceFeatures That the gold price could hit $7,000 an ounce is a logical and plausible possibility, says Charlie Morris. Here, he explains how it could get there.